- Telefonica S.A. (TEF, Financial) reports a decline in EBITDAaL and revenue, impacting its financial performance.

- Analysts offer a modest price target with a minimal upside potential.

- GuruFocus estimates suggest a potential downside from the current stock price, indicating caution for investors.

Telefonica's Financial Highlights: A Closer Look

Telefonica S.A. (TEF) recently disclosed a 5.6% reduction in its Q1 EBITDAaL, amounting to €2,350 million, alongside a 2.9% contraction in revenue, totaling €9.22 billion. Despite these challenges, net income from continuing operations achieved €427 million, translating to an earnings per share of €0.06. This financial report has set the tone for investor sentiment and strategic evaluations moving forward.

Wall Street's Insights: Analyst Price Targets

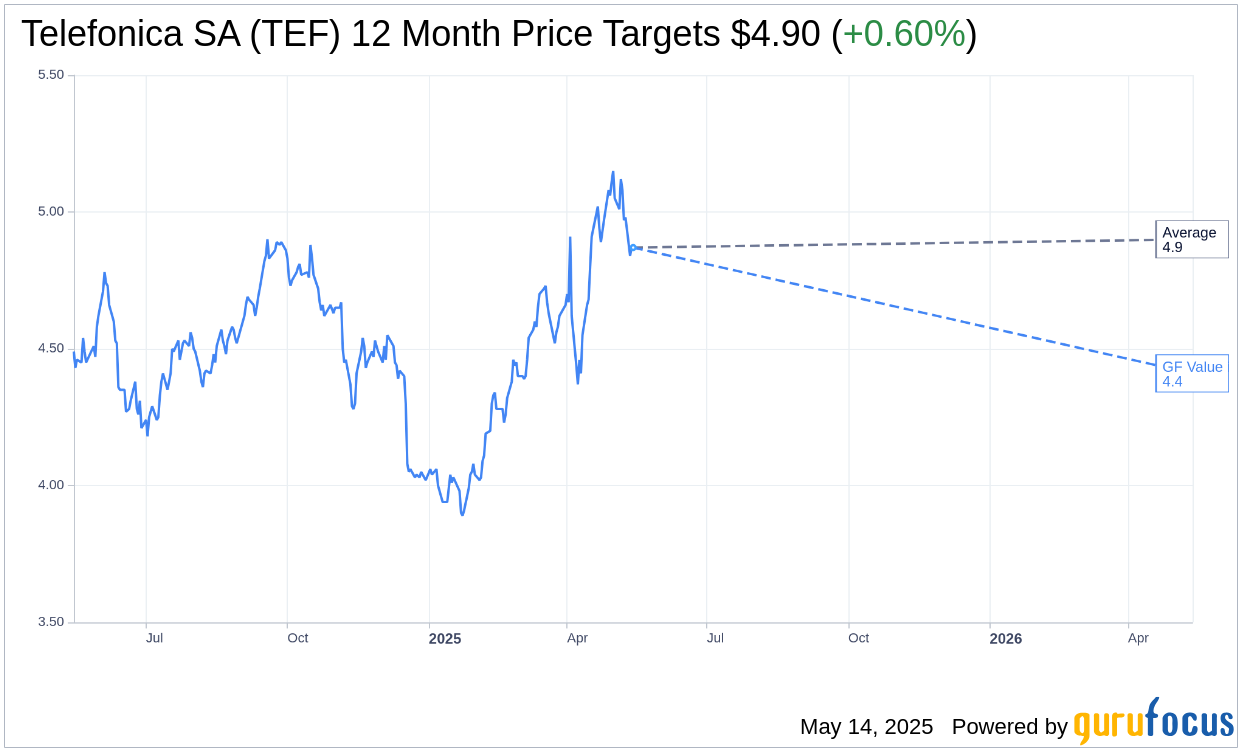

According to the one-year price targets given by analysts, Telefonica SA (TEF, Financial) has an average target price set at $4.90. This prediction is uniform, with high and low estimates mirroring the average. This target suggests a slight upside of 0.60% from the current trading price of $4.87. Investors seeking more in-depth analysis and forecasts can refer to the Telefonica SA (TEF) Forecast page for additional insights.

Brokerage Recommendations: A Balanced View

Brokerage reports provide a balanced perspective, with Telefonica SA (TEF, Financial) garnering an average recommendation of 2.5 from two firms, positioning it in the "Outperform" category. This rating scale, spanning from 1 (Strong Buy) to 5 (Sell), suggests that, while there are opportunities, investors should exercise measured optimism when considering TEF as part of their portfolio.

GuruFocus Valuation: Assessing the GF Value

GuruFocus presents a calculated GF Value for Telefonica SA (TEF, Financial) at $4.41 over the next year, indicating a potential downside of 9.45% from its current price of $4.87. The GF Value encapsulates a blend of historical trading multiples, past growth trends, and projected future performance, offering investors a well-rounded valuation assessment. For more comprehensive data, visit the Telefonica SA (TEF) Summary page to explore detailed metrics and analyses.