Resolute Holdings Management Inc (RHLD, Financial) released its 8-K filing on May 12, 2025, detailing its financial results for the first quarter ending March 31, 2025. The company, which provides operating management services, operates through two segments: Payment Card and Arculus. The Payment Card segment focuses on the production and sale of metal payment cards, while Arculus specializes in metal cards with technology for authentication and digital asset storage. The majority of its revenue is generated domestically.

Performance Overview and Challenges

Resolute Holdings reported a diluted earnings per share (EPS) of ($0.39) and a Non-GAAP Fee-Related Earnings per share of ($0.07) for the first quarter. The company faced significant challenges due to a higher than normal tax provision and professional fees following its spin-off from CompoSecure in February. Despite these hurdles, the company remains optimistic about its long-term prospects, with CEO Tom Knott expressing confidence in the team and the company's strategic positioning.

Financial Achievements and Industry Context

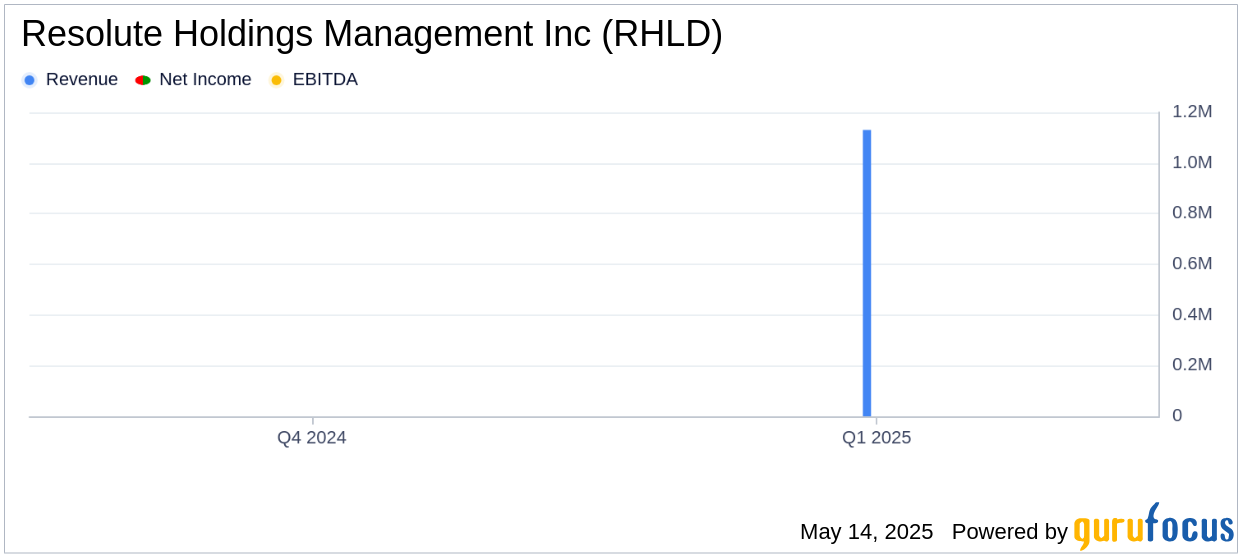

Resolute Holdings' financial achievements are noteworthy given the context of its recent spin-off. The company reported management fees of $1,129,000, although it faced selling, general, and administrative expenses totaling $3,926,000. The company's focus on recurring, long-duration management fees and a relatively fixed expense base is crucial for its business model in the Business Services industry.

Key Financial Metrics

The income statement reveals a net loss of $3,366,000 attributable to common stockholders, with income from operations at a loss of $2,797,000. The balance sheet and cash flow statements further illustrate the company's financial position, highlighting the importance of managing expenses and optimizing revenue streams. These metrics are vital for assessing the company's financial health and operational efficiency.

| Financial Metric | Value ($ in thousands) |

|---|---|

| Management Fees | 1,129 |

| Selling, General and Administrative Expenses | 3,926 |

| Income from Operations | (2,797) |

| Net Income (Loss) | (3,366) |

| Net Income (Loss) per Share - Diluted | (0.39) |

Commentary and Strategic Outlook

“The first quarter was foundational for Resolute Holdings, with the spin-off from CompoSecure completed in February. We experienced a higher than normal tax provision and post spin-off professional fees in the quarter but reiterate our expectation for limited profitability for the full year with approximately $3.0mm of quarterly management fee revenue. I am pleased with the team we have assembled and believe our unique combination of permanent capital and differentiated operating capabilities position us well for the future.” - Tom Knott, CEO

“We are encouraged by the ongoing work to improve operations, drive organic growth, and build a high-performance culture at CompoSecure. In the first quarter, we also increased our efforts to evaluate potential acquisitions and anticipate those efforts to remain significant through 2025 and beyond.” - Dave Cote, Executive Chairman

Analysis and Future Prospects

Resolute Holdings' performance in the first quarter reflects the transitional challenges following its spin-off. The company's strategic focus on enhancing operational efficiency and exploring acquisition opportunities is crucial for its growth trajectory. The emphasis on recurring management fees and a fixed expense base aligns with industry practices, positioning the company for potential long-term success. However, managing expenses and optimizing revenue streams remain critical to achieving profitability.

Explore the complete 8-K earnings release (here) from Resolute Holdings Management Inc for further details.