- TUI AG (TUIFF, Financial) reports Q2 earnings with slight revenue growth amidst challenging market conditions.

- Wall Street analysts project a significant downside despite positive revenue forecasts for FY 2025.

- Current brokerage recommendations classify TUIFF as a "Sell" according to consensus analysis.

TUI AG (TUIFF) recently released its Q2 financial results, reporting earnings per share (EPS) under GAAP of €0.60. The company experienced a slight upward tick in revenue, reaching €3.7 billion. Despite facing a negative underlying EBIT of €-206.8 million, TUI has demonstrated resilience by achieving a €14 million improvement, particularly when excluding a €32 million influence from the Easter holiday. The travel giant remains optimistic, upholding its fiscal year 2025 outlook, which anticipates a revenue uptick of 5% to 10% and a 7% to 10% increase in underlying EBIT.

Wall Street Analysts' Projections

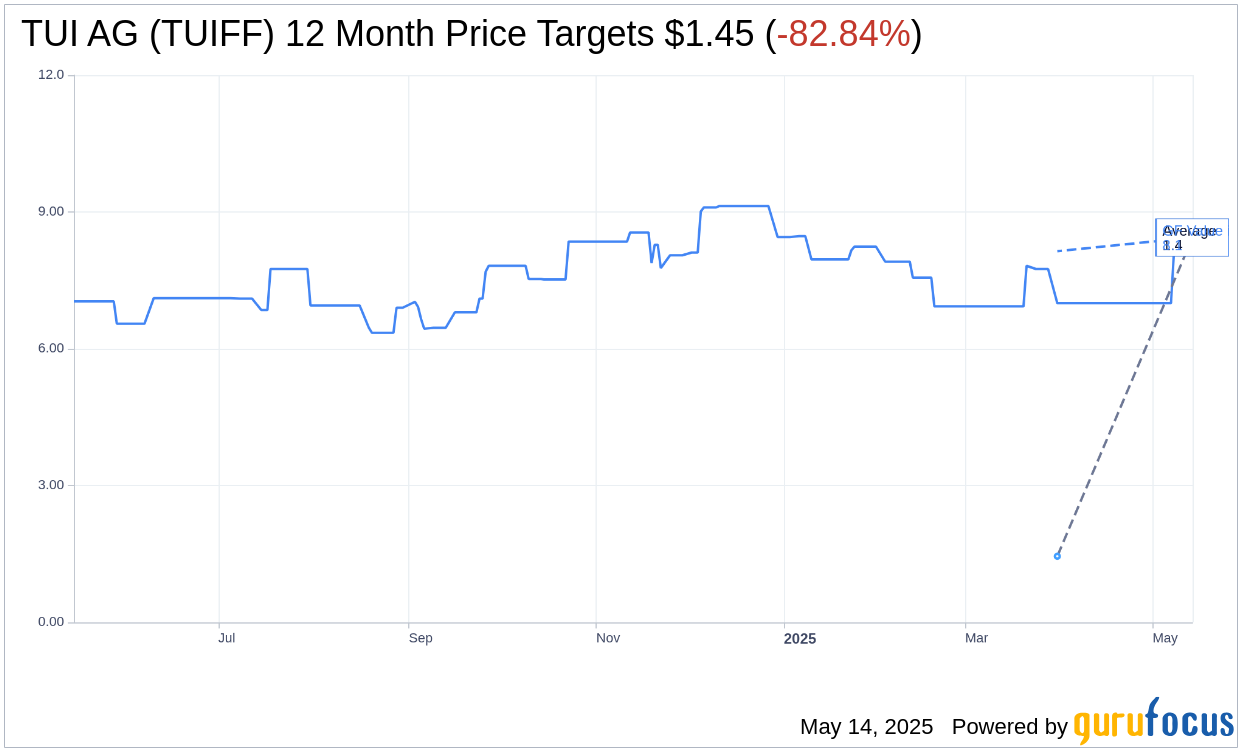

According to insights from a single analyst, the one-year price target for TUI AG (TUIFF, Financial) stands at $1.45, with estimates ranging uniformly from a high of $1.45 to a low of $1.45. This average price target indicates a significant downside of 82.84% from the current trading price of $8.44. For further information, investors can visit the TUI AG (TUIFF) Forecast page.

The consensus from one brokerage firm categorizes TUI AG (TUIFF, Financial) with an average recommendation score of 5.0, suggesting a "Sell" status. This rating uses a scale where 1 signifies a Strong Buy and 5 signifies Sell, reflecting cautious sentiment in the market.

Leveraging GuruFocus estimates, the anticipated GF Value for TUI AG (TUIFF, Financial) in the next year is calculated at $8.14. This represents a downside of 3.55% compared to the current stock price of $8.44. The GF Value is determined by evaluating historical trading multiples, the company’s historical growth, and future business performance estimates. Additional detailed insights can be accessed on the TUI AG (TUIFF) Summary page.