KeyBanc analyst Sophie Karp has upgraded Ameren (AEE, Financial) from Sector Weight to Overweight, setting a price target of $103. Despite a turbulent first quarter, the utility sector's recent earnings season was relatively stable. The analyst noted that demand from large-load customers remains robust, and potential risks related to tariffs and legislative acts like the Inflation Reduction Act are now better defined. This stability is expected to reignite investor interest and risk-taking within the sector.

In line with this outlook, KeyBanc adjusted its ratings across various utility stocks: downgrading Exelon, Consolidated Edison, and Southern Co. to Underweight due to valuation concerns and Portland General Electric to Sector Weight citing regional challenges. Conversely, Ameren and Entergy received an upgrade to Overweight, highlighting their strong growth potential within the industry.

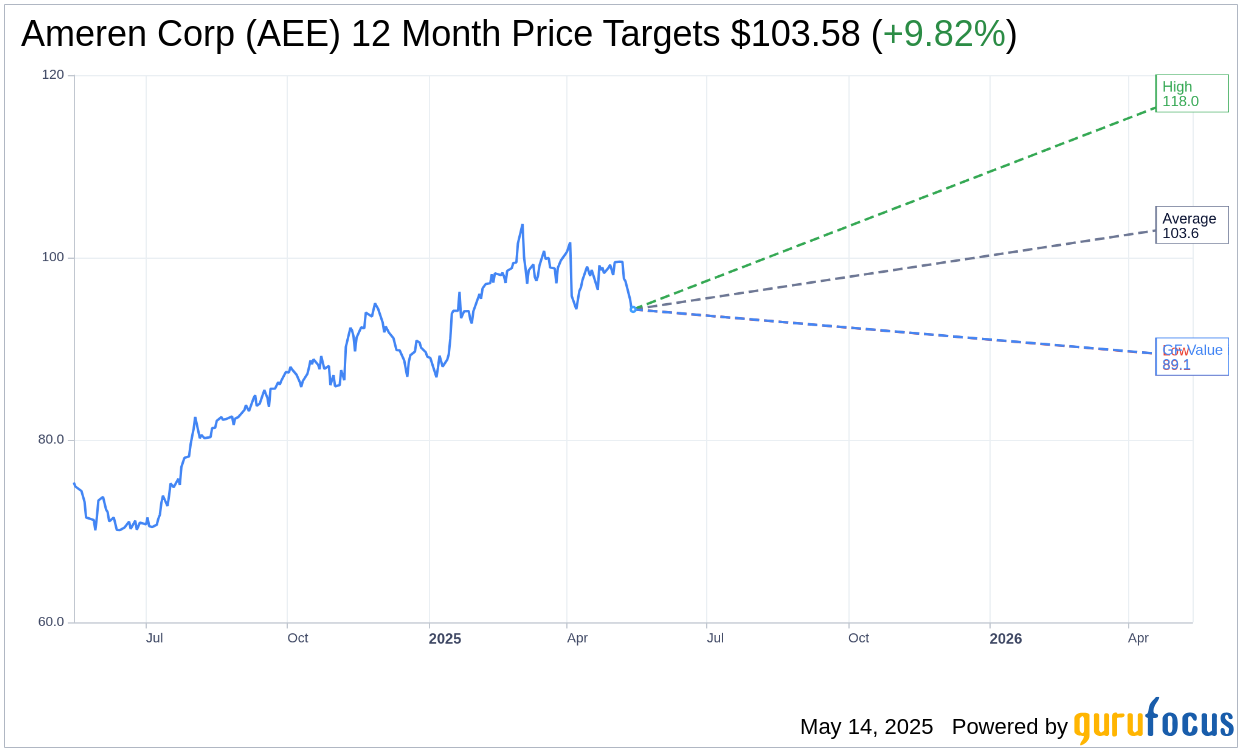

Wall Street Analysts Forecast

Based on the one-year price targets offered by 14 analysts, the average target price for Ameren Corp (AEE, Financial) is $103.58 with a high estimate of $118.00 and a low estimate of $89.12. The average target implies an upside of 9.82% from the current price of $94.32. More detailed estimate data can be found on the Ameren Corp (AEE) Forecast page.

Based on the consensus recommendation from 17 brokerage firms, Ameren Corp's (AEE, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Ameren Corp (AEE, Financial) in one year is $89.14, suggesting a downside of 5.49% from the current price of $94.32. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Ameren Corp (AEE) Summary page.

AEE Key Business Developments

Release Date: May 02, 2025

- Earnings Per Share (EPS): First quarter 2025 EPS of $1.07 compared to adjusted EPS of $1.02 in Q1 2024.

- 2025 EPS Guidance: Expected to be in the range of $4.85 to $5.05 per share.

- Revenue Increase: Missouri PSC approved a $355 million annual revenue increase.

- Retail Sales Growth: Ameren Missouri's total weather-normalized retail sales increased by approximately 3% over the 12 trailing months ended in March.

- Debt Issuance: Completed over 80% of 2025 debt financings, including $350 million of 5.625% bonds and $750 million of 5.375% notes.

- Equity Issuance: Approximately $600 million of common equity expected to be issued in 2025.

- Capital Investment: Supported nearly a dozen projects bringing over $700 million of capital investment and over 1,000 jobs.

- Rate Base Growth: Strong compound annual rate base growth of 9.2% expected from 2025 through 2029.

- Dividend Growth: Expectation of strong long-term earnings and dividend growth.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Ameren Corp (AEE, Financial) reported an increase in first quarter 2025 earnings to $1.07 per share, up from $1.02 per share in the first quarter of 2024.

- The company has made significant infrastructure investments, enhancing reliability and resiliency for its 2.5 million electric and 900,000 natural gas customers.

- Ameren Corp (AEE) has secured regulatory and legislative support in Missouri, facilitating a constructive environment for future investments.

- The company has signed construction agreements with data center developers, representing a total of approximately 2.3 gigawatts of future demand, indicating strong growth prospects.

- Ameren Corp (AEE) has a robust pipeline of investment opportunities exceeding $63 billion, aimed at strengthening and modernizing the energy grid over the next decade.

Negative Points

- The company faces potential impacts from proposed trade tariffs, which could affect its capital budget and increase costs.

- Ameren Corp (AEE) plans to issue approximately $600 million of common equity in 2025, which could dilute existing shareholders.

- The company is exposed to macroeconomic uncertainties, including potential changes in tax credit transferability, which could impact its financial plans.

- There is a need for ongoing regulatory approvals and stakeholder alignment to execute its strategic plans, which could pose challenges.

- Ameren Corp (AEE) must manage the risks associated with large-scale infrastructure projects, including potential delays and cost overruns.