Barclays analyst Peter Lawson has revised the price target for Adaptimmune (ADAP, Financial), reducing it to $0.46 from the previous $1, while maintaining an Underweight rating. This adjustment comes as Adaptimmune's first-quarter revenue aligned with market expectations. However, the company is currently exploring strategic options to tackle its limited financial resources.

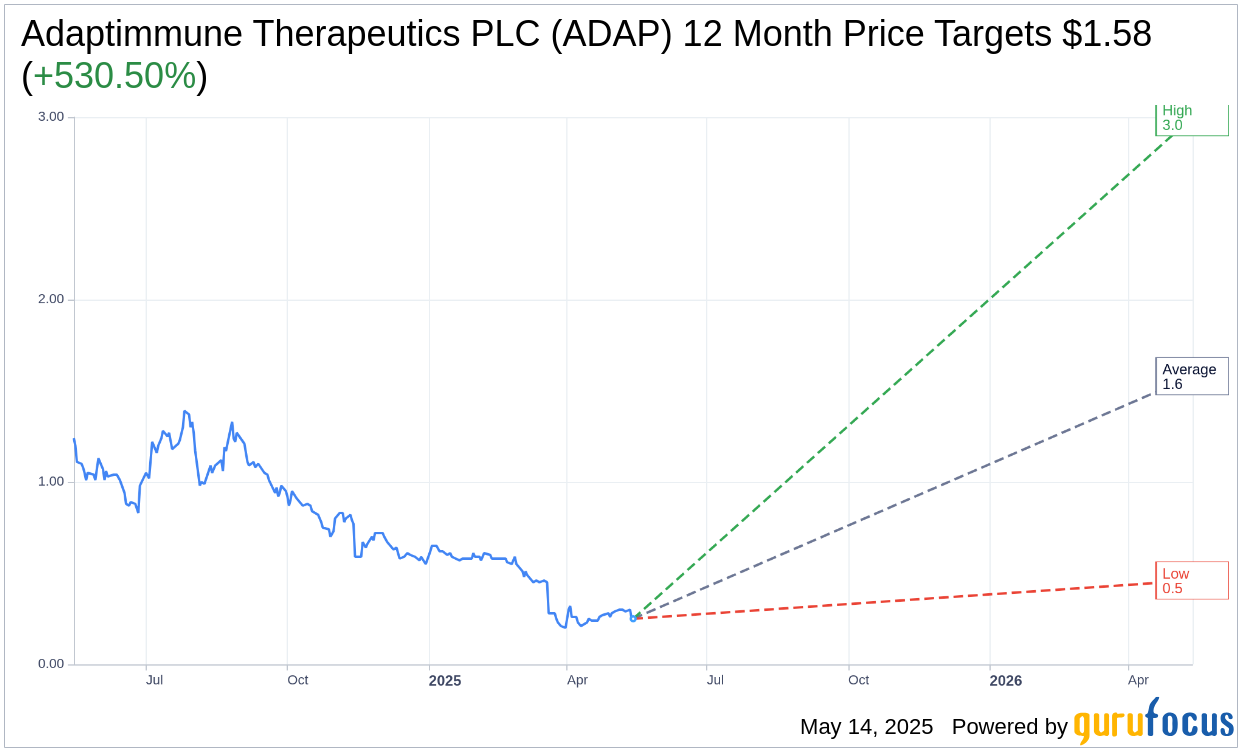

Wall Street Analysts Forecast

Based on the one-year price targets offered by 8 analysts, the average target price for Adaptimmune Therapeutics PLC (ADAP, Financial) is $1.58 with a high estimate of $3.00 and a low estimate of $0.46. The average target implies an upside of 530.50% from the current price of $0.25. More detailed estimate data can be found on the Adaptimmune Therapeutics PLC (ADAP) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, Adaptimmune Therapeutics PLC's (ADAP, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Adaptimmune Therapeutics PLC (ADAP, Financial) in one year is $0.99, suggesting a upside of 296% from the current price of $0.25. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Adaptimmune Therapeutics PLC (ADAP) Summary page.

ADAP Key Business Developments

Release Date: May 13, 2025

- Revenue Guidance: Full-year Tecelra sales projected between $35 million and $45 million.

- Net Sales for Q1 2025: $4 million from Tecelra treatments.

- Tecelra Treatments Invoiced: 14 treatments in 2025 to date, with 6 in Q1.

- Authorized Treatment Centers: 28 centers currently accepting referrals, with a target of approximately 30 by the end of 2025.

- Manufacturing Success Rate: 100% success from the US Tecelra manufacturing center.

- Average Turnaround Time: 27 days from apheresis to release, beating the target of 30 days.

- Peak Sales Projection: $400 million from combined Tecelra and Lete-cel sarcoma franchise.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Adaptimmune Therapeutics PLC (ADAP, Financial) reported strong momentum with the launch of Tecelra, achieving $4 million in net sales for Q1 2025.

- The company has successfully apheresed 21 patients in 2025, with 13 in Q1 and 8 in early Q2, supporting their revenue guidance of $35 million to $45 million for the year.

- Adaptimmune has established 28 authorized treatment centers (ATCs) for Tecelra, with plans to reach 30 by the end of 2025, a year ahead of schedule.

- The manufacturing success rate for Tecelra has been 100%, with no capacity issues and an average turnaround time of 27 days, beating the target of 30 days.

- There have been no patient denials for Tecelra, indicating effective patient access and a positive payer environment.

Negative Points

- Adaptimmune Therapeutics PLC (ADAP) has a going concern warning, indicating less than 12 months of cash runway, which raises concerns about financial sustainability.

- The company has not provided detailed cash runway guidance due to various impacting factors, including the success of Tecelra's launch and ongoing cost reduction actions.

- The cost of goods sold (COGS) is expected to be higher in the initial quarters, affecting margins, although they are projected to normalize over time.

- There is uncertainty regarding the impact of potential regulatory changes on the business, although the company has not seen any negative indications from the FDA.

- The company is still exploring strategic options with Cowen, which could imply potential changes or uncertainties in their strategic direction.