Key Takeaways:

- Super Micro Computer (SMCI, Financial) stock surged 7% following a positive rating from Raymond James.

- AI server solutions are a major revenue driver for SMCI, contributing 70% of total revenue.

- Analysts predict a modest upside, supported by growing AI demand and enterprise adoption.

Super Micro Computer's Growth Catalysts

Super Micro Computer (SMCI) experienced a notable 7% boost in its stock value after Raymond James commenced coverage with an “Outperform” rating and a strategic price target of $41. Known for its advanced AI server solutions, SMCI generates approximately 70% of its revenue from AI platforms. While facing short-term risks such as potential tariffs and evolving technology landscapes, the enduring demand for AI serves as a potent growth catalyst. Key prospects for future expansion include increased hyperscale AI growth, the broadening of NVIDIA's platform, and greater adoption within enterprises, particularly in sectors like finance and healthcare.

Wall Street Analysts' Projections

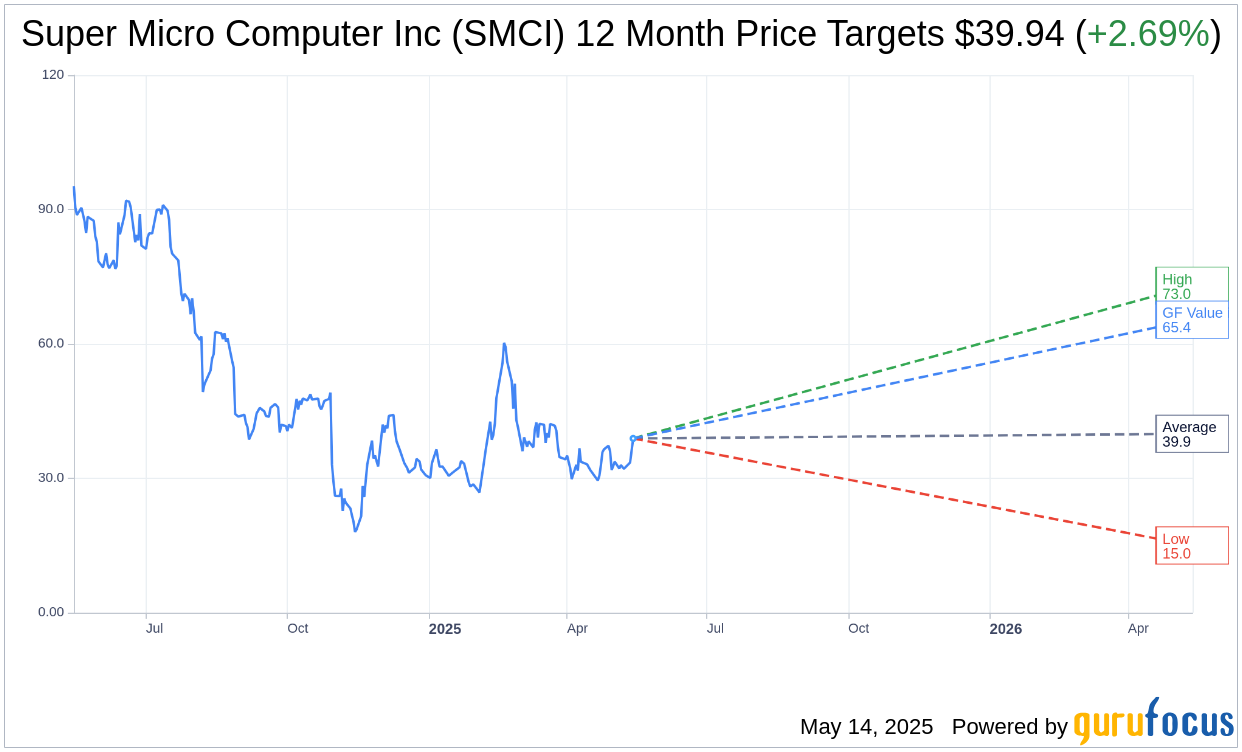

Analyzing the one-year price targets from 14 analysts, the average target price for Super Micro Computer Inc (SMCI, Financial) stands at $39.94. Projections range from a high estimate of $73.00 to a low of $15.00, with the average target suggesting a potential upside of 2.69% from the current stock price of $38.89. For detailed estimate data, visit the Super Micro Computer Inc (SMCI) Forecast page.

Consistent with the consensus recommendation of 16 brokerage firms, Super Micro Computer Inc's (SMCI, Financial) average recommendation currently suggests a "Hold" status, averaging at 2.8 on a scale where 1 represents a Strong Buy and 5 indicates a Sell.

GuruFocus' Valuation Insights

According to GuruFocus estimates, the projected GF Value for Super Micro Computer Inc (SMCI, Financial) in one year is anticipated to be $65.42, indicating a significant potential upside of 68.22% from the current price of $38.89. The GF Value is a calculated assessment of the fair trading value of the stock, derived from historical trading multiples, past business growth, and future business performance projections. For more comprehensive data, explore the Super Micro Computer Inc (SMCI) Summary page.