Needham has elevated its rating on Establishment Labs (ESTA, Financial) from Hold to Buy, setting a price target of $48. The firm notes that the de-escalation of the U.S.-China trade conflict alleviates worries regarding Establishment’s international operations. Additionally, the growth prospects for products Mia and Preserve are anticipated to strengthen outside the U.S. The company’s management expresses confidence in the U.S. rollout of Motiva, and Needham shares this optimism, expecting it to contribute positively by 2025. The upcoming investor day on June 12 is projected to serve as a favorable catalyst for the stock's performance. Given Establishment Labs’ prospective growth, Needham finds the current stock valuation appealing.

Wall Street Analysts Forecast

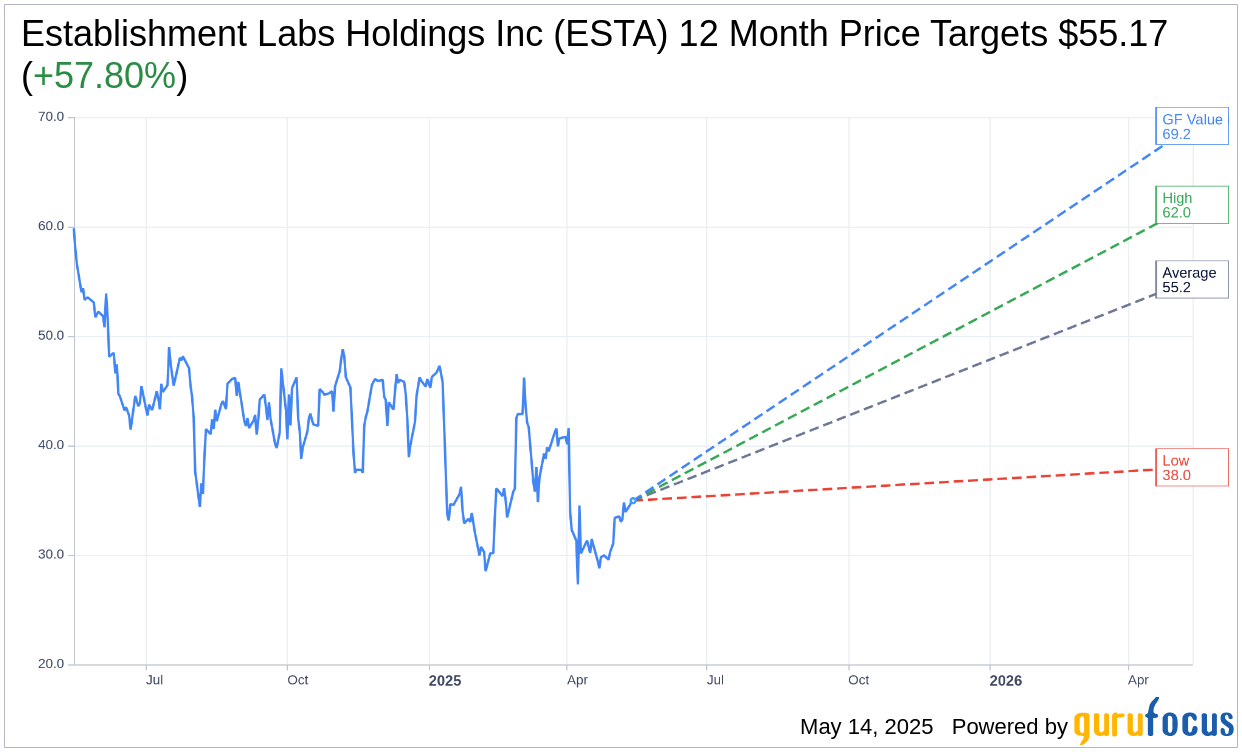

Based on the one-year price targets offered by 6 analysts, the average target price for Establishment Labs Holdings Inc (ESTA, Financial) is $55.17 with a high estimate of $62.00 and a low estimate of $38.00. The average target implies an upside of 57.80% from the current price of $34.96. More detailed estimate data can be found on the Establishment Labs Holdings Inc (ESTA) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, Establishment Labs Holdings Inc's (ESTA, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Establishment Labs Holdings Inc (ESTA, Financial) in one year is $69.21, suggesting a upside of 97.97% from the current price of $34.96. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Establishment Labs Holdings Inc (ESTA) Summary page.

ESTA Key Business Developments

Release Date: May 07, 2025

- Revenue: $41.4 million in the first quarter, an 11% increase from the previous year.

- U.S. Revenue: $6.2 million, exceeding the previous guidance of $5.5 million.

- Gross Profit: $27.8 million, representing 67.2% of revenue, a 160 basis point increase from the previous year.

- SG&A Expenses: $39.7 million, approximately $10.8 million higher than the first quarter of 2024.

- R&D Expenses: $5.1 million for the first quarter.

- Total Operating Expenses: $44.8 million, an increase of approximately $11.5 million from the previous year.

- Adjusted EBITDA: Loss of $12.1 million, an improvement from the $13.1 million loss in the fourth quarter.

- Cash Position: $69.2 million as of March 31, with an additional $25 million available under the credit facility.

- Cash Use: $21.2 million in the first quarter, with expectations to reduce by approximately $5 million per quarter throughout 2025.

- Revenue Guidance for 2025: $205 million to $210 million, representing growth of 23% to 26%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Establishment Labs Holdings Inc (ESTA, Financial) reported a strong start to 2025 with first-quarter revenue totaling $41.4 million, exceeding previous guidance.

- The U.S. launch of Motiva has been successful, with over 900 accounts onboarded and 84% reordering, indicating strong market adoption.

- The company is on track to achieve its first positive EBITDA quarter in 2025 and cash flow breakeven in 2026, demonstrating financial progress.

- The partnership with Meghan Trainor has generated significant media attention, with over 75 press articles and four billion impressions, enhancing brand visibility.

- The minimally invasive platform, including Mia and Preserve, is gaining traction and is expected to contribute significantly to future growth.

Negative Points

- Operating expenses increased by approximately $11.5 million from the previous year, primarily due to the U.S. launch and acquisition-related costs.

- The company experienced minimal sales into China in the first quarter, impacting overall revenue growth.

- Despite revenue growth, adjusted EBITDA was a loss of $12.1 million, indicating ongoing financial challenges.

- The Latin American market, particularly Brazil, continues to face challenges, affecting regional performance.

- The company remains cautious with its revenue guidance due to macroeconomic uncertainties and potential impacts from trade policies.