H.C. Wainwright has adjusted its price target for Genmab (GMAB, Financial), decreasing it from $37 to $35, while maintaining a Buy rating on the stock. This decision comes in the wake of the company's first-quarter report. Despite the price target reduction, the firm remains confident in Genmab's ability to withstand potential challenges within the biotech sector. This optimism is anchored in Genmab's history of profitability, a robust financial standing, formidable presence in the multiple myeloma field, and an extensive pipeline that offers potential for several clinical data catalysts in the near and medium term.

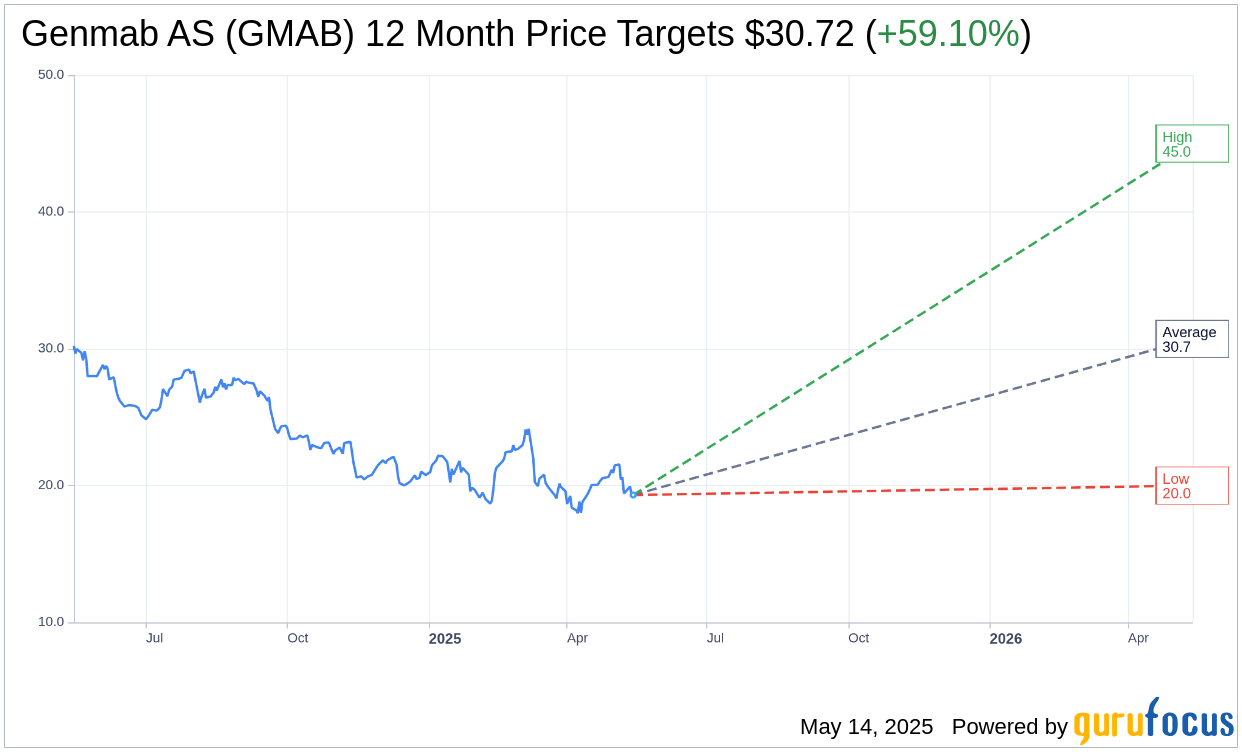

Wall Street Analysts Forecast

Based on the one-year price targets offered by 9 analysts, the average target price for Genmab AS (GMAB, Financial) is $30.72 with a high estimate of $45.00 and a low estimate of $20.00. The average target implies an upside of 59.10% from the current price of $19.31. More detailed estimate data can be found on the Genmab AS (GMAB) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Genmab AS's (GMAB, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Genmab AS (GMAB, Financial) in one year is $55.84, suggesting a upside of 189.18% from the current price of $19.31. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Genmab AS (GMAB) Summary page.

GMAB Key Business Developments

Release Date: May 08, 2025

- Total Revenue Growth: 19% increase, driven by strong performance of Abkindi and TIFA.

- Operating Profit Growth: 62% increase in operating profits.

- Cash Position: Over $3 billion in cash at the end of the quarter.

- Share Buyback: Initiated a planned buyback of up to 2.2 million shares.

- Recurring Revenue Growth: 33% increase, with royalties from Darzalex and Kesimpta contributing significantly.

- Epkinly and TIFA Sales: Combined sales increased by 56% year-over-year, accounting for 29% of total revenue growth.

- Epkinly Sales: $90 million in global sales, a 73% year-over-year increase.

- TIFA Sales: $33 million, up 22% over Q1 2024.

- Operating Expenses: $485 million, up 5% compared to the first quarter of last year.

- Net Profit: $195 million for the quarter.

- 2025 Financial Guidance: Revenue projected between $3.3 billion to $3.7 billion, with 12% growth at the midpoint.

- Operating Profit Guidance: Expected between $895 million to nearly $1.4 billion, with 16% growth at the midpoint.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Genmab AS (GMAB, Financial) reported a 19% increase in total revenue for the first quarter of 2025, driven by strong performance from products like Abkindi and TIFA.

- Operating profits grew by an impressive 62%, showcasing effective cost management and strategic investments.

- The company initiated a share buyback program, reflecting confidence in its future and commitment to shareholder value.

- Genmab AS (GMAB) ended the quarter with over $3 billion in cash, providing a strong financial foundation for future growth.

- The company is advancing its promising late-stage pipeline, with multiple billion-dollar opportunities anticipated by the end of the decade.

Negative Points

- The company faces geopolitical uncertainties, which could potentially impact its operations and financial guidance.

- There is a risk associated with forward-looking statements, as actual results may differ due to unsuccessful development projects.

- Genmab AS (GMAB) is heavily reliant on the success of its late-stage pipeline, which carries inherent risks of clinical trial failures.

- The competitive landscape in oncology and immunology is intense, posing challenges for market share and growth.

- The company must navigate regulatory hurdles and approval processes, which can be unpredictable and time-consuming.