- Super Micro Computer (SMCI, Financial) sees a significant stock surge following a $20 billion deal with Saudi Arabia's DataVolt.

- Wall Street analysts offer mixed forecasts, with target prices ranging from $15.00 to $73.00.

- GuruFocus estimates indicate a potential 68.22% upside based on the GF Value.

Super Micro Computer (SMCI) experienced a notable 10% increase in premarket trading. This surge came after the company revealed a substantial multi-year partnership with Saudi Arabia's DataVolt, an agreement valued at an impressive $20 billion. This strategic collaboration is set to accelerate the provision of advanced GPU platforms and systems, catering to artificial intelligence initiatives within both Saudi Arabia and the United States.

Wall Street Analysts Forecast

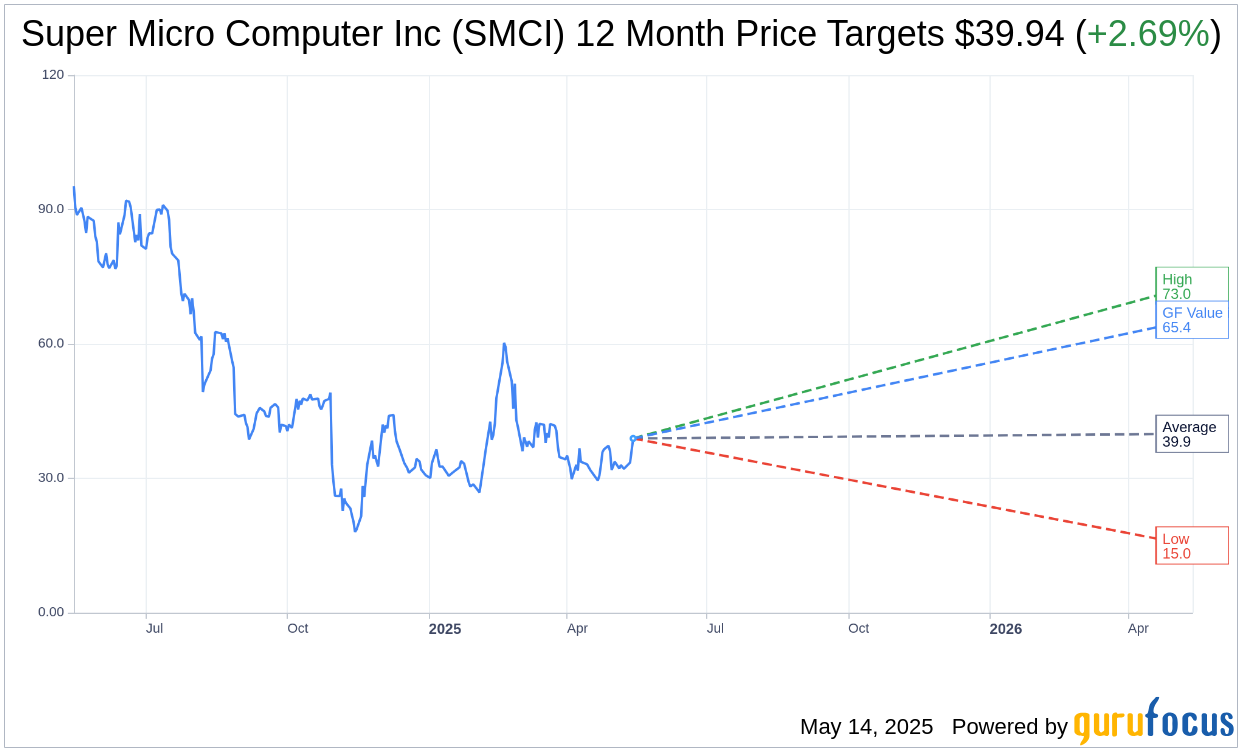

According to the insights of 14 analysts, the average one-year price target for Super Micro Computer Inc (SMCI, Financial) stands at $39.94. The projections present a broad spectrum, with a high estimate reaching $73.00 and a low estimate at $15.00. When juxtaposed with the current stock price of $38.89, these forecasts suggest a modest potential upside of 2.69%. For a deeper dive into these estimates, visit the Super Micro Computer Inc (SMCI) Forecast page.

The consensus from 16 brokerage firms positions Super Micro Computer Inc's (SMCI, Financial) average recommendation at 2.8, equivalent to a "Hold" rating. This rating is derived from a scale where 1 signifies a Strong Buy, progressing to 5, which indicates a Sell recommendation.

Turning to GuruFocus metrics, the estimated GF Value for Super Micro Computer Inc (SMCI, Financial) in the upcoming year is priced at $65.42. This projection underscores a significant upside of 68.22% from the current share price of $38.89. GF Value represents GuruFocus' calculated estimation of the stock's intrinsic value, derived from historical trading multiples and anticipated business growth trajectories. For further detailed insights, please refer to the Super Micro Computer Inc (SMCI) Summary page.