Piper Sandler has increased its price target for Samsara (IOT, Financial) to $53, up from $44, while maintaining an Overweight rating on the stock. According to the firm, through a detailed examination of highly correlated data up to April, the metrics suggest an anticipated revenue of at least $365 million for this quarter, indicating a potential 4% to 5% increase. This forecast is supported by the strongest correlation metrics. Despite this positive outlook, overarching economic indicators present a mixed picture. The start of the year saw declines in heavy duty truck sales and the Cass Shipment Index, though employment figures, Samsara's job listings, and shipment tonnage show improvement.

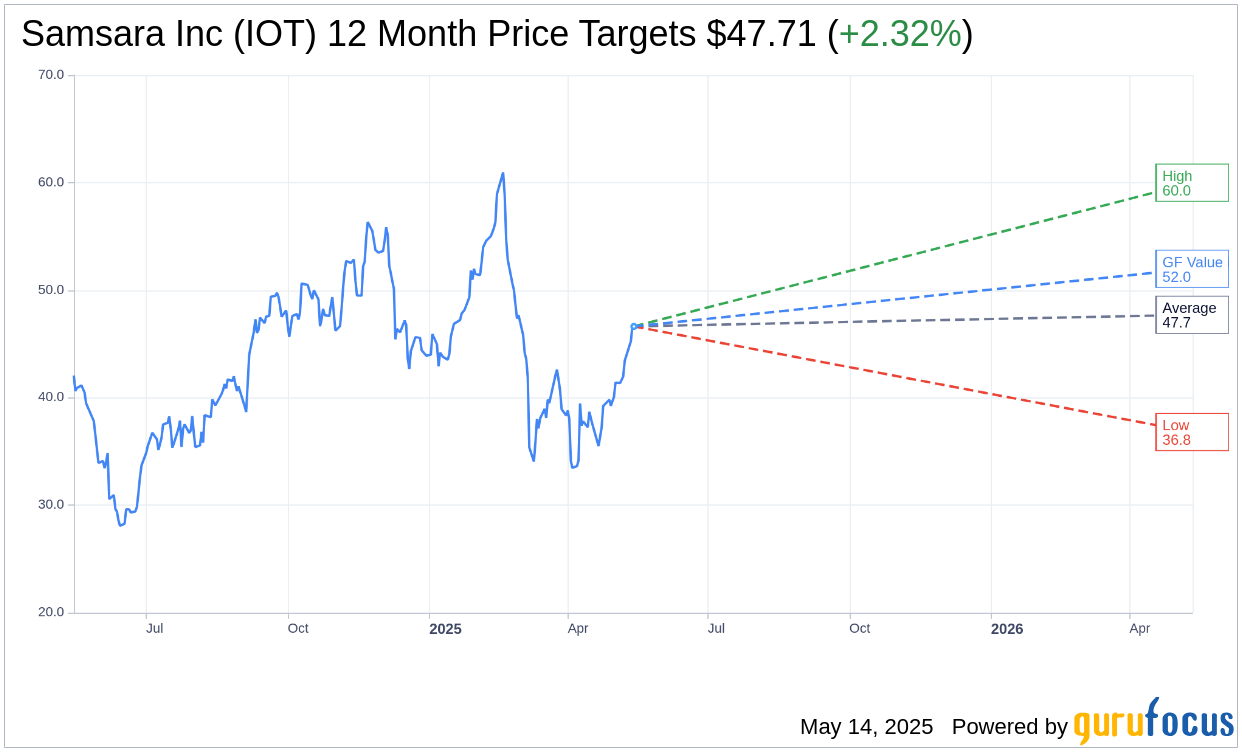

Wall Street Analysts Forecast

Based on the one-year price targets offered by 17 analysts, the average target price for Samsara Inc (IOT, Financial) is $47.71 with a high estimate of $60.00 and a low estimate of $36.80. The average target implies an upside of 2.32% from the current price of $46.63. More detailed estimate data can be found on the Samsara Inc (IOT) Forecast page.

Based on the consensus recommendation from 19 brokerage firms, Samsara Inc's (IOT, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Samsara Inc (IOT, Financial) in one year is $51.99, suggesting a upside of 11.49% from the current price of $46.63. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Samsara Inc (IOT) Summary page.

IOT Key Business Developments

Release Date: March 06, 2025

- Annual Recurring Revenue (ARR): $1.46 billion, 32% year-over-year growth, 33% adjusted growth.

- Q4 Revenue: $346 million, 25% year-over-year increase, 36% adjusted growth.

- FY25 Revenue: $1.25 billion, 33% year-over-year increase, 37% adjusted growth.

- Net New ARR (Q4): $109 million, 10% year-over-year increase, 12% adjusted for constant currency.

- Gross Margin (Q4): 78%, a quarterly record.

- Operating Margin (Q4): 16%, a quarterly record.

- Free Cash Flow Margin (Q4): 14%, a quarterly record.

- $100,000+ ARR Customers: 2,506, 36% year-over-year growth, 203 added in Q4.

- $1 Million+ ARR Customers: 118, 44% year-over-year growth, 14 added in Q4.

- Average ARR per $100,000+ Customer: $323,000, up from $313,000 one year ago.

- Dollar-Based Net Retention Rate: Approximately 115% for core customers, 120% for large customers.

- Q1 FY26 Revenue Guidance: $350 million to $352 million, 25% year-over-year growth.

- FY26 Revenue Guidance: $1.523 billion to $1.533 billion, 22% to 23% year-over-year growth.

- Non-GAAP Operating Margin Guidance (Q1 FY26): 7%.

- Non-GAAP EPS Guidance (Q1 FY26): $0.05 to $0.06.

- Non-GAAP Operating Margin Guidance (FY26): Approximately 11%.

- Non-GAAP EPS Guidance (FY26): $0.32 to $0.34.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Samsara Inc (IOT, Financial) achieved a 32% year-over-year growth in ARR, reaching $1.46 billion.

- The company increased its $100,000-plus ARR customer count by 203, setting a quarterly record.

- Samsara Inc (IOT) reported a 78% gross margin, a 16% operating margin, and a 14% free cash flow margin, all quarterly records.

- The company is seeing strong momentum with large enterprise customers, with 62% of large customers using three or more products.

- Samsara Inc (IOT) is leveraging AI to enhance customer operations, with significant reductions in safety events and operational costs reported by clients.

Negative Points

- Large enterprise sales cycles are complex and can span multiple years, making them less predictable.

- The company faces challenges in quantifying the impact of an extra week in Q4 on ARR, complicating financial comparisons.

- There is uncertainty regarding the macroeconomic environment and potential impacts on customer spending.

- Despite strong growth, the penetration of telematics and safety products remains low, with less than half of North American commercial vehicles using telematics.

- The company is still in the early stages of monetizing new AI-driven products, with many still in beta testing.