Foghorn Therapeutics (FHTX, Financial) reported first-quarter revenue of $5.9 million, surpassing the consensus estimate of $4.97 million. The company is making significant strides in its partnered and proprietary program advancements. The FHD-909 Phase 1 dose escalation trial is progressing well, and recently presented data at the AACR annual meeting demonstrates the promising potential of the selective SMARCA2 inhibitor in non-small cell lung cancer.

Encouraging initial data for the Selective CBP degrader program suggests possible combination therapies in ER+ breast cancer beyond EP300-mutant cancers. Additionally, the Selective EP300 degrader program continues to exhibit anti-proliferative effects in various hematological cancers. Achievements in the Selective ARID1B program have been reported, with a program update anticipated in 2025.

Foghorn Therapeutics highlights its leadership in developing selective therapeutics, supported by a solid balance sheet and financial runway extending into 2027. This positions the company to deliver significant value through differentiated and impactful therapeutics by 2025 and beyond.

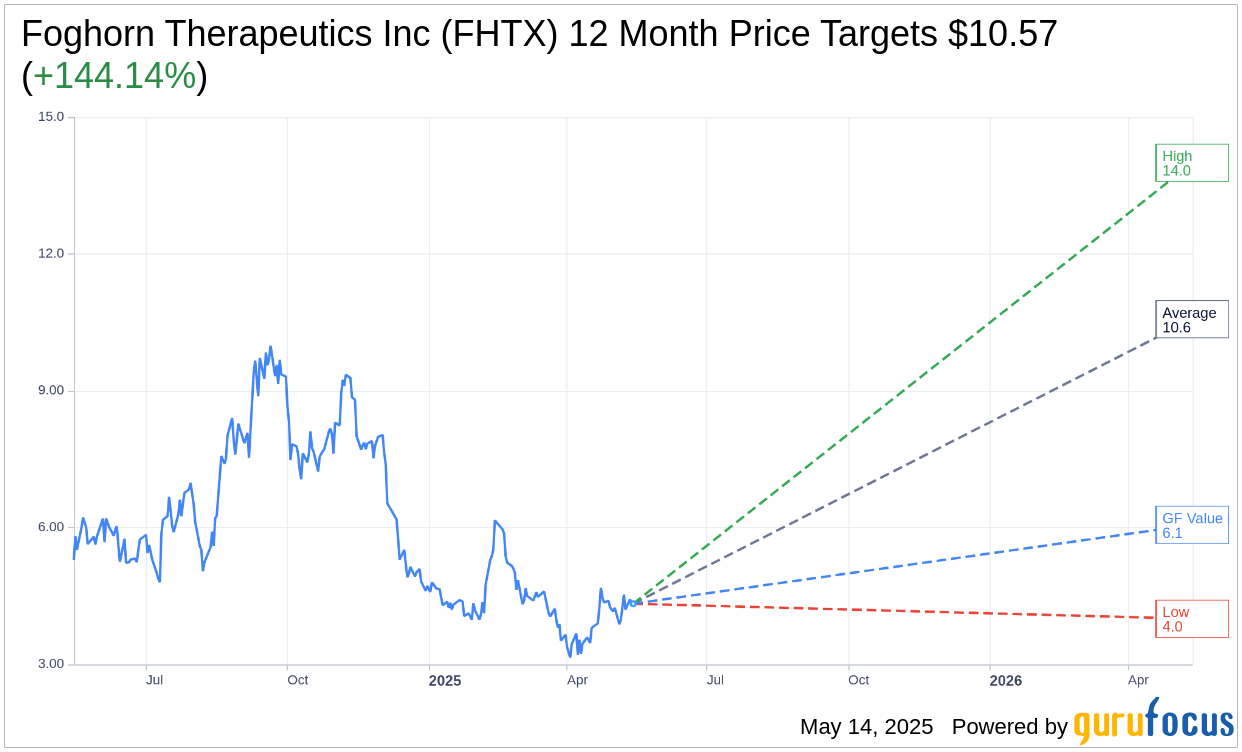

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Foghorn Therapeutics Inc (FHTX, Financial) is $10.57 with a high estimate of $14.00 and a low estimate of $4.00. The average target implies an upside of 144.14% from the current price of $4.33. More detailed estimate data can be found on the Foghorn Therapeutics Inc (FHTX) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, Foghorn Therapeutics Inc's (FHTX, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Foghorn Therapeutics Inc (FHTX, Financial) in one year is $6.06, suggesting a upside of 39.95% from the current price of $4.33. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Foghorn Therapeutics Inc (FHTX) Summary page.