Summary

- Rivian Automotive (RIVN, Financial) stock was downgraded by Jefferies due to weaker demand and R2 project updates.

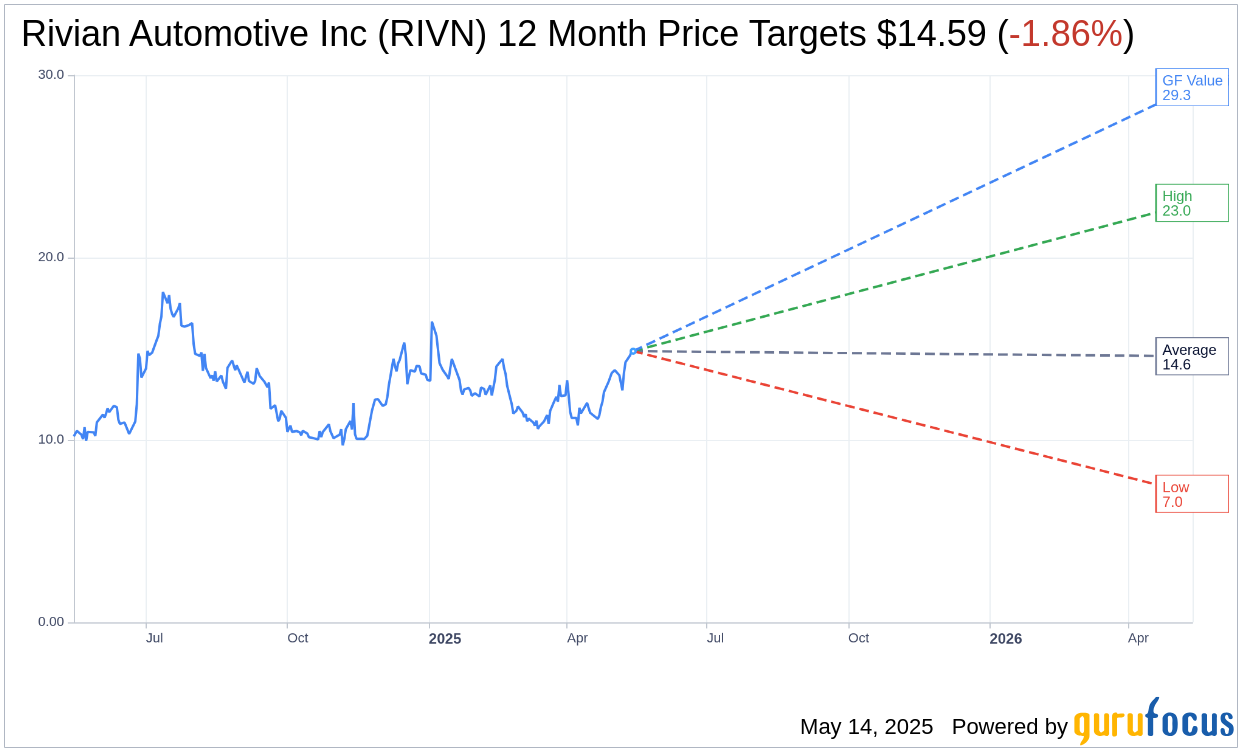

- Analysts' average price target for RIVN is $14.59, slightly below the current price of $14.87.

- GuruFocus estimates indicate a potential upside of 97.31% for RIVN, suggesting significant growth possibilities.

Jefferies Downgrades Rivian: Impact on Stock

Rivian Automotive (RIVN) recently experienced a decline in its stock value following a downgrade by Jefferies from "Buy" to "Hold." This decision was primarily influenced by concerns over decreased demand and awaited updates regarding the company's R2 project. As a result, Jefferies adjusted its 2025 revenue forecasts and set a price target of $16, while acknowledging Rivian's milestone of achieving a gross profit in Q1.

Wall Street Analysts' Forecast

According to projections from 28 analysts, the average price target for Rivian Automotive Inc (RIVN, Financial) is pinpointed at $14.59. This target comes with a high estimate of $23.00 and a low of $7.05, indicating a potential downside of 1.86% from the current trading price of $14.87. Investors can explore more in-depth estimate data on the Rivian Automotive Inc (RIVN) Forecast page.

Brokerage Firm Consensus

The consensus from 31 brokerage firms ranks Rivian Automotive Inc's (RIVN, Financial) average recommendation at 2.7, signifying a "Hold" status. The brokers' rating scale ranges from 1 to 5, with 1 representing a Strong Buy and 5 a Sell.

GuruFocus Estimated GF Value

GuruFocus' estimate for Rivian Automotive Inc's (RIVN, Financial) GF Value in one year stands at $29.34, implying a substantial upside potential of 97.31% from the current price of $14.87. The GF Value provides an estimate of what the stock's fair trading value should be, derived from historical trading multiples, past business growth, and anticipated future performance. Investors seeking more comprehensive information can visit the Rivian Automotive Inc (RIVN) Summary page.