Bernstein has adjusted its target price for Tencent Music (TME, Financial), boosting it from $15 to $15.50 while affirming the stock's Outperform rating. This decision reflects the company's solid performance in its music subscription services, which showed alignment with expectations on both the top and bottom lines.

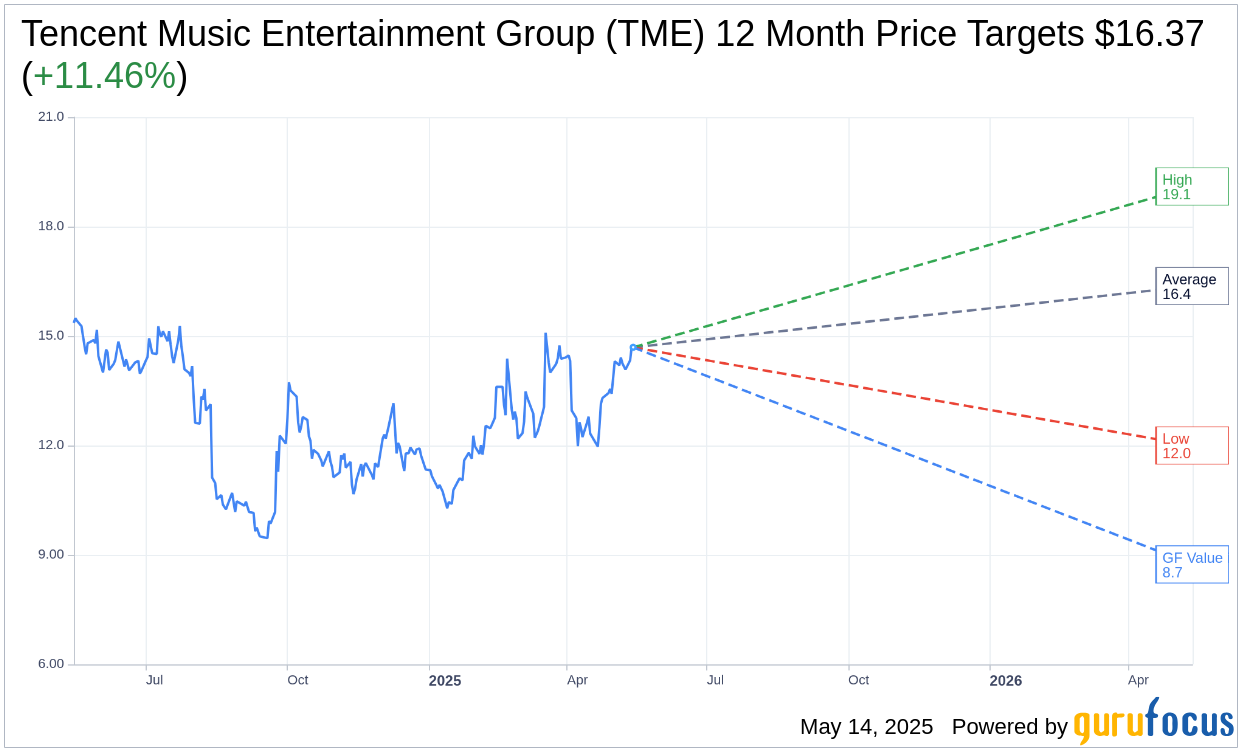

Wall Street Analysts Forecast

Based on the one-year price targets offered by 28 analysts, the average target price for Tencent Music Entertainment Group (TME, Financial) is $16.37 with a high estimate of $19.10 and a low estimate of $12.00. The average target implies an upside of 11.46% from the current price of $14.69. More detailed estimate data can be found on the Tencent Music Entertainment Group (TME) Forecast page.

Based on the consensus recommendation from 29 brokerage firms, Tencent Music Entertainment Group's (TME, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Tencent Music Entertainment Group (TME, Financial) in one year is $8.74, suggesting a downside of 40.5% from the current price of $14.69. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Tencent Music Entertainment Group (TME) Summary page.

TME Key Business Developments

Release Date: May 13, 2025

- Revenue: RMB7.4 billion, 9% year-over-year growth.

- Online Music Revenue: RMB5.8 billion, 16% year-over-year increase.

- Music Subscription Revenue: RMB4.2 billion, 17% year-over-year increase.

- Monthly ARPPU: Increased to RMB11.4 from RMB10.6 in Q1 2024.

- Gross Margin: Improved to 44.1%, up 3.2 percentage points year-over-year.

- Operating Expenses: Decreased to 15.5% of revenue from 16.8% in the same period last year.

- Effective Tax Rate: 9.2%, down from 19.9% in Q1 2024.

- Net Profit: RMB4.4 billion.

- Non-IFRS Net Profit: Increased by 23% to RMB2.2 billion.

- Diluted Earnings per ADS: RMB2.77.

- Non-IFRS Diluted Earnings per ADS: RMB1.37, up 26% year-over-year.

- Cash, Cash Equivalents, and Short-term Deposits: RMB37.7 billion as of March 31, 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Tencent Music Entertainment Group (TME, Financial) reported a strong first quarter performance with robust topline growth and increased profitability.

- The company renewed multiyear contracts with major record labels like Sony Music Entertainment, enhancing its music library with premium audio features.

- TME's SVIP membership program saw growth, driven by unique perks such as premium sound quality, early access to merchandise, and exclusive event privileges.

- Advertising revenues achieved strong year-over-year growth, supported by innovative ad-supported models and interactive features.

- The company reported a 17% year-over-year increase in music subscription revenues, with a rise in monthly ARPPU, indicating effective monetization strategies.

Negative Points

- Social entertainment services and other revenues declined by 12% year-over-year, indicating challenges in this segment.

- The company has ceased disclosing operating metrics for its social entertainment business, suggesting a strategic shift away from this area.

- Despite strong growth in music subscriptions, the company faces challenges in monetizing nonpaying users, relying heavily on advertising and fan merchandise.

- The podcast market in China remains limited in coverage, presenting challenges for growth in this segment.

- While gross margins improved, the company must continue to manage costs effectively to sustain profitability amidst competitive pressures.