As of the first quarter of 2025, APRE reported a decline in its cash reserves, with cash and cash equivalents totaling $19.3 million. This marks a decrease from the $22.8 million reported at the close of 2024. The company remains optimistic that the current cash reserves will be sufficient to cover its expected operating expenses and capital investments through the beginning of the second quarter of 2026.

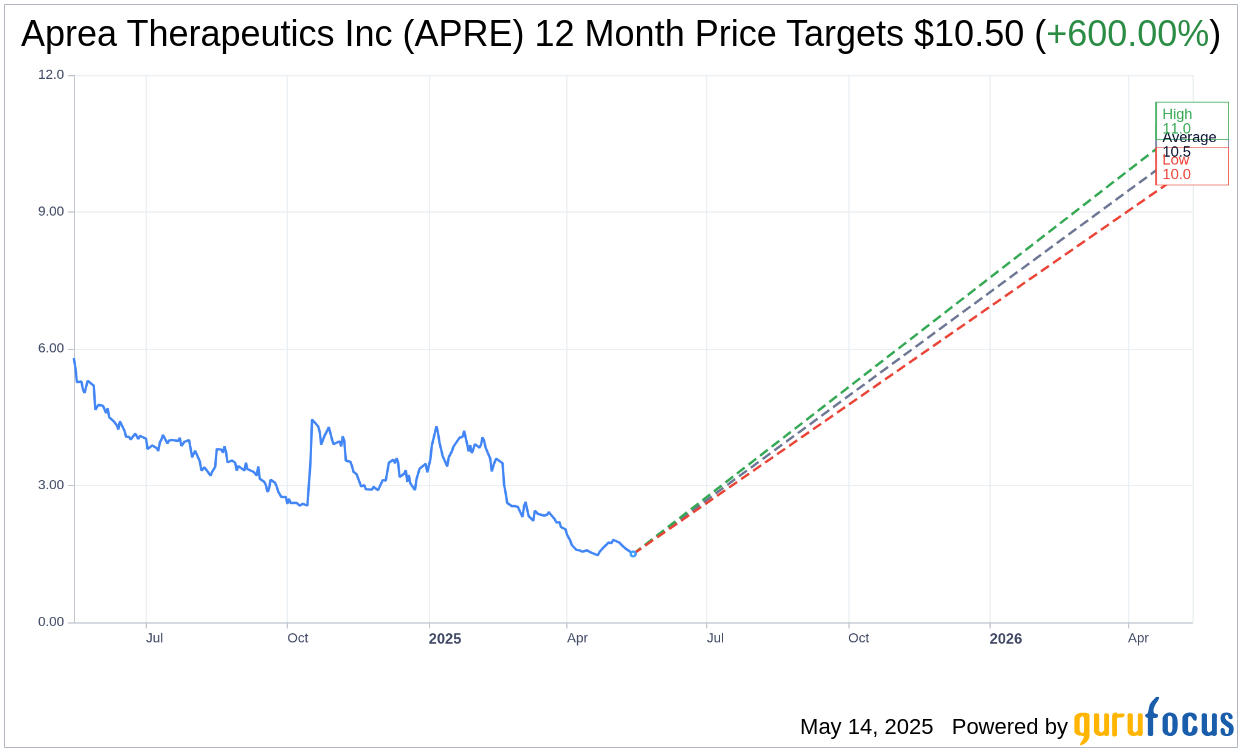

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for Aprea Therapeutics Inc (APRE, Financial) is $10.50 with a high estimate of $11.00 and a low estimate of $10.00. The average target implies an upside of 600.00% from the current price of $1.50. More detailed estimate data can be found on the Aprea Therapeutics Inc (APRE) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Aprea Therapeutics Inc's (APRE, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.