IN8bio (INAB, Financial) has introduced compelling preclinical findings for its INB-619 program at the 2025 ASGCT Annual Meeting. The research demonstrated that INB-619 effectively eradicated disease-inducing B cells in blood samples from individuals with active Systemic Lupus Erythematosus.

The data highlights INB-619's ability to achieve complete and targeted depletion of B cells derived from lupus patients. An important aspect of IN8bio's work is its gammadelta TCE that expands the Vdelta1+ and Vdelta2+ subtypes of gammadelta T cells. These cells play a crucial role in targeting both circulating and tissue-resident B cells, which could lead to more comprehensive B cell reduction.

Unlike traditional CD3-based TCEs, INB-619 does not induce significant inflammatory cytokine release, such as IL-6, which is often linked to adverse effects like CRS. This research underscores the potential of gammadelta T cell engagers as a safer and more targeted approach for treating autoimmune diseases.

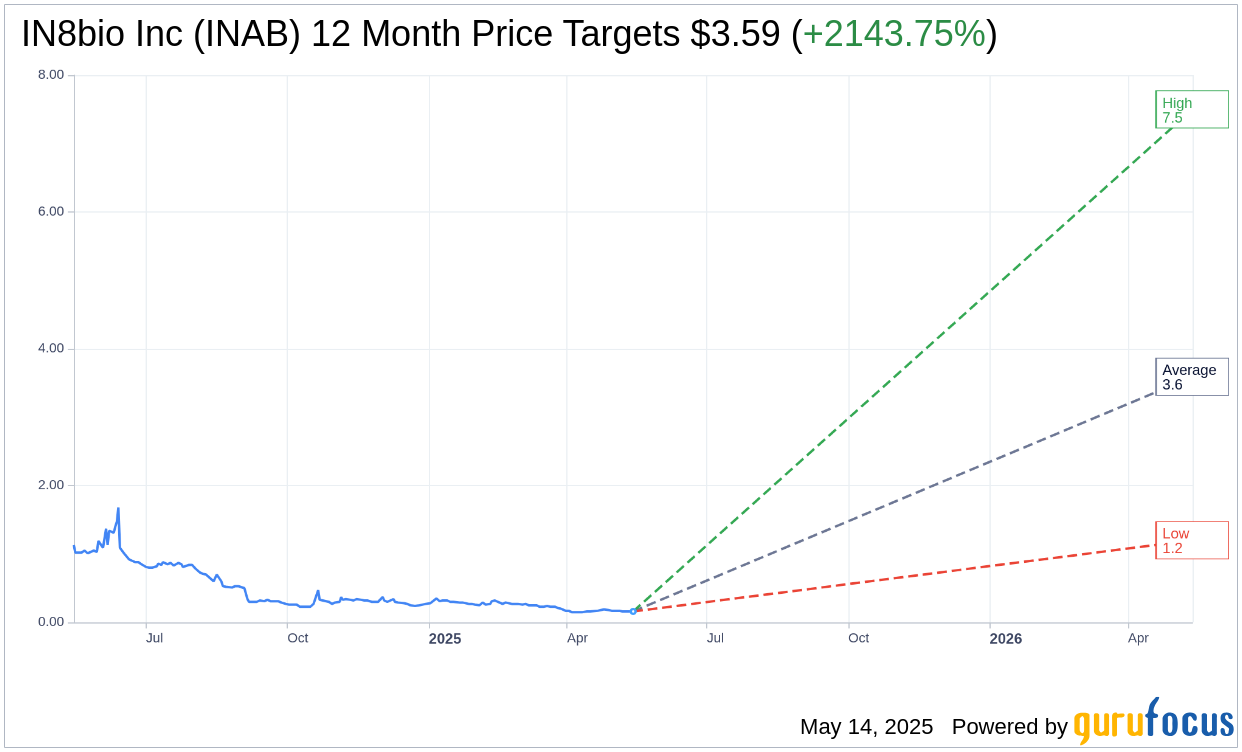

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for IN8bio Inc (INAB, Financial) is $3.59 with a high estimate of $7.50 and a low estimate of $1.20. The average target implies an upside of 2,143.75% from the current price of $0.16. More detailed estimate data can be found on the IN8bio Inc (INAB) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, IN8bio Inc's (INAB, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.