On May 14, 2025, Millrose Properties Inc (MRP, Financial) released its 8-K filing detailing its financial performance for the first quarter of 2025. This marks the company's inaugural earnings report following its spin-off from Lennar Corporation on February 7, 2025. Millrose Properties Inc, a holding company, provides operational and capital solutions for home builders and land development companies through its Homesite Option Purchase Platform.

Performance and Challenges

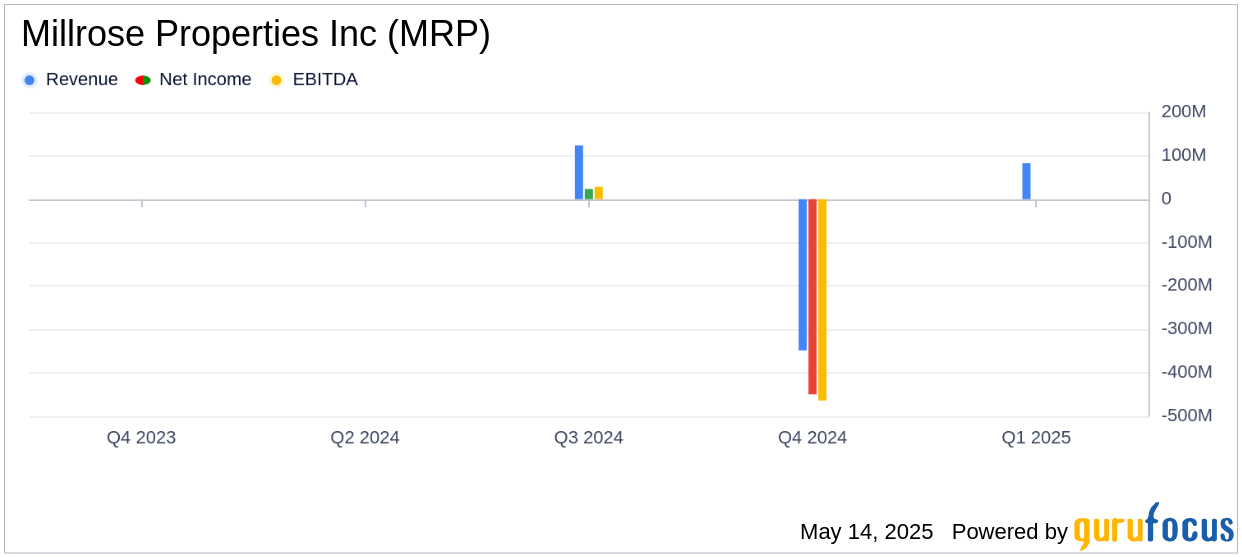

Millrose Properties Inc reported a net income attributable to common shareholders of $64.8 million, or $0.39 per share, driven by $82.7 million in option fees. The company's business model, which generates predictable, recurring income through monthly option fee payments, has shown strength. However, the company faces challenges in maintaining its growth momentum and managing its capital allocation effectively to ensure continued attractive returns for shareholders.

Financial Achievements

The company declared its inaugural dividend of $63.1 million, or $0.38 per share, covering the period from its spin-off to March 31, 2025. This dividend represents a pro-rated portion of what would equate to $0.65 per share on a normalized quarterly basis. Such financial achievements are crucial for a company in the real estate investment trust (REIT) sector, as they reflect the company's ability to generate and distribute income to shareholders.

Key Financial Metrics

Millrose Properties Inc reported a book value per share of $35.40 as of March 31, 2025. The company ended the quarter with approximately 111,000 homesites across 876 communities in 29 states. The total portfolio weighted average yield was 8.7%, reflecting the impact of new third-party homesite acquisitions under option.

| Metric | Value |

|---|---|

| Net Income | $64.8 million |

| EPS | $0.39 |

| Book Value Per Share | $35.40 |

| Dividend | $0.38 per share |

| Total Assets | $7.2 billion |

| Liquidity | $1.1 billion |

| Total Debt | $350 million |

| Debt-to-Capitalization Ratio | 5% |

Analysis and Outlook

Millrose Properties Inc's performance in the first quarter of 2025 highlights its strong start as an independent company. The company's ability to generate predictable income and maintain a conservative risk profile is crucial for its long-term success. The increase in full-year 2025 guidance for new transaction funding to $1.5 billion, up from the previously announced $1 billion, indicates strong demand for its services. Additionally, the company has increased its year-end quarterly earnings per share run-rate guidance to a range of $0.69 to $0.71.

This quarter represents an exciting beginning for Millrose Properties as a standalone company," said Darren Richman, Chief Executive Officer and President of Millrose. "The strong demand for our innovative Homesite Option Purchase Platform is driving growth and delivering value to homebuilders, land developers, and our investors."

Millrose Properties Inc's strategic partnerships and acquisitions, such as the $700 million commitment to acquire homesites in partnership with New Home Company, underscore its ability to facilitate large-scale, capital-efficient acquisitions in the homebuilding sector. The company's conservative leverage profile and significant asset base provide a solid foundation for future growth.

Explore the complete 8-K earnings release (here) from Millrose Properties Inc for further details.