Quick Summary:

- DeFi Technologies (DEFT, Financial) showcases robust revenue growth with C$62.7 million in Q1 2025.

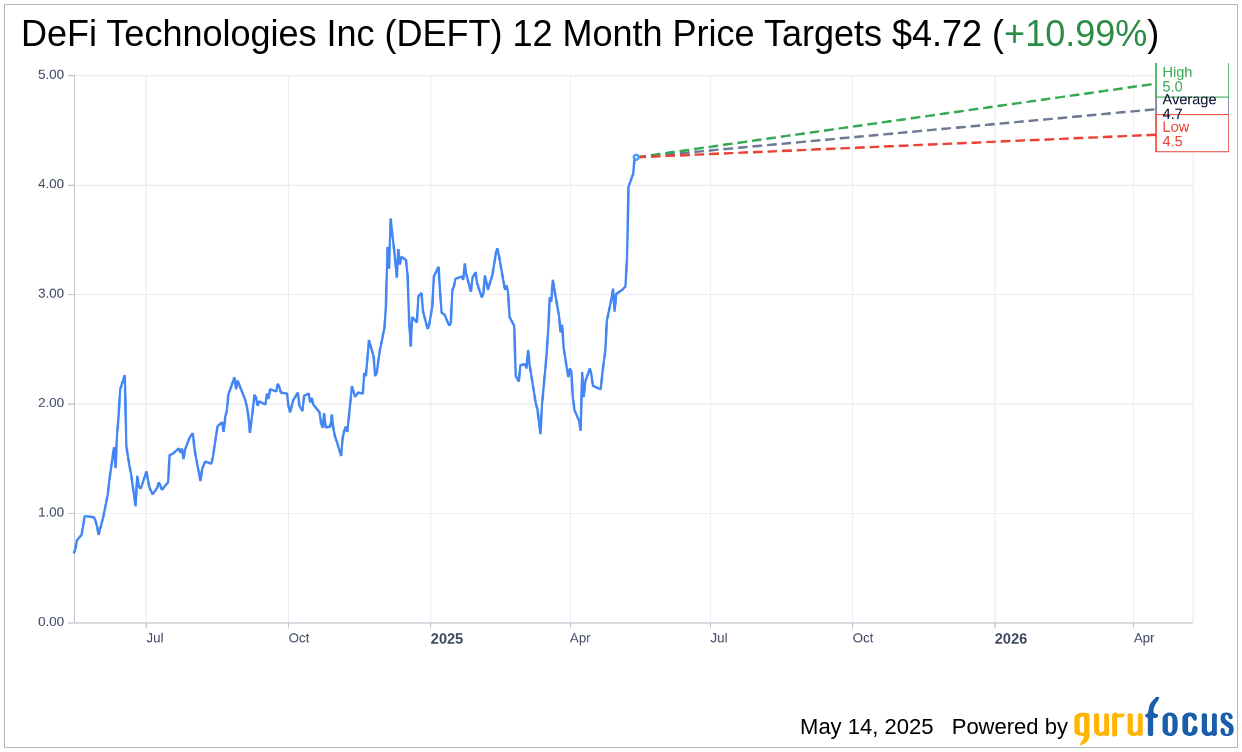

- Analysts forecast a potential price target increase to $4.72, indicating an upside potential of nearly 11%.

- GuruFocus evaluates DEFT's fair value at $1.07, highlighting a significant downside from the current market price.

DeFi Technologies (DEFT) has reported impressive financial results for the first quarter of 2025, with revenues soaring to C$62.7 million (US$43.1 million). This remarkable increase from the previous year’s C$4.9 million is primarily driven by the rising income from staking, enhanced management fees, and favorable digital asset prices. Additionally, DeFi Technologies achieved a net income of C$43.0 million, successfully turning around a prior-year loss of C$19.3 million.

Analyst Price Forecast for DeFi Technologies

Current evaluations by two analysts suggest a one-year target price for DeFi Technologies Inc (DEFT, Financial) averaging at $4.72. This includes a high estimate of $4.97 and a low estimate of $4.47. The average price target reflects a potential upside of 10.99% from the latest stock price of $4.25. For a more comprehensive analysis, visit the DeFi Technologies Inc (DEFT) Forecast page.

The consensus recommendation from one brokerage firm places DeFi Technologies Inc (DEFT, Financial) at an average rating of 2.0, which corresponds to an "Outperform" status. This rating scale ranges from 1, indicating a Strong Buy, to 5, signaling a Sell.

GuruFocus GF Value Assessment

According to GuruFocus metrics, the estimated GF Value of DeFi Technologies Inc (DEFT, Financial) for the coming year is calculated to be $1.07. This suggests a substantial downside of 74.82% from the current stock price of $4.25. The GF Value is derived from historical trading multiples, past business growth, and projected future business performance. More detailed information is available on the DeFi Technologies Inc (DEFT) Summary page.