- Arbutus Biopharma (ABUS, Financial) recorded a revenue increase of 15% year-over-year.

- Analyst consensus indicates an "Outperform" rating with a potential upside of 64.58%.

- GuruFocus estimates suggest a significant downside based on GF Value calculations.

Arbutus Biopharma (NASDAQ: ABUS) has announced its financial results for the first quarter, and the numbers present a mixed bag for investors. While the company reported a GAAP EPS of -$0.13, falling $0.03 short of expectations, it also delivered promising revenue growth. The revenue reached $1.76 million, marking a 15% increase compared to the same period last year and exceeded projections by $0.17 million. Moreover, Arbutus holds a solid financial position with $113 million in cash, cash equivalents, and marketable securities.

Wall Street Analyst Projections

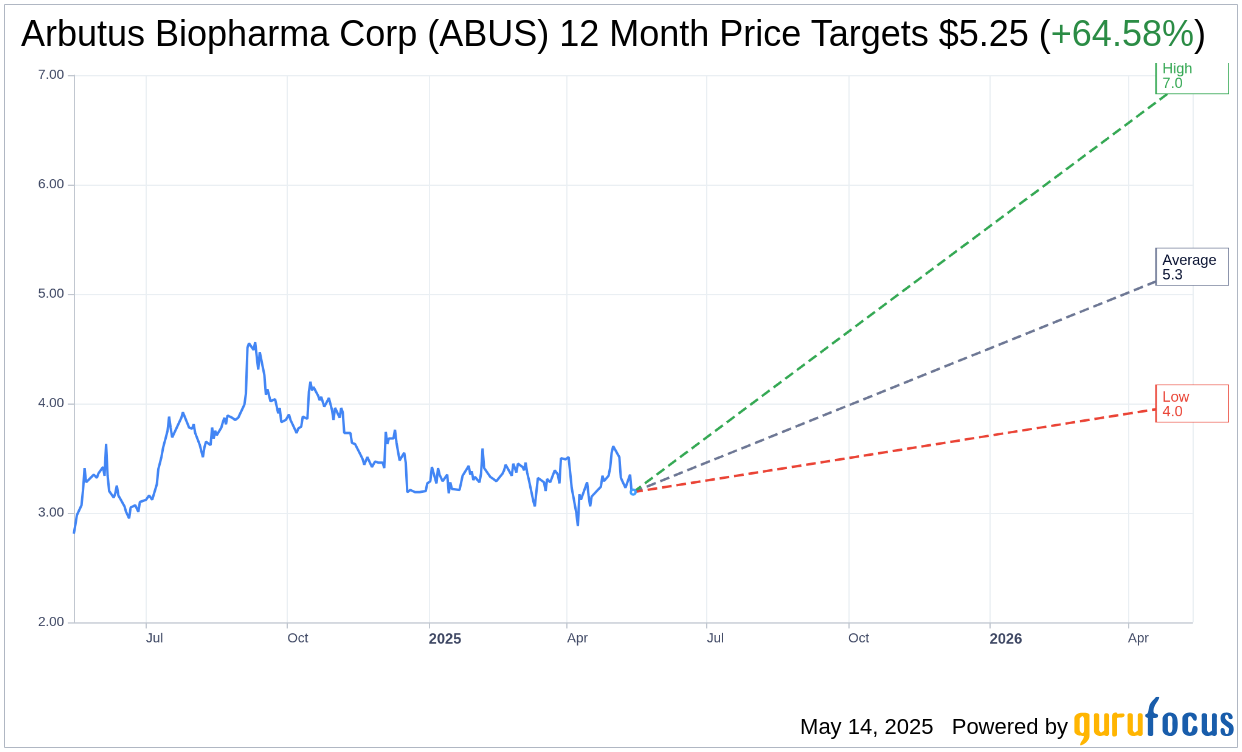

On the price forecast front, a group of four analysts have set a one-year target price for Arbutus Biopharma Corp. The average target stands at $5.25, with projections spanning from a low of $4.00 to a high of $7.00. This average target suggests a potential upside of 64.58% from the current share price of $3.19. For a deep dive into these projections, visit the Arbutus Biopharma Corp (ABUS, Financial) Forecast page.

Brokerage Firm Recommendations

The consensus from four brokerage firms gives Arbutus Biopharma Corp an average brokerage recommendation of 2.0. This "Outperform" rating places Arbutus on a favorable path with investors, as the scale ranges from 1 (Strong Buy) to 5 (Sell).

Understanding the GF Value Estimate

Despite positive analyst sentiment, the GuruFocus GF Value model presents a stark contrast. It estimates a fair value of $0.63 for Arbutus Biopharma Corp in one year, indicating a potential downside of 80.25% from the current $3.19 price point. The GF Value is developed based on the stock's historical trading multiples, past business performance, and future growth estimates. For comprehensive data on this methodology, refer to the Arbutus Biopharma Corp (ABUS, Financial) Summary page.