Lucid Diagnostics (LUCD, Financial) reported first-quarter revenue of $828,000, significantly falling short of the expected $1.54 million. However, the company remains optimistic about its future prospects, particularly with its EsoGuard product. Lucid's CEO, Lishan Aklog, M.D., highlighted the progress being made in several areas, including expanding cash-pay and contracted programs aimed at concierge medicine practices and self-insured employers. Furthermore, Lucid is seeing increasing support from regional commercial insurers for EsoGuard coverage.

With recent capital influxes, Lucid has extended its operational timeline to surpass key reimbursement milestones, including those from Medicare. This financial cushioning positions the firm to enhance its commercialization activities after reaching these crucial checkpoints.

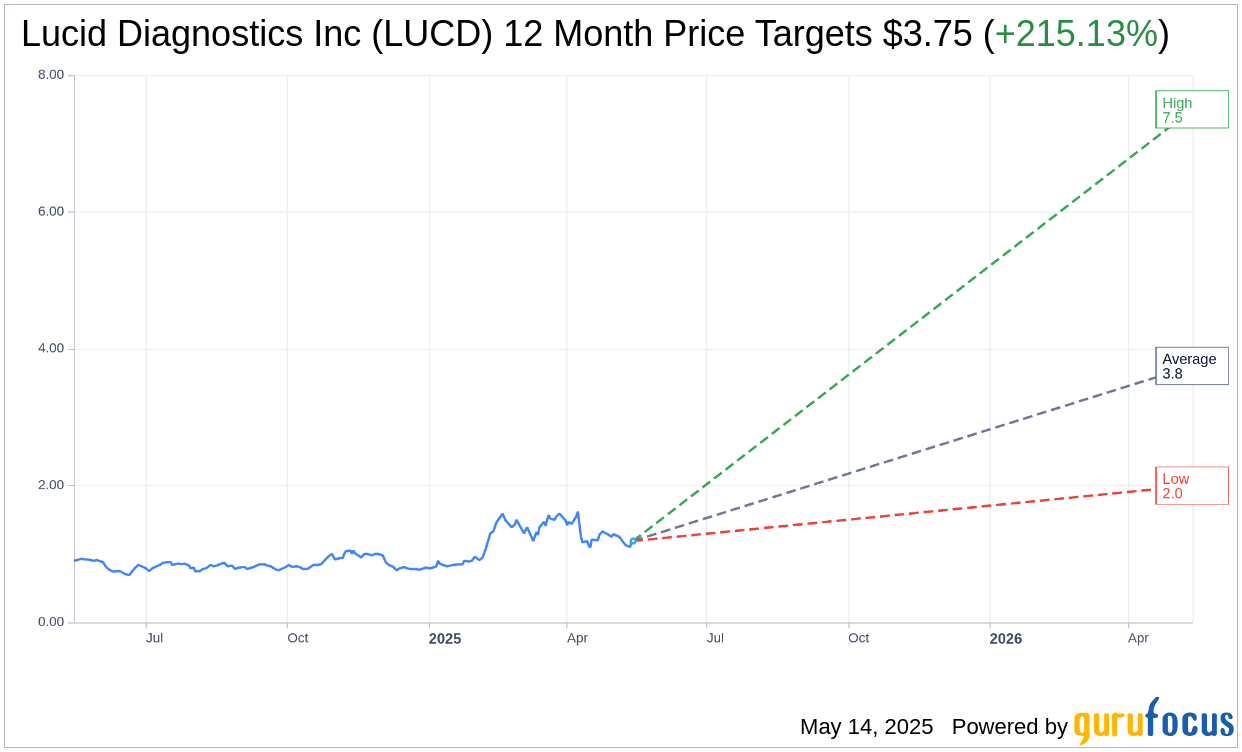

Wall Street Analysts Forecast

Based on the one-year price targets offered by 6 analysts, the average target price for Lucid Diagnostics Inc (LUCD, Financial) is $3.75 with a high estimate of $7.50 and a low estimate of $2.00. The average target implies an upside of 215.13% from the current price of $1.19. More detailed estimate data can be found on the Lucid Diagnostics Inc (LUCD) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Lucid Diagnostics Inc's (LUCD, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Lucid Diagnostics Inc (LUCD, Financial) in one year is $8.84, suggesting a upside of 642.86% from the current price of $1.19. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Lucid Diagnostics Inc (LUCD) Summary page.

LUCD Key Business Developments

Release Date: March 24, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Lucid Diagnostics Inc (LUCD, Financial) reported a strong finish to 2024 with significant advancements in sales channels and reimbursement milestones.

- The company achieved a record quarterly test volume of over 4,000 tests, surpassing their target of 2,500 to 3,000 tests per quarter.

- Lucid Diagnostics Inc (LUCD) secured its first positive commercial insurance coverage policy with Highmark Blue Cross Blue Shield of New York, setting a precedent for future engagements with commercial payers.

- The National Comprehensive Cancer Network (NCCN) included a section on screening for esophageal pre-cancer in their clinical practice guidelines, aligning with existing guidelines and supporting the use of non-endoscopic biomarker testing.

- The company strengthened its balance sheet with a long-term debt refinancing and a registered direct common stock offering, extending their financial runway past upcoming key reimbursement milestones.

Negative Points

- Revenue for the fourth quarter was $1.2 million, which was relatively flat compared to recent quarters.

- The company's quarterly burn rate was $10.1 million, although this was lower than the average burn rate for the four preceding quarters.

- The effective average selling price (ASP) per test was lower than expected, around $300, due to timing of payments and elongated collection periods.

- A significant portion of reimbursement claims are still being adjudicated, with some claims being denied as not medically necessary or requiring prior authorization.

- The company is still in the early stages of its reimbursement process, recognizing revenue only upon actual cash collections rather than when the test report is delivered.