Aethlon Medical (AEMD, Financial) has announced a significant development with the publication of a pre-clinical ex vivo study on bioRxiv. This study, titled “Ex Vivo Removal of CD41 positive platelet microparticles from Plasma by a Medical Device containing a Galanthus nivalis agglutinin, or GNA, affinity resin,” highlights their Hemopurifier technology. The Hemopurifier is a cutting-edge blood filtration device aimed at extracting harmful extracellular vesicles (EVs) and dangerous viruses from blood and other bodily fluids.

This innovation is applicable across multiple fields, including oncology, infectious diseases, organ transplantation, and other critical medical areas. Platelet-derived extracellular vesicles, the most prevalent EVs in the body, are released in response to various stimuli and play roles in vascular damage, immune activation, and tumor cell dissemination. Elevated levels of these EVs are associated with numerous diseases such as cancer, lupus, systemic sclerosis, multiple sclerosis, Alzheimer’s, sepsis, and acute and Long COVID.

The company plans to submit the study findings to a peer-reviewed medical journal and will focus on analyzing the removal of PD-EVs and their cargo from plasma in diseases of interest in future research.

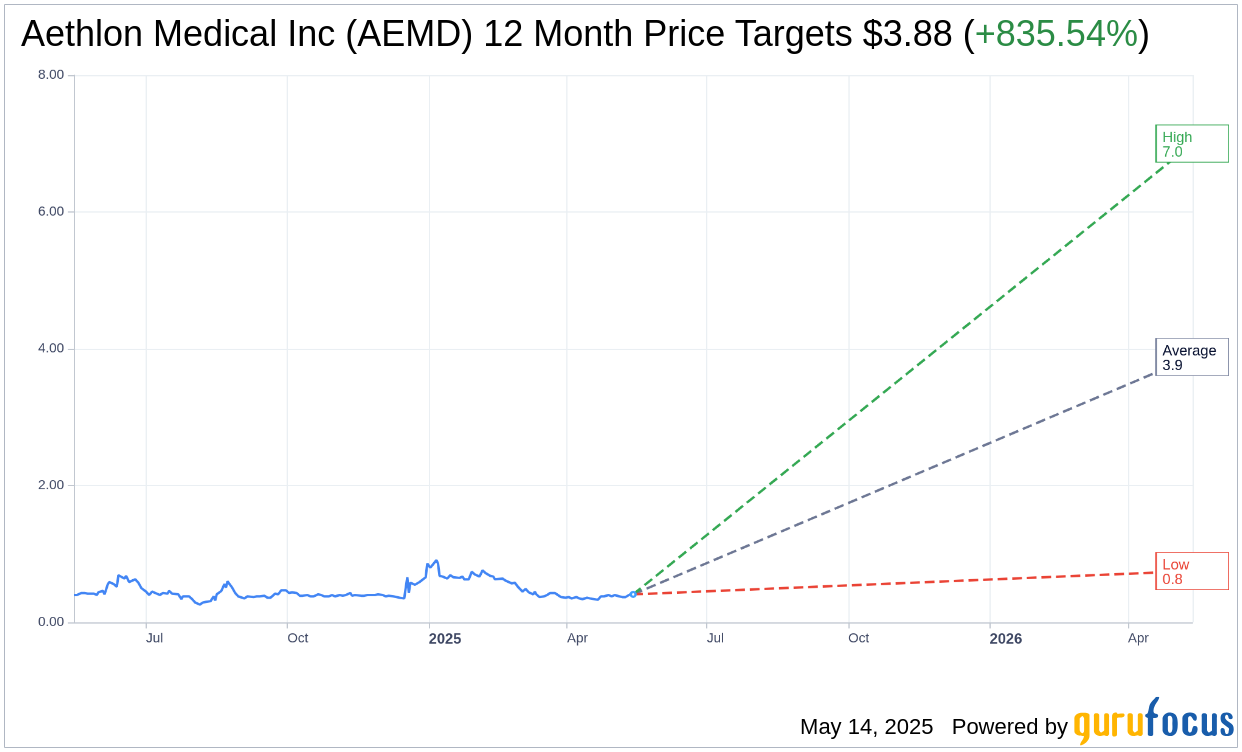

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for Aethlon Medical Inc (AEMD, Financial) is $3.88 with a high estimate of $7.00 and a low estimate of $0.75. The average target implies an upside of 835.54% from the current price of $0.41. More detailed estimate data can be found on the Aethlon Medical Inc (AEMD) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Aethlon Medical Inc's (AEMD, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Aethlon Medical Inc (AEMD, Financial) in one year is $12.50, suggesting a upside of 2917.87% from the current price of $0.4142. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Aethlon Medical Inc (AEMD) Summary page.