Key Highlights:

- Sanara MedTech (SMTI, Financial) exceeds EPS expectations in Q1 despite a slight revenue shortfall.

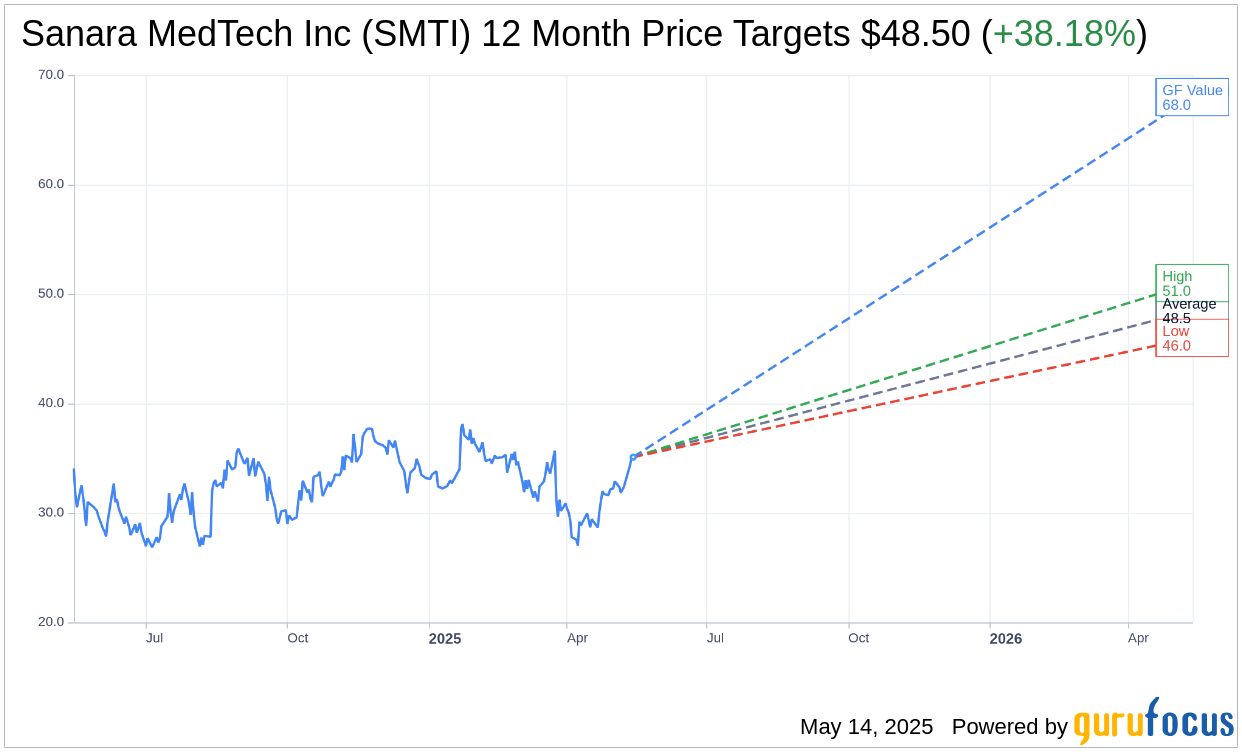

- Analysts predict substantial upside with a target price signaling a 38.18% increase.

- Gurus estimate a remarkable 93.73% potential upside based on GF Value calculations.

In its latest financial release, Sanara MedTech (SMTI) reported a Q1 GAAP EPS of -$0.41, surpassing analyst expectations by $0.10. The company's revenue saw a significant rise, reaching $23.4 million, a 26.5% increase compared to the previous year, though it fell short by $0.08 million against projections. Investors can look forward to the company's pilot launch of Tissue Health Plus set for Q2 2025.

Wall Street Analysts' Forecast

Delving into the projections from two analysts, Sanara MedTech Inc (SMTI, Financial) has an average target price set at $48.50, with expectations ranging from a high of $51.00 to a low of $46.00. This suggests a promising upside of 38.18% from its current trading price of $35.10. Investors seeking more comprehensive estimate data should visit the Sanara MedTech Inc (SMTI) Forecast page.

The consensus among two brokerage firms rates Sanara MedTech Inc (SMTI, Financial) at an average recommendation of 2.0, categorizing it as "Outperform." This rating is part of a scale from 1 to 5, where 1 indicates a Strong Buy and 5 signifies a Sell.

According to GuruFocus estimates, the projected GF Value for Sanara MedTech Inc (SMTI, Financial) one year from now stands at $68.00. This estimation suggests a potential upside of 93.73% from its current price of $35.1. The GF Value represents an estimation of the fair market value based on historical trading multiples, previous growth, and future performance forecasts of the business. For more in-depth data, visit the Sanara MedTech Inc (SMTI) Summary page.