Cingulate (CING, Financial) has received feedback from the U.S. Food and Drug Administration (FDA) concerning its upcoming New Drug Application (NDA) for CTx-1301, a treatment aimed at managing Attention Deficit/Hyperactivity Disorder (ADHD). The FDA has laid out a commitment for post-approval stability data for six intermediate dosage strengths, ranging from 12.5 mg to 43.75 mg. These measures are intended for review during the drug’s approval process.

Additionally, Cingulate anticipates that all dosage strengths will have a shelf-life of 24 months upon launch, with potential for extension based on results from stability tests. The FDA has deemed the available nonclinical safety data sufficient to proceed with filing. Furthermore, Cingulate has established a scientific rationale that allows CTx-1301 to utilize efficacy and safety data from the established drug, Focalin XR. The company's strategy for summarizing safety and efficacy has been considered reasonable by the FDA.

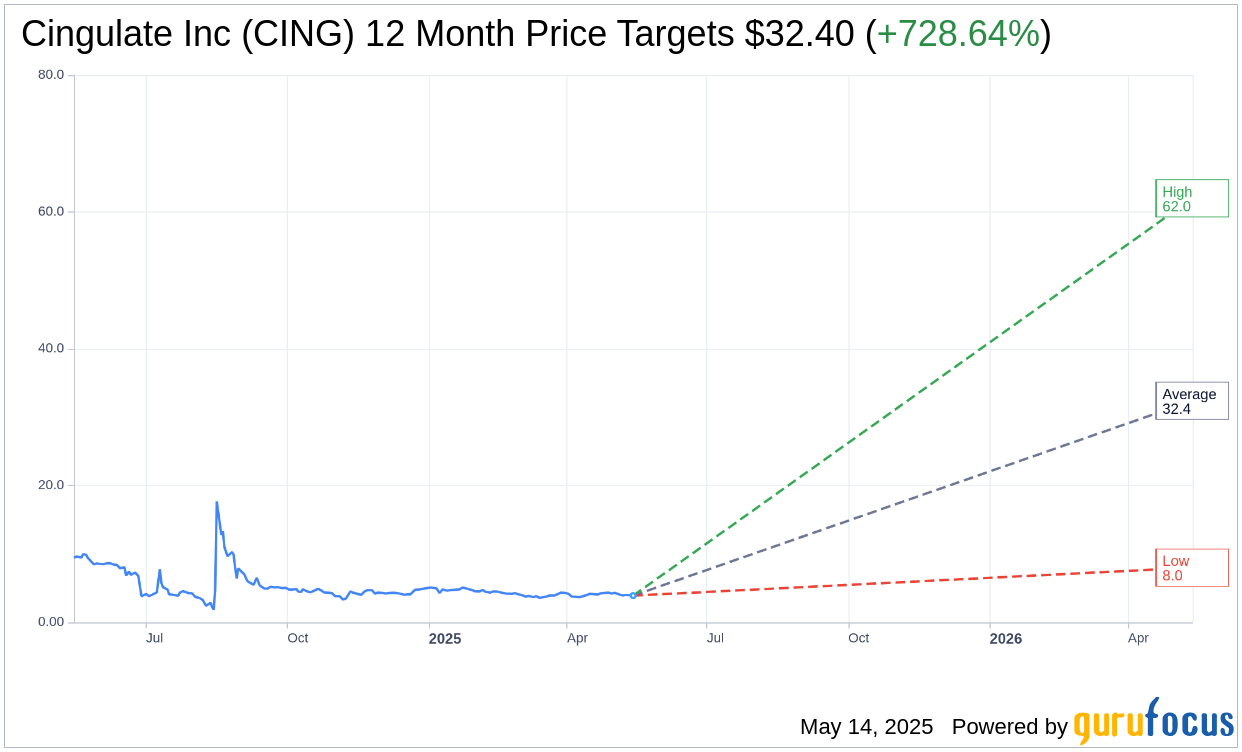

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Cingulate Inc (CING, Financial) is $32.40 with a high estimate of $62.00 and a low estimate of $8.00. The average target implies an upside of 728.64% from the current price of $3.91. More detailed estimate data can be found on the Cingulate Inc (CING) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, Cingulate Inc's (CING, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.