UBS has revised its price target for Arrowhead (ARWR, Financial), decreasing it from $71 to $63. Despite this adjustment, the firm maintains its Buy rating on the stock, indicating continued confidence in its potential. Investors are encouraged to consider the company's performance metrics, which are available through various financial analysis tools, to make informed decisions.

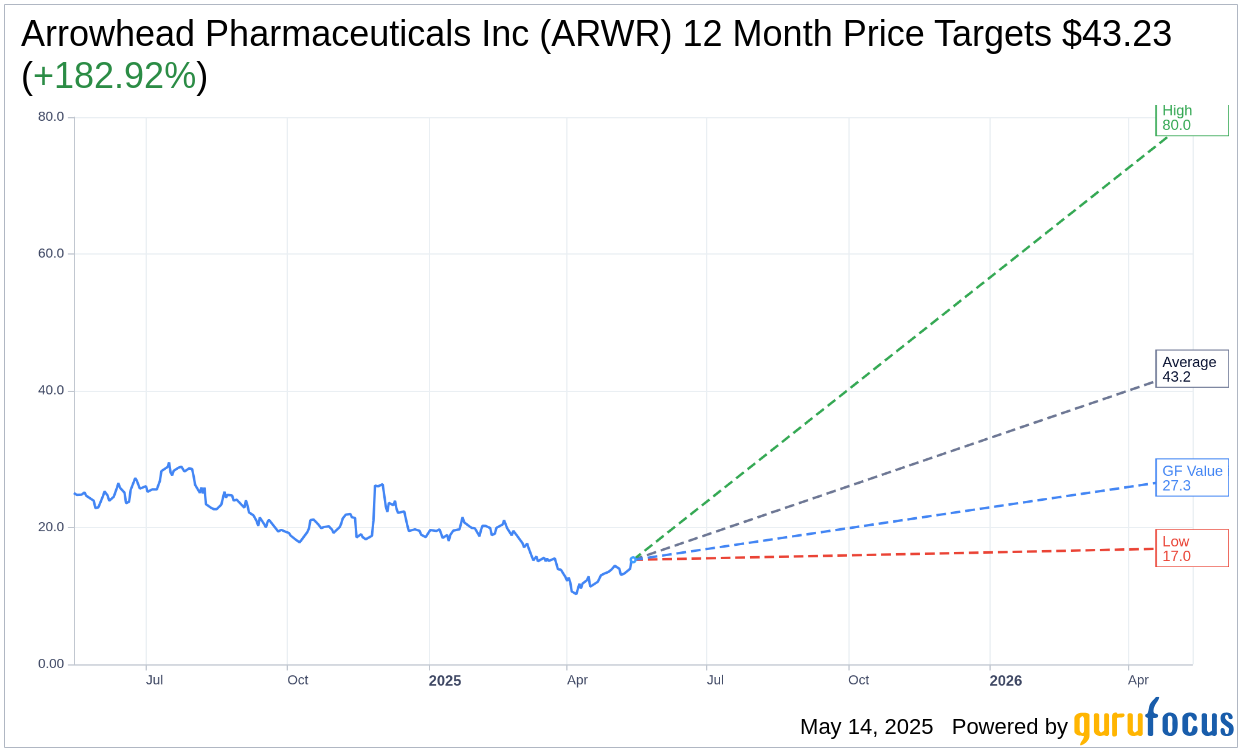

Wall Street Analysts Forecast

Based on the one-year price targets offered by 13 analysts, the average target price for Arrowhead Pharmaceuticals Inc (ARWR, Financial) is $43.23 with a high estimate of $80.00 and a low estimate of $17.00. The average target implies an upside of 182.92% from the current price of $15.28. More detailed estimate data can be found on the Arrowhead Pharmaceuticals Inc (ARWR) Forecast page.

Based on the consensus recommendation from 15 brokerage firms, Arrowhead Pharmaceuticals Inc's (ARWR, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Arrowhead Pharmaceuticals Inc (ARWR, Financial) in one year is $27.32, suggesting a upside of 78.8% from the current price of $15.28. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Arrowhead Pharmaceuticals Inc (ARWR) Summary page.

ARWR Key Business Developments

Release Date: May 12, 2025

- Net Income: $370.4 million or $2.75 per share for the quarter ended March 31, 2025.

- Revenue: $542.7 million for the quarter ended March 31, 2025.

- Operating Expenses: $161.5 million for the quarter ended March 31, 2025.

- Cash and Investments: $1.1 billion as of March 31, 2025.

- Common Shares Outstanding: 138.1 million as of March 31, 2025.

- Cash Flow from Operating Activities: $460.1 million provided during the quarter ended March 31, 2025.

- Sarepta Agreement Revenue Recognition: $542.7 million recognized during the quarter ended March 31, 2025.

- Future Revenue Guidance: $90 million to $125 million expected over the next 12 months from initial fixed contract revenue.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Arrowhead Pharmaceuticals Inc (ARWR, Financial) is on track to launch its first commercial product, plozasiran, this year, pending regulatory approval.

- The company has a strong financial position, with $1.1 billion in cash and investments, and is funded into 2028.

- Arrowhead Pharmaceuticals Inc (ARWR) has a robust pipeline with multiple Phase III studies and potential launches in the coming years.

- The company has secured a significant partnership with Sarepta Therapeutics, bringing in $500 million upfront and additional potential milestones.

- Arrowhead Pharmaceuticals Inc (ARWR) is making progress in expanding its RNAi technology to new areas, including CNS and obesity treatments.

Negative Points

- The biotech market remains uncertain, which could impact future funding and partnerships.

- Regulatory approval for plozasiran is still pending, with a PDUFA date set for November 18, 2025.

- There is competition in the triglyceride-lowering market, which could impact the commercial success of plozasiran.

- The company faces challenges in patient identification and market education for its rare disease treatments.

- Arrowhead Pharmaceuticals Inc (ARWR) has not yet finalized its commercialization strategy for plozasiran outside the U.S., which could delay international market entry.