Truist has increased its price target for American Public Education (APEI, Financial) from $24 to $30 while maintaining a Hold rating on the stock. This adjustment follows the company's strong performance in the first quarter, which exceeded expectations. Additionally, APEI has slightly revised its EBITDA guidance for 2025 upwards. Although the updated guidance is considered "conservative," it indicates a strategic effort by the company to restore its pattern of surpassing expectations after challenges faced post-RU acquisition, according to analysts.

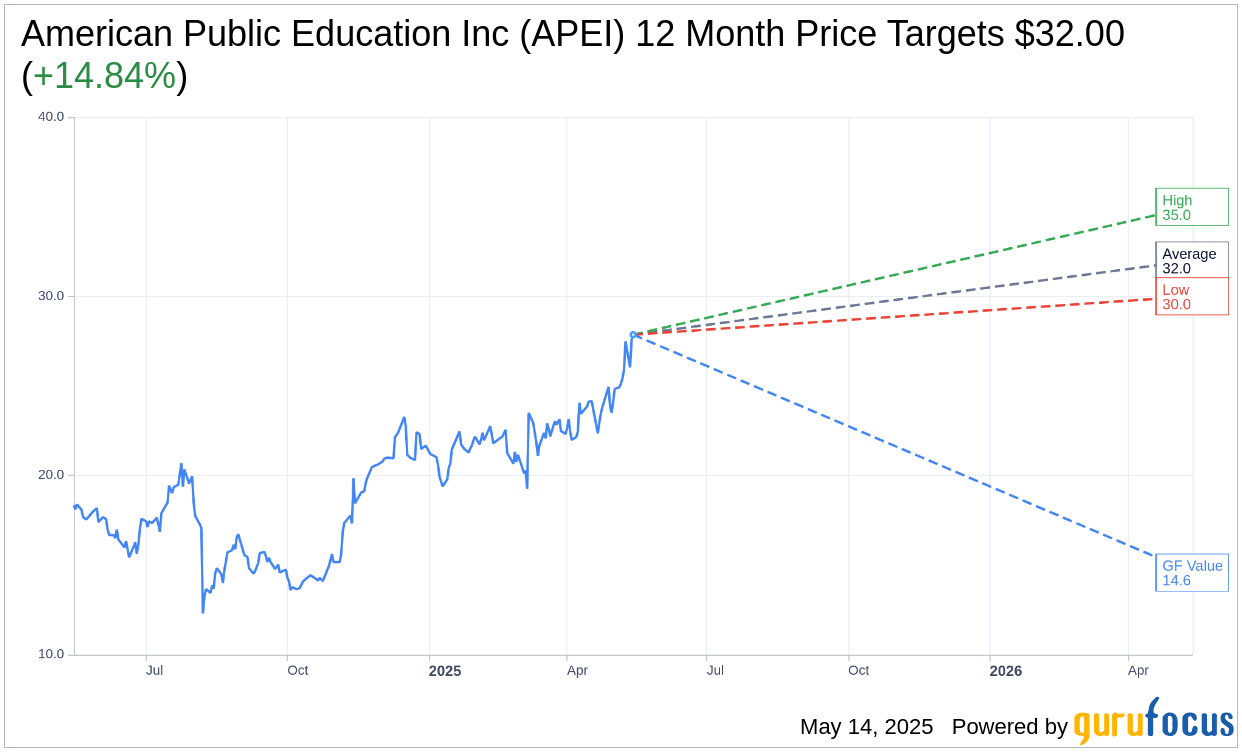

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for American Public Education Inc (APEI, Financial) is $32.00 with a high estimate of $35.00 and a low estimate of $30.00. The average target implies an upside of 14.84% from the current price of $27.87. More detailed estimate data can be found on the American Public Education Inc (APEI) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, American Public Education Inc's (APEI, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for American Public Education Inc (APEI, Financial) in one year is $14.58, suggesting a downside of 47.68% from the current price of $27.865. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the American Public Education Inc (APEI) Summary page.

APEI Key Business Developments

Release Date: May 12, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- American Public Education Inc (APEI, Financial) outperformed its first quarter 2025 financial guidance, with revenue, adjusted EBITDA margin, and net income exceeding expectations.

- Rasmussen College showed significant improvement, with an 8% year-over-year enrollment increase in Q2 and a positive $5 million adjusted EBITDA swing from a loss in the previous year.

- APEI's net income to common shareholders increased to $0.5 million from a negative $6.2 million net loss, demonstrating a strong financial turnaround.

- The company is improving operating leverage through increased enrollment and disciplined cost management, with revenue up 6.6% and adjusted EBITDA increasing nearly 25%.

- APEI plans to redeem preferred shares, which will save approximately $6 million in dividend expenses annually starting in 2026, contributing to future profitability.

Negative Points

- Graduate School USA faces challenges due to government employee headcount reductions and budget uncertainties, impacting APEI's full-year revenue guidance.

- APEI's second quarter guidance includes a net loss due to a $2.9 million redemption premium on preferred stock and $1.7 million in costs related to institutional consolidation.

- The company is experiencing headwinds at the Graduate School due to changing federal priorities and policies, affecting revenue expectations.

- APEI's guidance assumes potential downside from Graduate School, indicating ongoing uncertainty in this segment.

- Despite positive enrollment trends, APEI faces challenges in optimizing its program mix and addressing mixed shifts in programs at Hondros, which impacted profitability.