On May 14, 2025, Cantor Fitzgerald analyst Timur Ivannikov reiterated an "Overweight" rating for Astria Therapeutics (ATXS, Financial). This decision underscores the confidence in the company's prospects, indicating a positive outlook without changes to the existing evaluation.

The price target for Astria Therapeutics (ATXS, Financial) remains consistent at $47.00 USD. This reflects the continued belief in the company's performance potential, with no alterations from the previous target set by the analyst.

The steady price target and maintained rating suggest stability in the stock's projected growth. Investors may see this reiteration as a signal of confidence from Cantor Fitzgerald in the long-term valuation of Astria Therapeutics (ATXS, Financial).

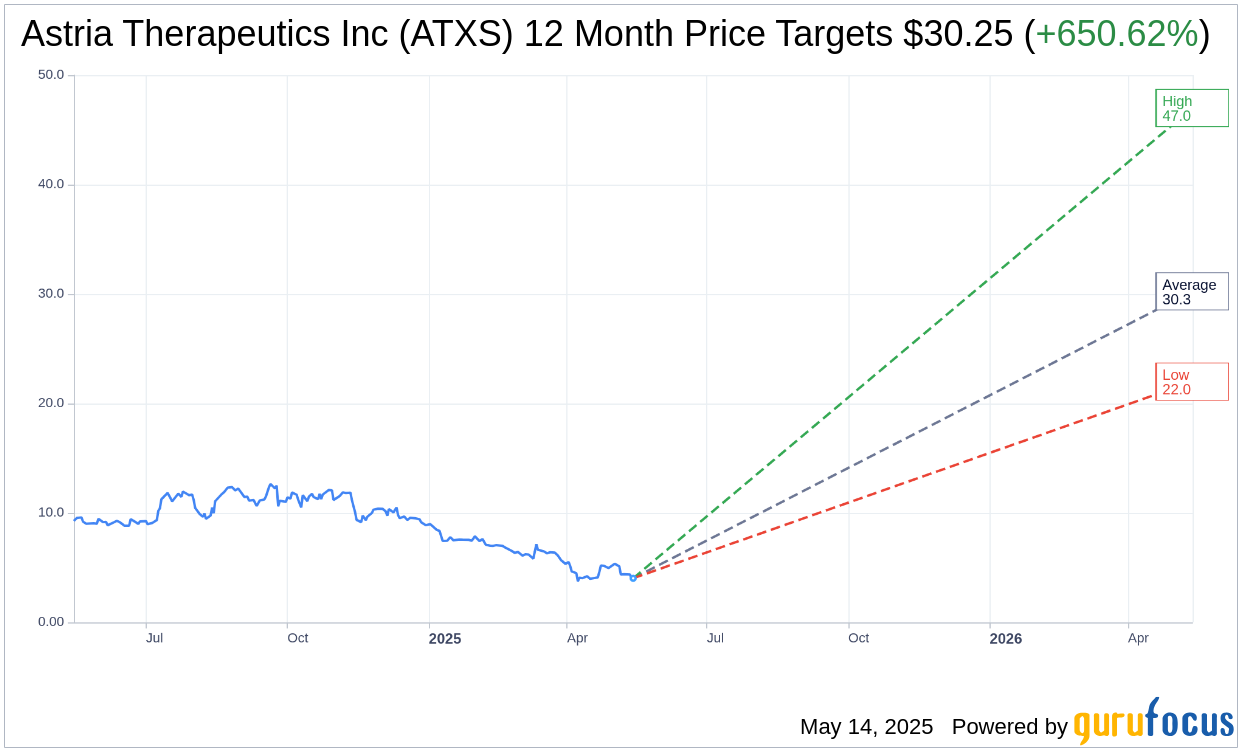

Wall Street Analysts Forecast

Based on the one-year price targets offered by 8 analysts, the average target price for Astria Therapeutics Inc (ATXS, Financial) is $30.25 with a high estimate of $47.00 and a low estimate of $22.00. The average target implies an upside of 644.16% from the current price of $4.07. More detailed estimate data can be found on the Astria Therapeutics Inc (ATXS) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Astria Therapeutics Inc's (ATXS, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.