Expedia Group (EXPE, Financial) has rolled out an extensive enhancement of its business-to-business technology platform, introducing innovative APIs and new advertising features. The company is broadening its technological offerings with the inclusion of GenAI-driven tools, such as the novel Expedia Trip Matching. This unique feature converts Instagram reels into tailored travel recommendations.

Moreover, Expedia Group is advancing its service capabilities with the latest update of its comprehensive AI Agent on Hotels.com. This development includes integration with cutting-edge technologies like OpenAI Operator and Microsoft Copilot Actions, aiming to simplify and enrich the trip-planning process. These initiatives were highlighted during the company's premier EXPLORE event, signaling Expedia's commitment to enhancing user experience at every stage of travel planning.

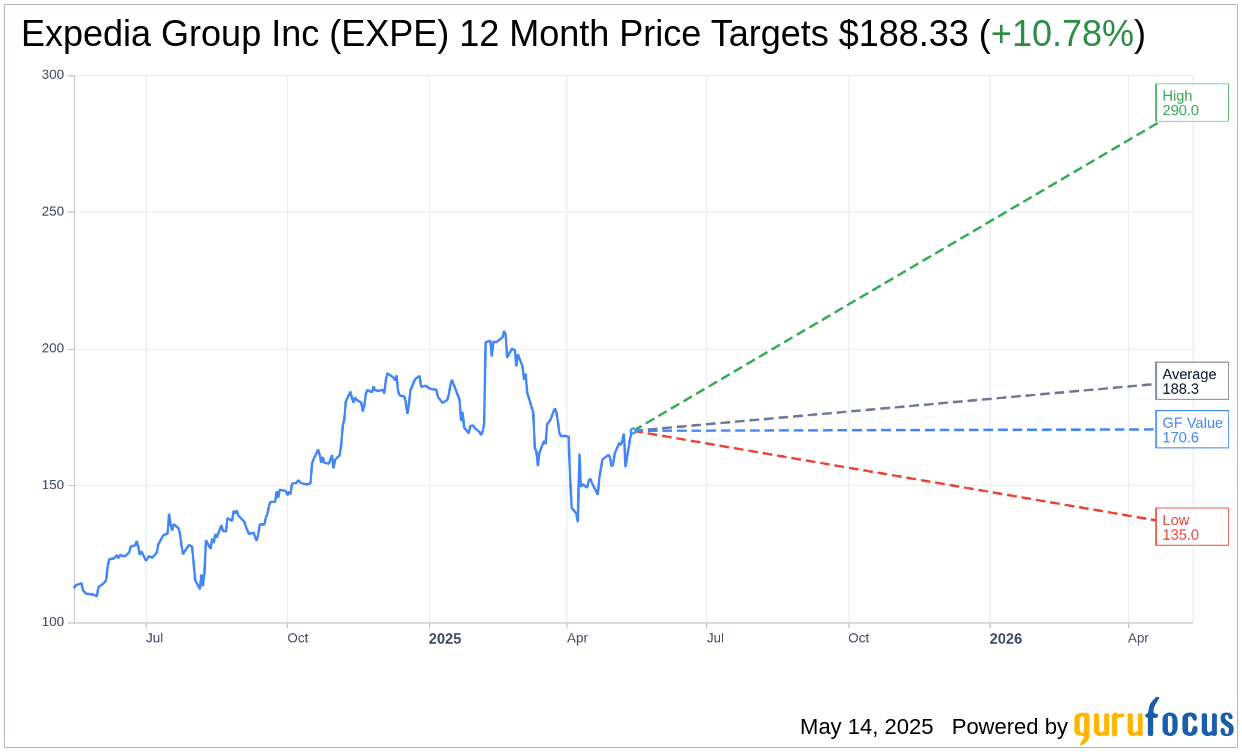

Wall Street Analysts Forecast

Based on the one-year price targets offered by 31 analysts, the average target price for Expedia Group Inc (EXPE, Financial) is $188.33 with a high estimate of $290.00 and a low estimate of $135.00. The average target implies an upside of 10.33% from the current price of $170.70. More detailed estimate data can be found on the Expedia Group Inc (EXPE) Forecast page.

Based on the consensus recommendation from 37 brokerage firms, Expedia Group Inc's (EXPE, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Expedia Group Inc (EXPE, Financial) in one year is $170.57, suggesting a downside of 0.08% from the current price of $170.7. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Expedia Group Inc (EXPE) Summary page.

EXPE Key Business Developments

Release Date: May 08, 2025

- Revenue: $3 billion, up 3% year-over-year.

- EBITDA Growth: 16% increase.

- Earnings Per Share (EPS): 90% growth.

- Booked Room Nights: 6% growth to 108 million.

- Gross Bookings: $31.5 billion, up 4%.

- B2B Bookings Growth: 14% increase.

- Advertising Revenue Growth: 20% increase.

- Average Daily Rates: $214, down 1% (up 1% on an FX neutral basis).

- EBITDA Margin: 9.9%, expanding by more than 1 point.

- Cash and Short-term Investments: $6.1 billion.

- Debt Level: $6.3 billion with a leverage ratio of 2.1 times.

- Share Repurchases: $330 million or 1.7 million shares in Q1.

- Dividend: $0.40 per share.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Expedia Group Inc (EXPE, Financial) achieved 16% EBITDA growth and a 90% increase in earnings per share, surpassing bottom-line expectations.

- The B2B segment demonstrated strong performance with 14% bookings growth, significantly outperforming the industry.

- The advertising business experienced robust growth, with a 20% increase in revenue and a record number of $1 million-plus deals.

- Expedia's strategic partnerships, such as with Southwest Airlines and Ryanair, have successfully attracted new customers and enhanced supply offerings.

- The company is leveraging AI to enhance product experiences, streamline operations, and improve marketing effectiveness, positioning it well for future growth.

Negative Points

- Overall bookings and revenue growth were at the lower end of guidance due to weaker-than-expected travel demand in the US.

- The consumer business, particularly in the US, saw only 1% bookings growth, impacted by declining consumer sentiment.

- Hotels.com experienced negative growth due to softer US demand and foreign exchange headwinds.

- The US market softness and macroeconomic headwinds led to a revision of full-year guidance for gross bookings and revenue.

- Inbound travel to the US faced significant pressure, with bookings from Canada falling nearly 30%.