- Citi upgrades Regeneron (REGN, Financial) to Buy, citing reduced policy risks and an enhanced price target.

- Regeneron's pipeline and market position highlight a compelling risk-reward scenario.

- Wall Street analysts forecast substantial upside potential for REGN shares.

Citi has upgraded Regeneron Pharmaceuticals Inc. (NASDAQ: REGN) from a Neutral to a Buy rating, forecasting diminished impacts from U.S. drug price reduction policies. The firm raised its price target to $700, underscoring the company's strong pipeline and a promising risk-reward profile following a notable decline in share price.

Wall Street Analysts' Price Forecast

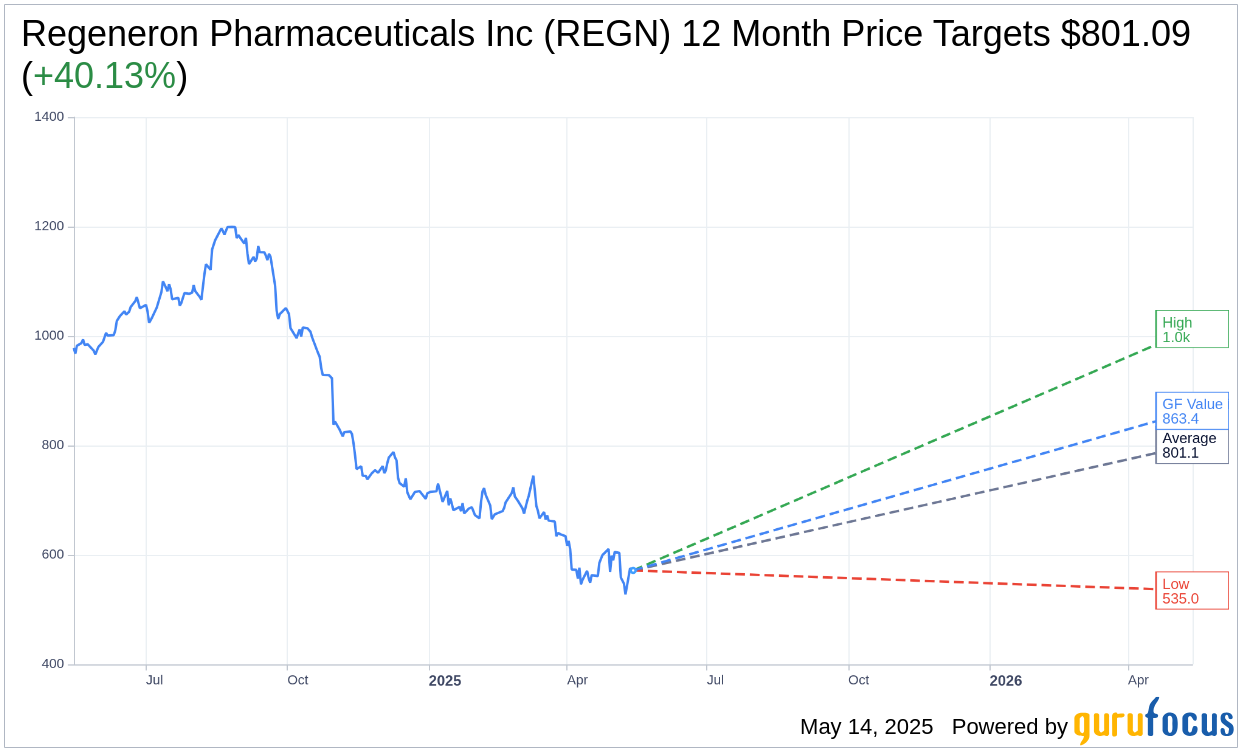

The one-year price targets proposed by 24 analysts suggest an average target price for Regeneron of $801.09, with predictions ranging from a high of $1,013.00 to a low of $535.00. This average target suggests an upside potential of 40.13% from its current trading price of $571.68. For an in-depth analysis, visit the Regeneron Pharmaceuticals Inc (REGN, Financial) Forecast page.

Analysts' Recommendations

According to consensus from 28 brokerage firms, Regeneron Pharmaceuticals Inc. is rated as an "Outperform" with an average recommendation score of 2.0. This rating scale ranks from 1 to 5, where 1 is a Strong Buy and 5 is a Sell.

GuruFocus Value Estimation

As per GuruFocus estimates, the GF Value for Regeneron is expected to reach $863.35 in one year, which indicates a potential upside of 51.02% from the current price of $571.68. The GF Value reflects GuruFocus' assessment of the fair market value, calculated using historical trading multiples, past business growth, and future performance estimates. More comprehensive data is available on the Regeneron Pharmaceuticals Inc (REGN, Financial) Summary page.