Summary:

- Allurion Technologies (ALUR, Financial) aligns with Q1 2025 revenue expectations at $5.6 million.

- The company is aggressively cutting costs, reducing expenses by 45% to focus on global expansion.

- Aims for profitability in markets outside the U.S. by the end of the year.

Allurion Technologies (ALUR) delivered solid financial results for Q1 2025, reporting revenue of $5.6 million, meeting market expectations. The company is on a strategic path to reduce its adjusted operating expenses by an impressive 45%. With an eye on global growth, Allurion plans to drive profitability beyond U.S. borders by year-end. Notably, the company is prioritizing the pursuit of FDA approval and intensifying its commercial endeavors in France.

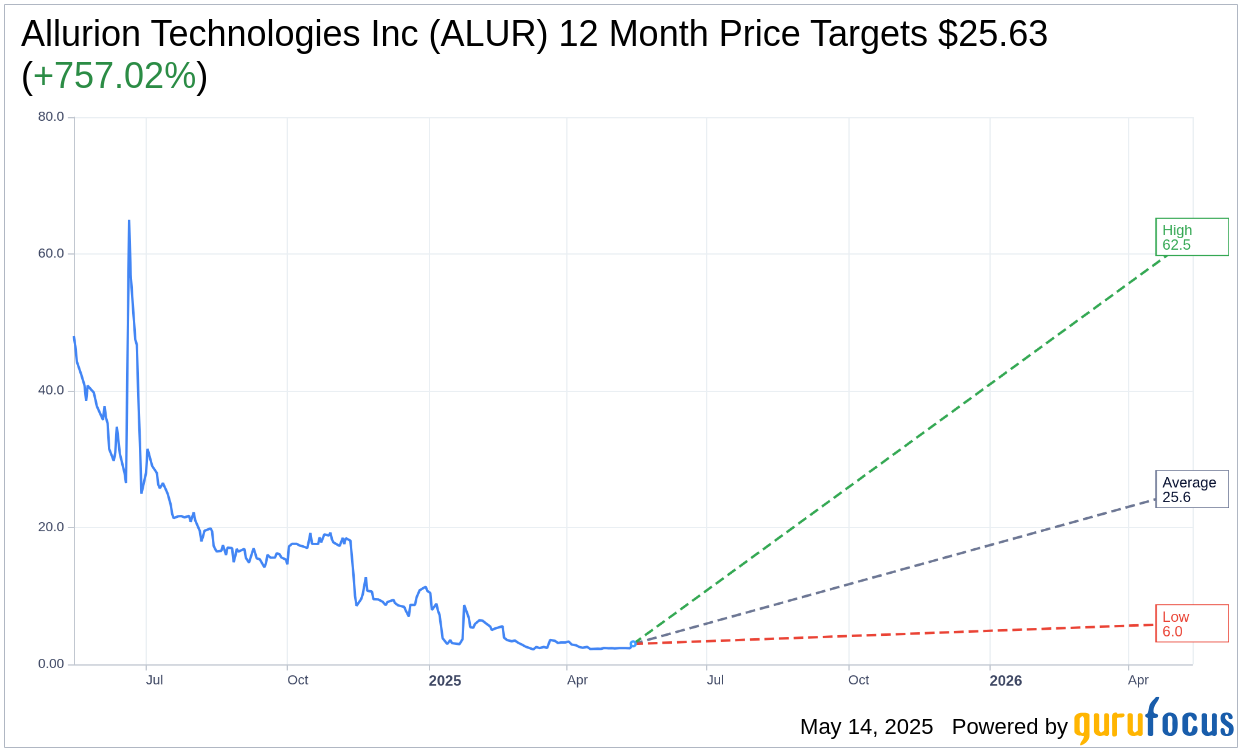

Wall Street Analysts Forecast

Four analysts have projected a one-year price target for Allurion Technologies Inc (ALUR, Financial), providing an average target price of $25.63. This forecast includes a high estimate of $62.50 and a low estimate of $6.00. With the current stock price at $2.99, this average target suggests a significant upside potential of 757.02%. For more comprehensive forecast details, visit the Allurion Technologies Inc (ALUR) Forecast page.

In terms of brokerage recommendations, Allurion Technologies Inc (ALUR, Financial) boasts an average brokerage recommendation of 2.0 from four brokerage firms. This rating denotes an "Outperform" status, falling within a scale where 1 signifies a Strong Buy and 5 indicates a Sell. This suggests a positive outlook from the broker community.