Fulcrum Therapeutics, identified by the stock ticker FULC, has been upgraded by Cantor Fitzgerald from a Neutral to an Overweight rating. The financial services firm has set a price target of $10, reflecting a more optimistic view of the company's future performance.

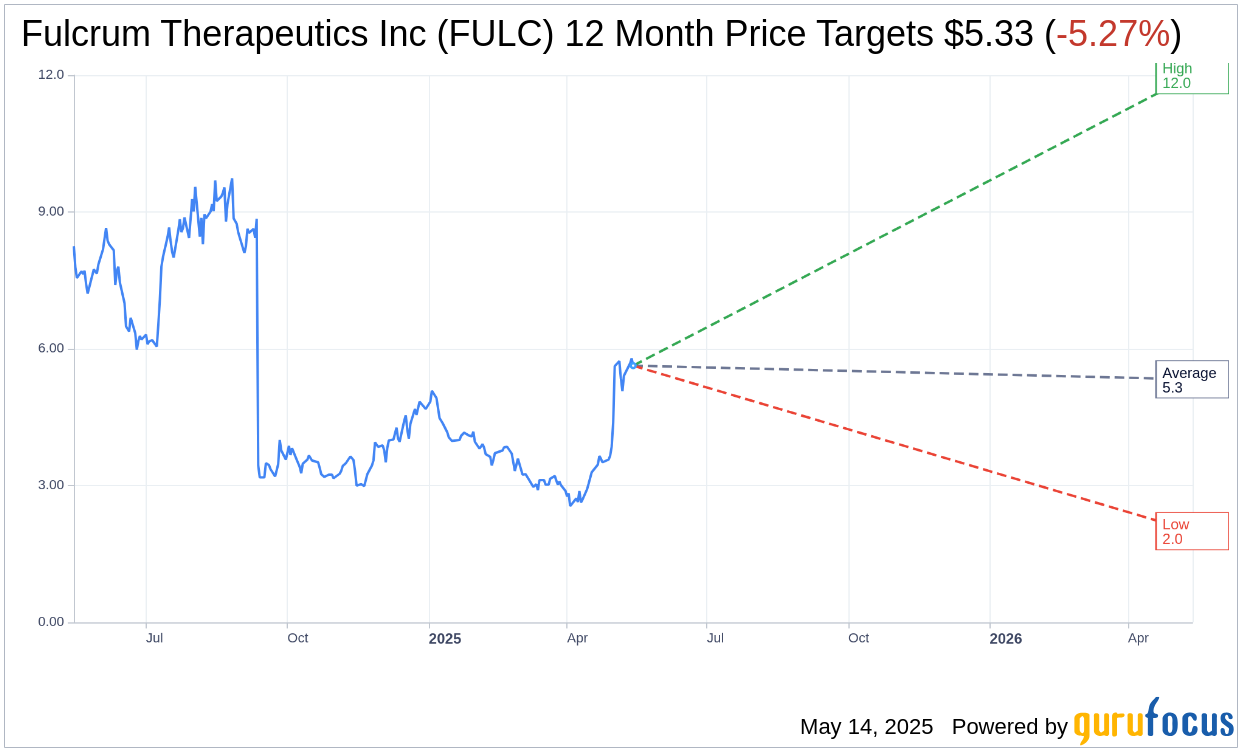

Wall Street Analysts Forecast

Based on the one-year price targets offered by 6 analysts, the average target price for Fulcrum Therapeutics Inc (FULC, Financial) is $5.33 with a high estimate of $12.00 and a low estimate of $2.00. The average target implies an downside of 5.27% from the current price of $5.63. More detailed estimate data can be found on the Fulcrum Therapeutics Inc (FULC) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, Fulcrum Therapeutics Inc's (FULC, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Fulcrum Therapeutics Inc (FULC, Financial) in one year is $39.01, suggesting a upside of 592.9% from the current price of $5.63. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Fulcrum Therapeutics Inc (FULC) Summary page.

FULC Key Business Developments

Release Date: May 01, 2025

- Research and Development Expenses: $13.4 million for Q1 2025, down from $19.8 million in Q1 2024.

- General Administrative Expenses: $7 million for Q1 2025, down from $10.1 million in Q1 2024.

- Net Loss: $17.7 million for Q1 2025, compared to $26.9 million in Q1 2024.

- Cash, Cash Equivalents, and Marketable Securities: $226.6 million as of March 31, 2025, down from $241 million as of December 31, 2024.

- Cash Guidance: Expected to fund operating requirements into at least 2027.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Fulcrum Therapeutics Inc (FULC, Financial) completed enrollment in the 12 mg cohort of their Pioneer trial for sickle cell disease, with plans to share results in early Q3.

- The data monitoring committee recommended continuing the Pioneer study as planned, initiating the 20 mg cohort.

- The company reported a significant decrease in research and development expenses, attributed to the discontinuation of the losmapimod program and cost-sharing under the Sanofi collaboration.

- Fulcrum Therapeutics Inc (FULC) ended the first quarter with $226.6 million in cash equivalents and marketable securities, sufficient to fund operations into at least 2027.

- The company plans to submit an IND for Diamond-Blackfan Anemia in the fourth quarter of this year, expanding their pipeline beyond sickle cell disease.

Negative Points

- Net loss for the first quarter of 2025 was $17.7 million, although this was an improvement from the previous year.

- The decrease in general administrative expenses was primarily due to a reduction in workforce, indicating potential operational challenges.

- The baseline fetal hemoglobin levels in the Pioneer trial were higher than anticipated, which could affect the interpretation of treatment efficacy.

- There is uncertainty regarding the FDA's stance on using fetal hemoglobin as a surrogate marker, which could impact future regulatory interactions.

- The company faces competition from other novel HBF inducers in the pipeline, such as those from BMS and GSK, which could affect market positioning.