Canaan (ticker: CAN) has shared its April 2025 bitcoin mining update, highlighting significant developments in its operational scale and strategic partnerships. The company reported a month-end deployed hashrate of 8.15 EH/s, with 6.20 EH/s actively in operation. Canaan has entered new hosting agreements aimed at enhancing its North American self-mining capacity, which, once fully energized, is anticipated to contribute an additional 4.7 EH/s to its hashrate in the region.

The company successfully completed the taped-out process for its Avalon A16 series of bitcoin mining machines. Despite a slight dip in bitcoin accumulation due to a price decline, Canaan added 16 bitcoins to its holdings, closing the month with a total of 1,424 bitcoins. Its all-in power cost remained competitive at US$0.044/kWh, demonstrating cost efficiency in its global operations.

In addition to its North American expansion, Canaan's operations in Ethiopia have proven beneficial. The joint-mining initiative there has helped mitigate risks and leverage lower power costs. From January to March, the Ethiopian operation maintained a 98% uptime, with a 95% uptime recorded in April despite minor power disruptions. These achievements reflect Canaan's commitment to expanding its geographic footprint and fostering strategic partnerships to drive company value.

Wall Street Analysts Forecast

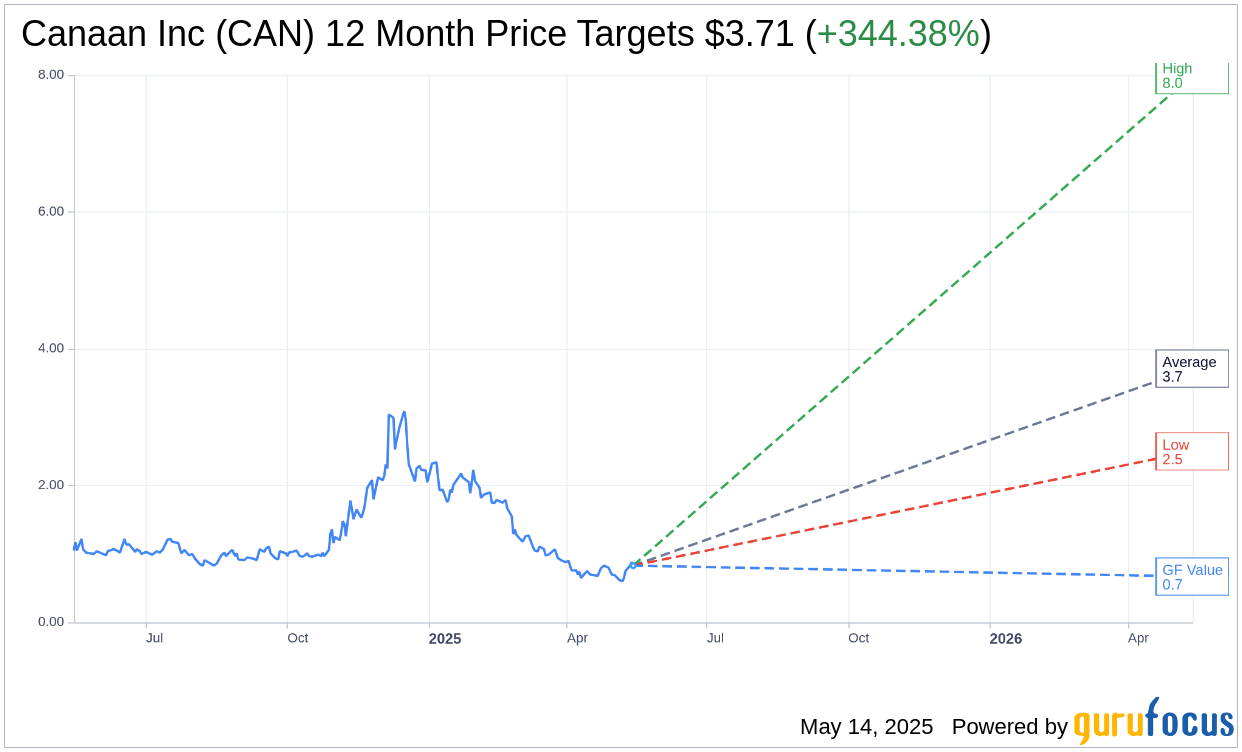

Based on the one-year price targets offered by 6 analysts, the average target price for Canaan Inc (CAN, Financial) is $3.71 with a high estimate of $8.00 and a low estimate of $2.50. The average target implies an upside of 344.38% from the current price of $0.83. More detailed estimate data can be found on the Canaan Inc (CAN) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Canaan Inc's (CAN, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Canaan Inc (CAN, Financial) in one year is $0.67, suggesting a downside of 19.71% from the current price of $0.8345. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Canaan Inc (CAN) Summary page.

CAN Key Business Developments

Release Date: March 26, 2025

- Total Revenue: $89 million in Q4 2024, up 81% year-over-year.

- Full-Year Revenue: Approximately $270 million, up 27.4% year-over-year.

- Mining Revenue: $15.3 million in Q4 2024, up 313% year-over-year.

- Bitcoin Mined: 186 Bitcoins in Q4 2024, up 84% year-over-year.

- Computing Power Sold: 9.1 million terahashes per second in Q4 2024, up 66% year-over-year.

- Gross Margin: Mining gross margin increased to 42% in Q4 2024.

- Adjusted EBITDA: $19.3 million gain in Q4 2024.

- Cash Flow from Operations: Positive $17 million in Q4 2024.

- Cash Balance: $96 million at the end of Q4 2024.

- Bitcoin Holdings: 1,293 Bitcoins at the end of 2024, valued at approximately $123 million.

- Inventory Write-Down: $13.6 million in Q4 2024, decreased 76% year-over-year.

- Operating Expenses: $49.3 million in Q4 2024, increased $10.1 million year-over-year.

- Revenue Guidance Q1 2025: Approximately $75 million.

- Revenue Guidance Q2 2025: $120 million to $150 million.

- Full-Year 2025 Revenue Guidance: $900 million to $1.1 billion.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Canaan Inc (CAN, Financial) achieved approximately $89 million in total revenues for Q4, surpassing their guidance of $80 million.

- The company reported a 27.4% year-over-year increase in full-year revenue, reaching nearly $270 million.

- Canaan Inc (CAN) successfully launched and delivered the high-performance A15 series, contributing significantly to revenue growth.

- The company's mining operations saw a substantial increase, with mining revenue reaching $15.3 million, up 313% year-over-year.

- Canaan Inc (CAN) expanded its presence in North America, with the region accounting for approximately 40% of mining machine sales.

Negative Points

- The company faced a gross loss of $6.4 million in Q4, despite narrowing it by 70.5% quarter-over-quarter.

- Canaan Inc (CAN) recorded a non-cash income tax expense of $85 million due to a valuation allowance against deferred tax assets.

- The company expressed caution regarding the uncertain economic environment and Bitcoin price volatility, impacting future revenue expectations.

- Operating expenses increased by $10.1 million year-over-year, driven by global business expansion and risk mitigation activities.

- Canaan Inc (CAN) faced challenges in managing supply chain constraints due to new US regulations affecting the semiconductor supply chain.