Innovative Solutions & Support, Inc. (ISSC, Financial) reported a significant surge in their second-quarter revenue for fiscal 2025, reaching $21.9 million, a notable increase from the $10.74 million posted in the same period last year. This impressive growth also saw the company's adjusted EBITDA climb by 219% to $7.7 million. The enhancement in financial performance was largely attributed to robust contributions from their F-16 product line and the broader air transport market. The positive results highlight the company's continued momentum and strategic market positioning.

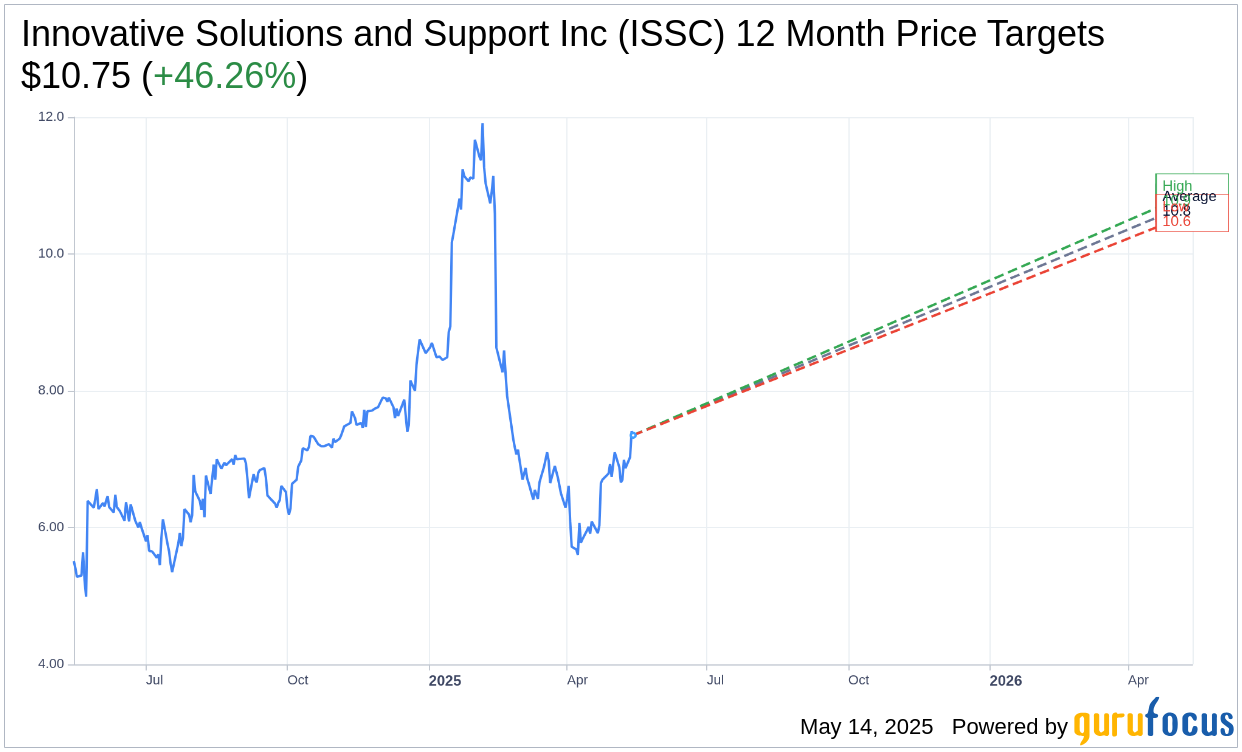

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for Innovative Solutions and Support Inc (ISSC, Financial) is $10.75 with a high estimate of $10.90 and a low estimate of $10.60. The average target implies an upside of 46.26% from the current price of $7.35. More detailed estimate data can be found on the Innovative Solutions and Support Inc (ISSC) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Innovative Solutions and Support Inc's (ISSC, Financial) average brokerage recommendation is currently 1.5, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Innovative Solutions and Support Inc (ISSC, Financial) in one year is $16.55, suggesting a upside of 125.17% from the current price of $7.35. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Innovative Solutions and Support Inc (ISSC) Summary page.