As of the end of March 2025, Citius Oncology (CTXR, Financial) reported holding $112 in cash and cash equivalents, with approximately 71.6 million common shares in circulation. To maintain operations beyond May 2025, the company needs to secure further financing.

In the second quarter of 2025, Citius Oncology transitioned from its development phase to becoming a commercial-stage entity, driven by the FDA approval of LYMPHIR. The focus has now shifted towards strategic capital management and operational achievements to facilitate the upcoming launch of LYMPHIR in the U.S. market.

The company's CEO highlighted the efforts to ensure LYMPHIR is accessible to patients with cutaneous T-cell lymphoma. Concurrently, Citius is exploring partnerships and capital avenues to bolster financial versatility, positioning the company for long-term commercial triumph and delivering significant shareholder value. The company's strategic initiatives are designed to contribute positively in the near term while ensuring sustainability.

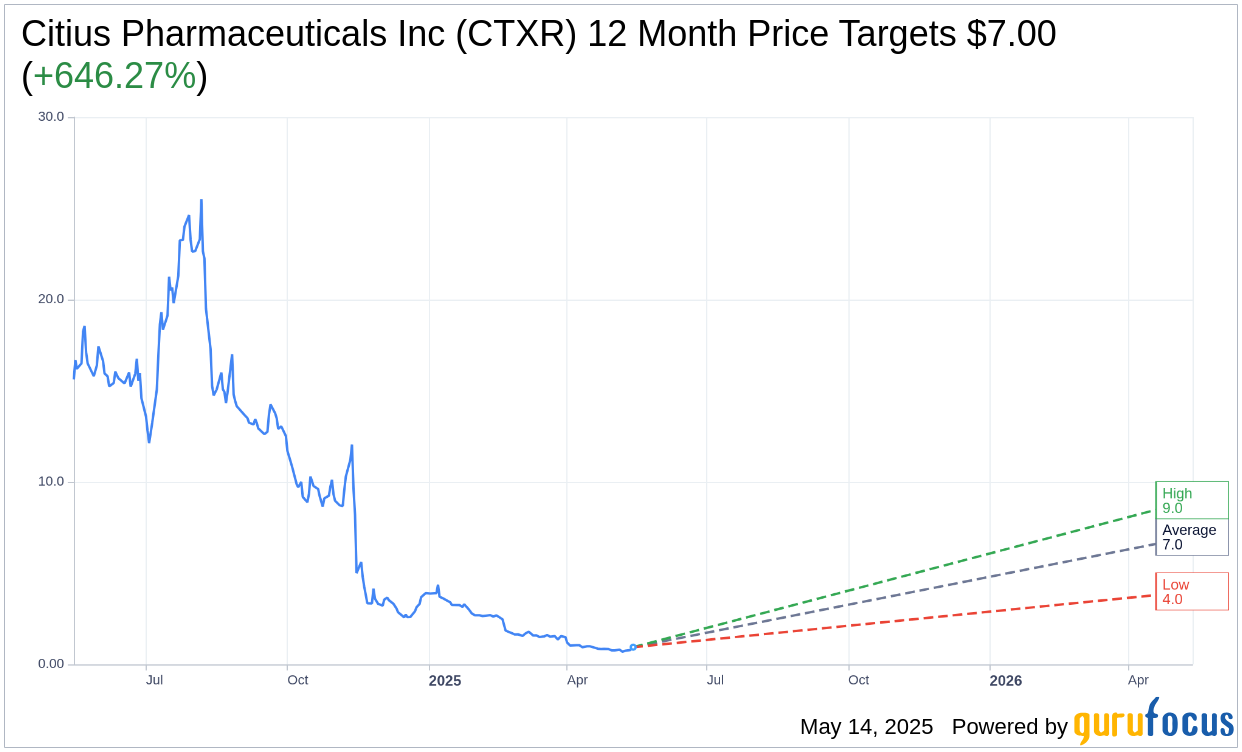

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Citius Pharmaceuticals Inc (CTXR, Financial) is $7.00 with a high estimate of $9.00 and a low estimate of $4.00. The average target implies an upside of 646.27% from the current price of $0.94. More detailed estimate data can be found on the Citius Pharmaceuticals Inc (CTXR) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Citius Pharmaceuticals Inc's (CTXR, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.