Insights into Keeley-Teton Advisors, LLC (Trades, Portfolio)'s Strategic Moves in Q1 2025

Keeley-Teton Advisors, LLC (Trades, Portfolio) recently submitted their 13F filing for the first quarter of 2025, offering a glimpse into their strategic investment decisions during this period. Since their inception, both Teton Advisors, Inc. (Teton) and Keeley Teton Advisors, LLC (Keeley Teton) have been at the forefront of small, mid, and micro-cap, active, value investing. Their investment philosophy is rooted in disciplined bottom-up, fundamental analysis aimed at identifying inefficiently priced equities. The acquisition of Keeley Asset Management Corp. by Teton in March 2017 marked a significant transformation, merging two established asset managers into a single, scalable entity. This merger has enhanced their research capabilities and operational infrastructure, benefiting both clients and stakeholders. The firm leverages a common distribution platform to optimize communication and outreach efforts across institutional and retail channels.

Summary of New Buy

Keeley-Teton Advisors, LLC (Trades, Portfolio) added a total of nine stocks to their portfolio. The most significant addition was Millrose Properties Inc (MRP, Financial), with 250,225 shares, accounting for 0.8% of the portfolio and a total value of $6.63 million. The second largest addition was Outfront Media Inc (OUT, Financial), consisting of 312,778 shares, representing approximately 0.61% of the portfolio, with a total value of $5.05 million. The third largest addition was Tennant Co (TNC, Financial), with 20,547 shares, accounting for 0.2% of the portfolio and a total value of $1.64 million.

Key Position Increases

Keeley-Teton Advisors, LLC (Trades, Portfolio) also increased stakes in a total of 146 stocks. The most notable increase was in Everus Construction Group Inc (ECG, Financial), with an additional 65,237 shares, bringing the total to 148,734 shares. This adjustment represents a significant 78.13% increase in share count, a 0.29% impact on the current portfolio, and a total value of $5.52 million. The second largest increase was in Concentra Group Holdings Parent Inc (CON, Financial), with an additional 98,473 shares, bringing the total to 192,716. This adjustment represents a significant 104.49% increase in share count, with a total value of $4.18 million.

Summary of Sold Out

Keeley-Teton Advisors, LLC (Trades, Portfolio) completely exited 18 holdings in the first quarter of 2025. Notable exits include Patterson Companies Inc (PDCO, Financial), where all 71,952 shares were sold, resulting in a -0.26% impact on the portfolio. Another significant exit was VSE Corp (VSEC, Financial), with the liquidation of all 21,192 shares, causing a -0.23% impact on the portfolio.

Key Position Reduces

Keeley-Teton Advisors, LLC (Trades, Portfolio) also reduced positions in 158 stocks. The most significant changes include a reduction in TechnipFMC PLC (FTI, Financial) by 114,479 shares, resulting in a -30.26% decrease in shares and a -0.38% impact on the portfolio. The stock traded at an average price of $29.98 during the quarter and has returned 3.87% over the past three months and 8.97% year-to-date. Another notable reduction was in Beacon Roofing Supply Inc (BECN, Financial) by 15,251 shares, resulting in a -45.62% reduction in shares and a -0.18% impact on the portfolio. The stock traded at an average price of $116.47 during the quarter and has returned 4.87% over the past three months and 22.24% year-to-date.

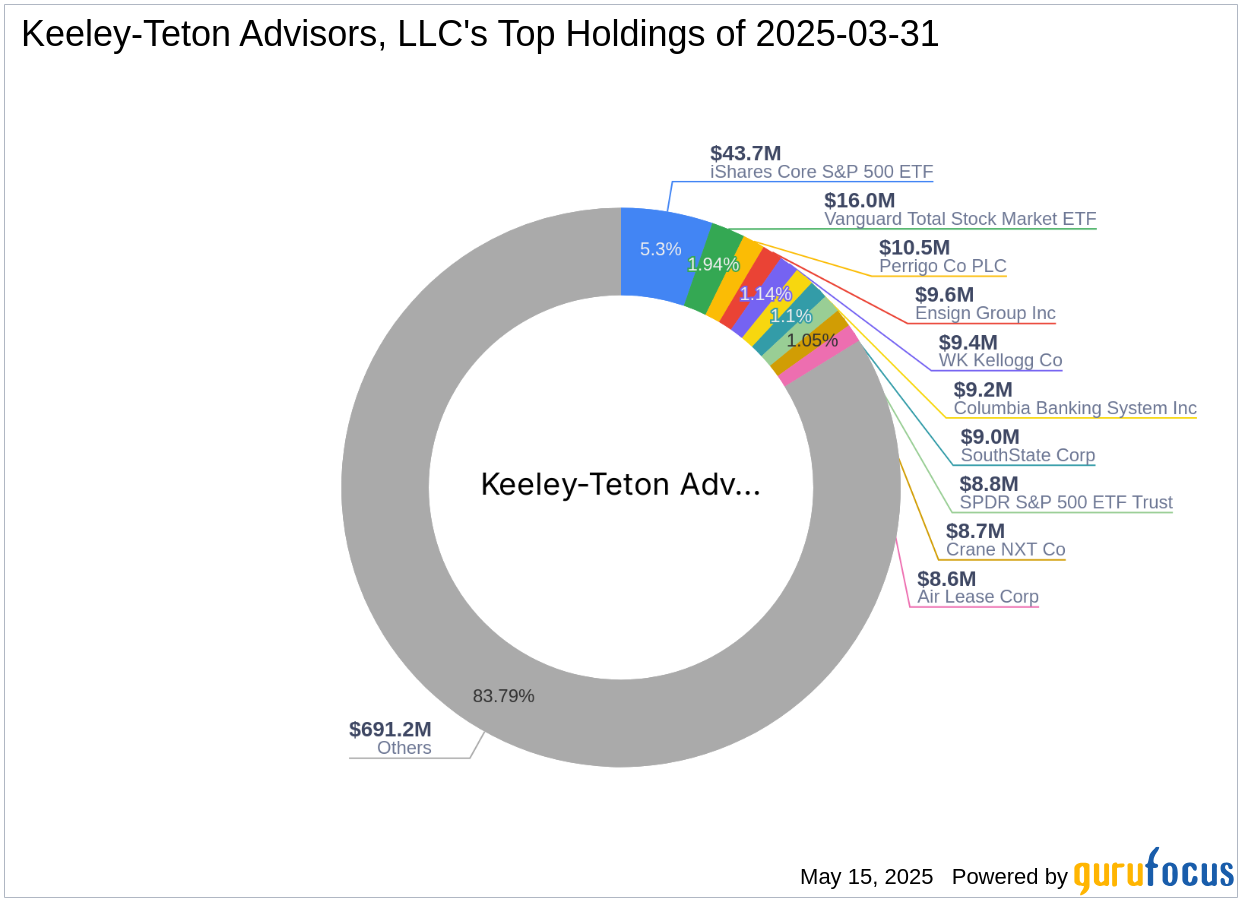

Portfolio Overview

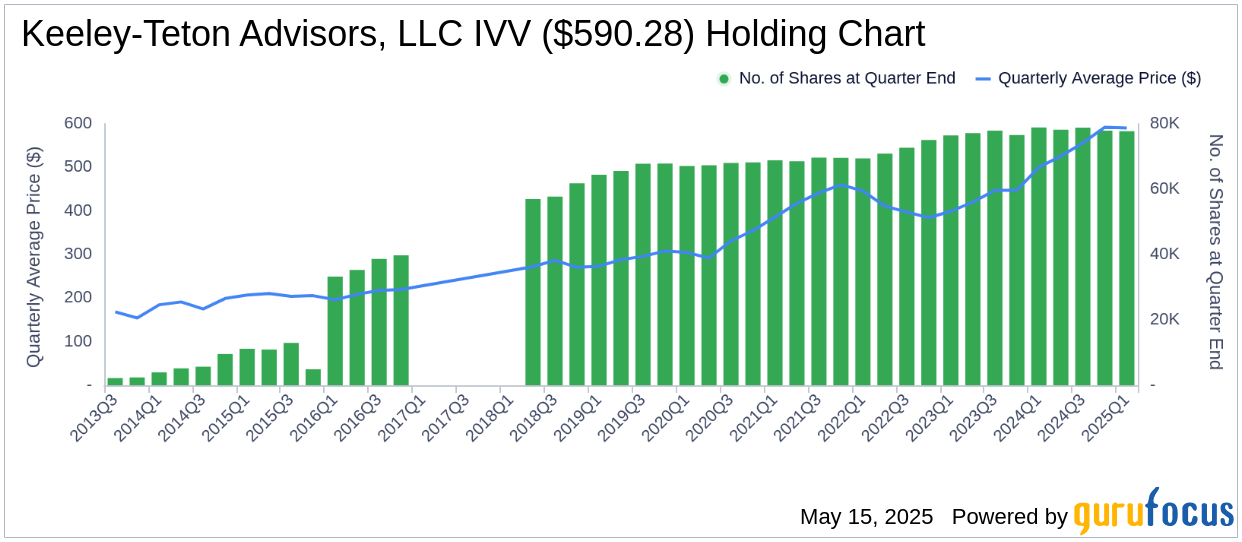

At the end of the first quarter of 2025, Keeley-Teton Advisors, LLC (Trades, Portfolio)'s portfolio included 362 stocks. The top holdings included 5.3% in iShares Core S&P 500 ETF (IVV, Financial), 1.94% in Vanguard Total Stock Market ETF (VTI, Financial), 1.28% in Perrigo Co PLC (PRGO, Financial), 1.17% in Ensign Group Inc (ENSG, Financial), and 1.14% in WK Kellogg Co (KLG, Financial).

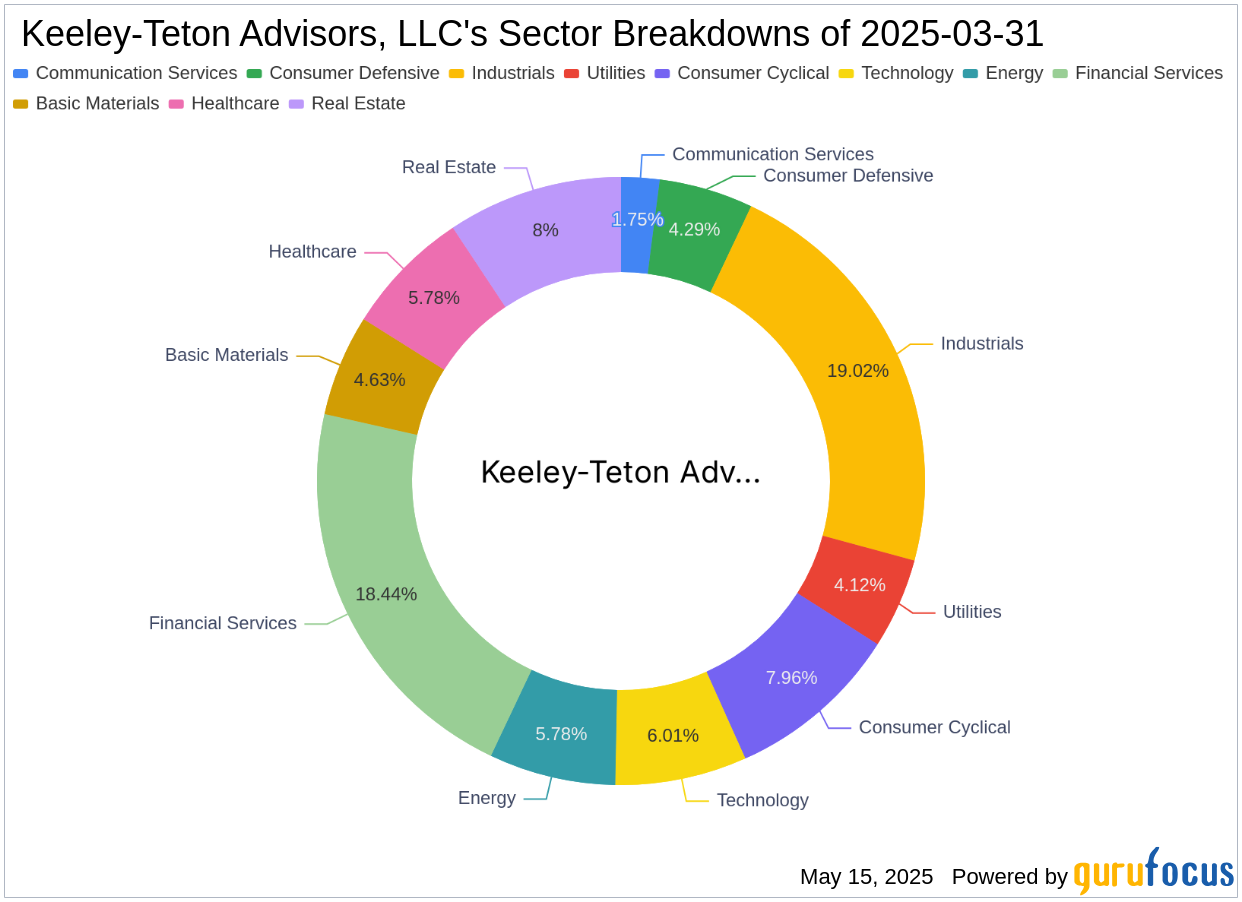

The holdings are mainly concentrated in 11 industries: Industrials, Financial Services, Real Estate, Consumer Cyclical, Technology, Energy, Healthcare, Basic Materials, Consumer Defensive, Utilities, and Communication Services.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.