Key Highlights:

- PAVmed (PAVM, Financial) surpasses EPS expectations with a Non-GAAP EPS of -$0.16.

- Revenue decreases by 17.8% year-over-year but still exceeds forecasts.

- Optimism remains high with significant potential upside as reflected by analyst price targets.

First Quarter Financial Performance

PAVmed Inc. (NASDAQ: PAVM) delivered a notable first-quarter performance with a Non-GAAP EPS of -$0.16, outshining market expectations by a margin of $0.13. While the company's revenue of $0.83 million marked a decline of 17.8% year-over-year, it still surpassed analyst estimates by $0.82 million. This performance has kept investor sentiment positive, providing a boost to the stock's outlook despite the challenges faced.

Wall Street Analyst Insights

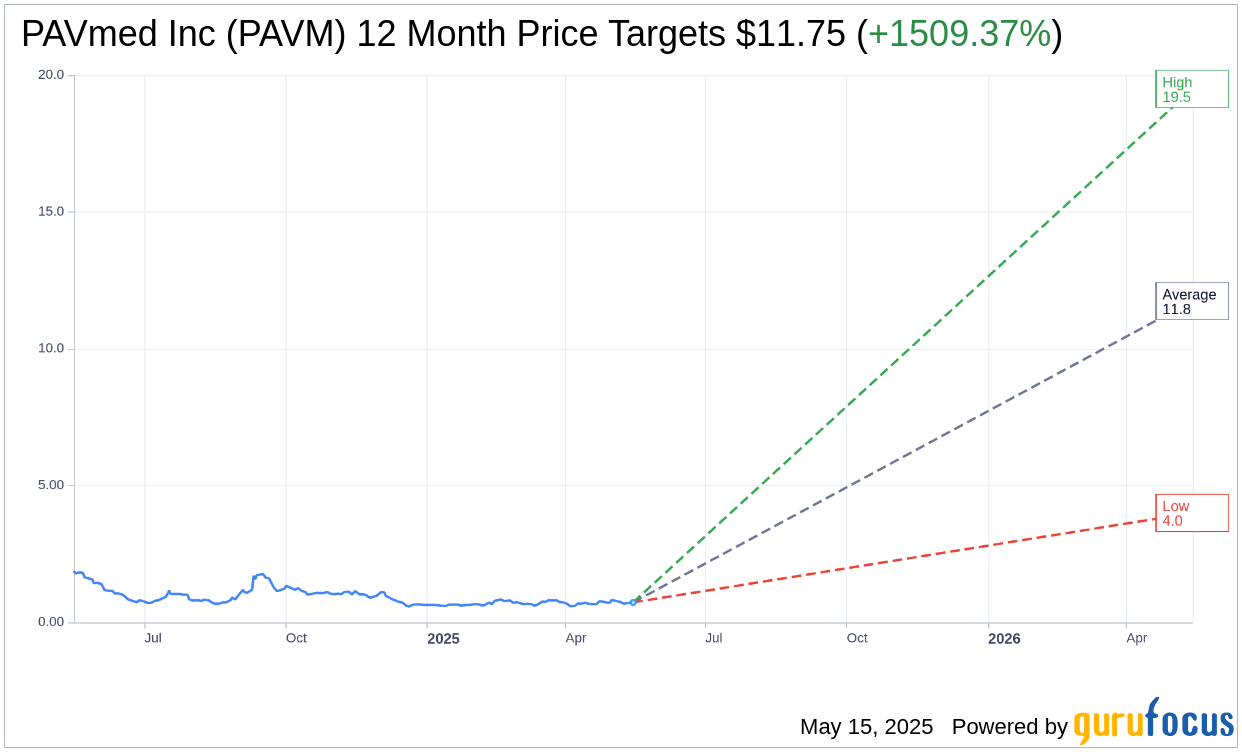

According to insights from two analysts, PAVmed Inc. (PAVM, Financial) has an average price target set at $11.75, with projections ranging between a high of $19.50 and a low of $4.00. This average target underscores a substantial potential upside of 1,509.37% over the current trading price of $0.73. Investors can explore further details on the PAVmed Inc (PAVM) Forecast page.

Brokerage Firm Recommendations

Reflecting a strong sentiment, PAVmed Inc. (PAVM, Financial) holds an "Outperform" status based on the consensus from two brokerage firms, with an average recommendation rating of 2.0 on a scale where 1 signifies Strong Buy and 5 indicates Sell. This rating reinforces the positive outlook that many investors and analysts share regarding the stock's future trajectory.

GuruFocus GF Value Estimation

GuruFocus estimates place the one-year GF Value for PAVmed Inc. (PAVM, Financial) at $7.48. This estimate suggests a remarkable upside potential of 924.52% from the current price of $0.7301. The GF Value is determined by analyzing historical trading multiples, past business growth, and future forecasts. For a comprehensive analysis, visit the PAVmed Inc (PAVM) Summary page.

Investors seeking significant growth potential may find PAVmed's current valuation and optimistic projections enticing, provided they consider the inherent risks and industry dynamics.