Advanced Drainage Systems (WMS, Financial) reported a fourth-quarter revenue of $615.8 million, falling short of the expected $653.22 million. Despite this, CEO Scott Barbour highlighted a 3% increase in domestic construction market sales for the fiscal year 2025. This growth is attributed to the company's focus on enhancing market performance through strategic material conversion in stormwater and onsite wastewater sectors.

Notably, the company's most profitable segments, Infiltrator and Allied Products, saw organic sales growth of 4.6% and 2.5%, respectively, now comprising 44% of overall revenue. The resilience shown by a 30.6% Adjusted EBITDA margin reflects WMS's strategy to prioritize these higher-margin products.

However, the fourth quarter experienced a 6% decline in net sales, influenced by the challenges of high interest rates and economic uncertainties, along with adverse winter weather conditions compared to favorable conditions in the previous year. Looking into fiscal year 2026, orders are favorable on a year-over-year basis, but the market outlook remains cautious. WMS remains committed to achieving profitable growth within the stormwater and onsite wastewater sectors over the long term.

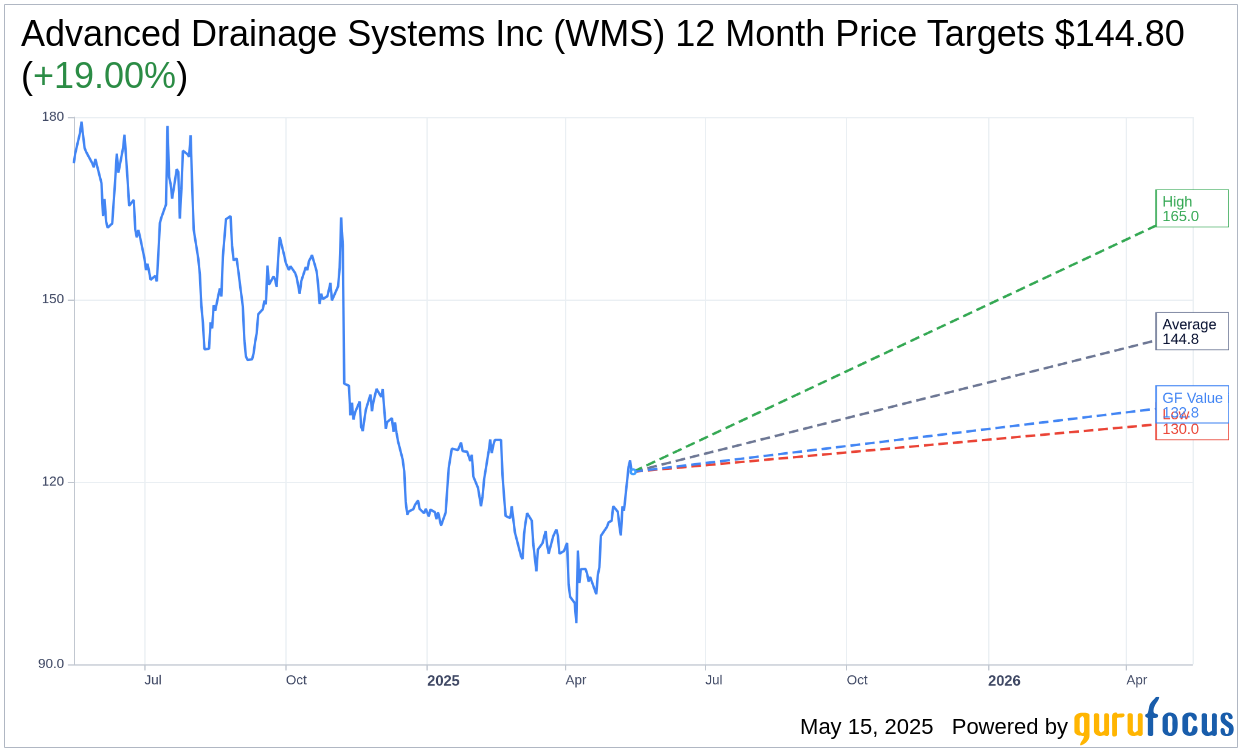

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Advanced Drainage Systems Inc (WMS, Financial) is $144.80 with a high estimate of $165.00 and a low estimate of $130.00. The average target implies an upside of 19.00% from the current price of $121.68. More detailed estimate data can be found on the Advanced Drainage Systems Inc (WMS) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Advanced Drainage Systems Inc's (WMS, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Advanced Drainage Systems Inc (WMS, Financial) in one year is $132.76, suggesting a upside of 9.11% from the current price of $121.68. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Advanced Drainage Systems Inc (WMS) Summary page.