On May 15, 2025, T1 Energy Inc (TE, Financial) released its 8-K filing detailing its financial performance for the first quarter ended March 31, 2025. T1 Energy Inc, a U.S.-based energy solutions provider, specializes in clean battery solutions and solar manufacturing, with a focus on integrating solar and battery storage.

Performance Overview and Challenges

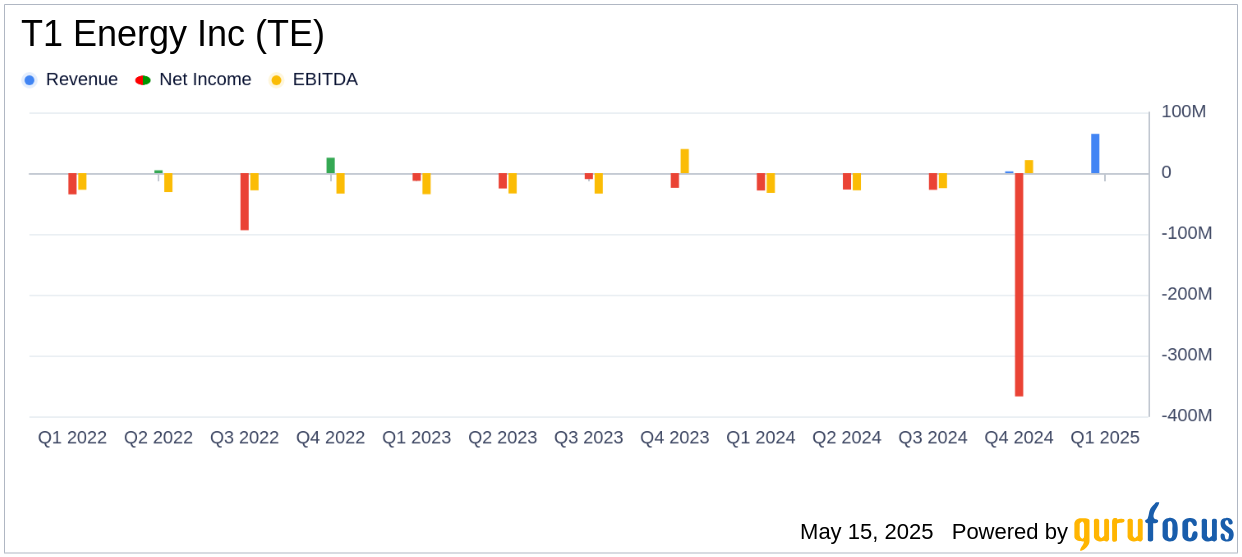

T1 Energy Inc reported a revenue of $64.6 million for the first quarter of 2025, falling short of the analyst estimate of $74.00 million. The company's earnings per share (EPS) was not explicitly stated, but the negative earnings per share estimate of -0.14 suggests a challenging financial period. The company has faced uncertainties due to trade policy changes, impacting its merchant sales market and leading to a reduction in its 2025 full-year EBITDA guidance from $75 - $125 million to $25 - $50 million.

Strategic Achievements and Industry Impact

Despite the challenges, T1 Energy Inc has made significant strides in securing customer commitments. The company signed a 253 MW sales agreement with a U.S. utility-scale developer, bringing its total 2025 customer module sales and offtake commitments to 1.75 GW. This highlights T1's commercial appeal and strategic positioning in the U.S. solar market.

Financial Statements and Key Metrics

The company's financial statements reveal a focus on ramping up production and sales at its G1 Dallas facility, which generated $64.6 million in revenue exclusively from the Trina offtake contract. T1 has also commenced deliveries under the RWE offtake contract in Q2 2025. The company expects to maintain a cash and liquidity position of over $100 million by the end of 2025, even after servicing approximately $70 million in cash debt.

| Metric | Q1 2025 | Analyst Estimate |

|---|---|---|

| Revenue | $64.6 million | $74.00 million |

| Estimated EPS | Not stated | -0.14 |

Commentary and Future Outlook

“T1’s rapid corporate transformation gained momentum during and following the first quarter,” said Daniel Barcelo, T1’s Chief Executive Officer and Chairman of the Board. “Although potential changes to trade policy are creating near-term uncertainties in the merchant sales market for T1 and our developer customers, we are well positioned to manage this sales environment with 1.7 GW of 2025 contracted module offtake coverage, a robust cash and liquidity position, and the continued production and sales ramp up at G1 Dallas.”

Analysis and Conclusion

T1 Energy Inc's first quarter results reflect both the challenges and opportunities in the evolving U.S. solar market. While the company missed revenue estimates, its strategic agreements and production ramp-up at G1 Dallas position it well for future growth. The reduction in EBITDA guidance underscores the impact of external trade policy uncertainties, but T1's focus on building a vertically integrated solar value chain and securing strategic partnerships could enhance its competitive position in the long term.

Explore the complete 8-K earnings release (here) from T1 Energy Inc for further details.