Raymond James has shifted its rating for MAA (MAA, Financial) from Strong Buy to Outperform, while lowering the price target to $175 from the previous $185. The decision comes as MAA has narrowed the valuation gap with its large-cap multifamily counterparts since the start of the year. Additionally, the rate of new supply deliveries in MAA's operational regions has seen a notable decrease. In March, the completion rate for multifamily projects was approximately 30% lower than the pace observed last fall.

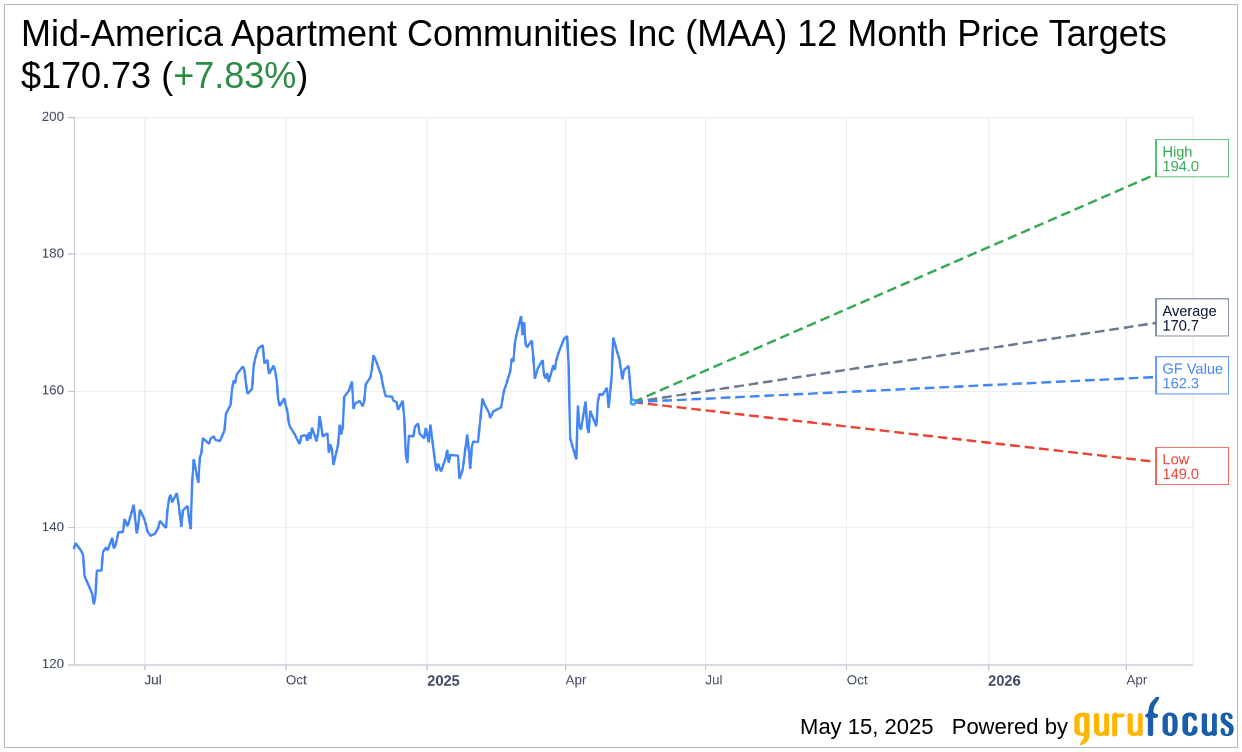

Wall Street Analysts Forecast

Based on the one-year price targets offered by 26 analysts, the average target price for Mid-America Apartment Communities Inc (MAA, Financial) is $170.73 with a high estimate of $194.00 and a low estimate of $149.00. The average target implies an upside of 7.83% from the current price of $158.34. More detailed estimate data can be found on the Mid-America Apartment Communities Inc (MAA) Forecast page.

Based on the consensus recommendation from 27 brokerage firms, Mid-America Apartment Communities Inc's (MAA, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Mid-America Apartment Communities Inc (MAA, Financial) in one year is $162.26, suggesting a upside of 2.48% from the current price of $158.34. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Mid-America Apartment Communities Inc (MAA) Summary page.

MAA Key Business Developments

Release Date: May 01, 2025

- Core FFO: $2.20 per diluted share, $0.04 above midpoint of guidance.

- Occupancy: Increased by 30 basis points year-over-year to 95.6%.

- Average Effective Rent: Down $9 per unit from Q1 2024.

- Same Store Revenue Growth: 0.1% for the quarter.

- New Lease Pricing: Negative 6.3% on a lease-over-lease basis.

- Renewal Rates: Grew 4.5% on a lease-over-lease basis.

- Blended Lease Pricing: Negative 0.5%, a 160 basis point improvement sequentially.

- Net Delinquency: 0.3% of billed rents.

- Development Pipeline: $1 billion to $1.2 billion range expected.

- Interior Unit Upgrades: 1,102 completed with $90 rent increase above non-upgraded units.

- Cash-on-Cash Return: Just under 18% for upgraded units.

- Lease-Up Properties Occupancy: Combined occupancy of 71.6%.

- Debt Profile: 94% fixed, average maturity of seven years, effective rate of 3.8%.

- Balance Sheet Strength: $1 billion in combined cash and borrowing capacity, net debt to EBITDA at 4 times.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- First quarter performance results exceeded expectations with strong demand in occupancy, collections, and pricing trends.

- Renewal pricing remains strong with an increasing retention rate, leading to better-than-expected blended lease pricing.

- The company has a robust development pipeline with a combined cost of $1.5 billion, poised to benefit from a supply environment trending below historical levels.

- MAA's focus on high-growth markets and diversification by market and price point positions it well to weather economic challenges.

- Investments in technology and property-wide Wi-Fi are expected to enhance operational efficiencies and support future earnings growth.

Negative Points

- New lease pricing on a lease-over-lease basis for the first quarter was negative 6.3%, indicating pressure from new supply.

- Some markets, such as Austin, Phoenix, and Nashville, continue to struggle with significant supply pressures.

- The transaction market is slow, with compelling acquisition opportunities likely to materialize only in the latter half of the year.

- The company faces macroeconomic uncertainties, including potential impacts from tariffs and immigration policy changes.

- Occupancy at some lease-up properties, like MAA Vale in Raleigh, has been slower than expected due to seasonal and operational challenges.