In the first quarter of 2025, FitLife Brands (FTLF, Financial) reported a revenue of $15.936 million, which represents a decrease from the $16.549 million generated during the same period last year. The company experienced a strong performance within its Legacy FitLife segment. This was attributed to a slight rise in wholesale revenue coupled with robust growth in its online sales, which is recognized as the most profitable segment of the business.

Despite these gains, other areas such as MRC and MusclePharm faced challenges during the quarter. However, the positive revenue dynamics in Legacy FitLife contributed to significant improvements in both gross margin and contribution as a percentage of revenue. These improvements signal a promising outlook for this segment of the business.

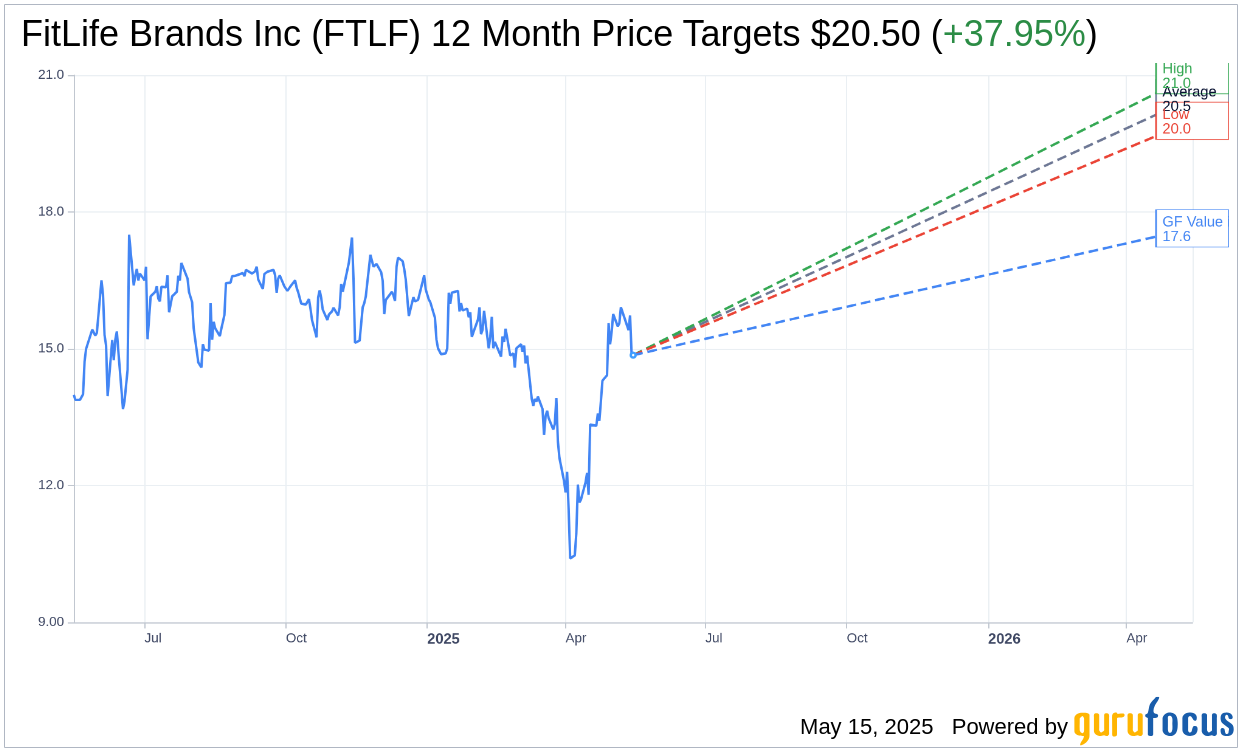

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for FitLife Brands Inc (FTLF, Financial) is $20.50 with a high estimate of $21.00 and a low estimate of $20.00. The average target implies an upside of 37.95% from the current price of $14.86. More detailed estimate data can be found on the FitLife Brands Inc (FTLF) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, FitLife Brands Inc's (FTLF, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for FitLife Brands Inc (FTLF, Financial) in one year is $17.64, suggesting a upside of 18.71% from the current price of $14.86. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the FitLife Brands Inc (FTLF) Summary page.