In a recent analyst update, HC Wainwright & Co. has maintained their "Buy" rating for Sanara MedTech (SMTI, Financial), signaling continued confidence in the company's market position. The analyst, Yi Chen, revealed adjustments to the price target from $51.00 previously to a new target of $53.00 USD. This represents a 3.92% increase, reflecting positive sentiment towards the company's future performance.

Sanara MedTech (SMTI, Financial), a company that operates in the medtech industry, has been under the spotlight with this recent price target raise. The adjustment in the price target highlights the belief in SMTI's growth potential and strategic direction. Investors are advised to take note of the maintained "Buy" rating, which suggests that SMTI remains a strong portfolio consideration.

This update comes amid a time where the medtech sector is witnessing various technological advancements and market dynamics changes. The raised price target indicates an expectation of Sanara MedTech (SMTI, Financial) benefiting from these broader sector trends.

As of May 15, 2025, Sanara MedTech (SMTI, Financial) continues to hold a steady position with its strategic initiatives, as reflected in the updated analyst insights from HC Wainwright & Co.

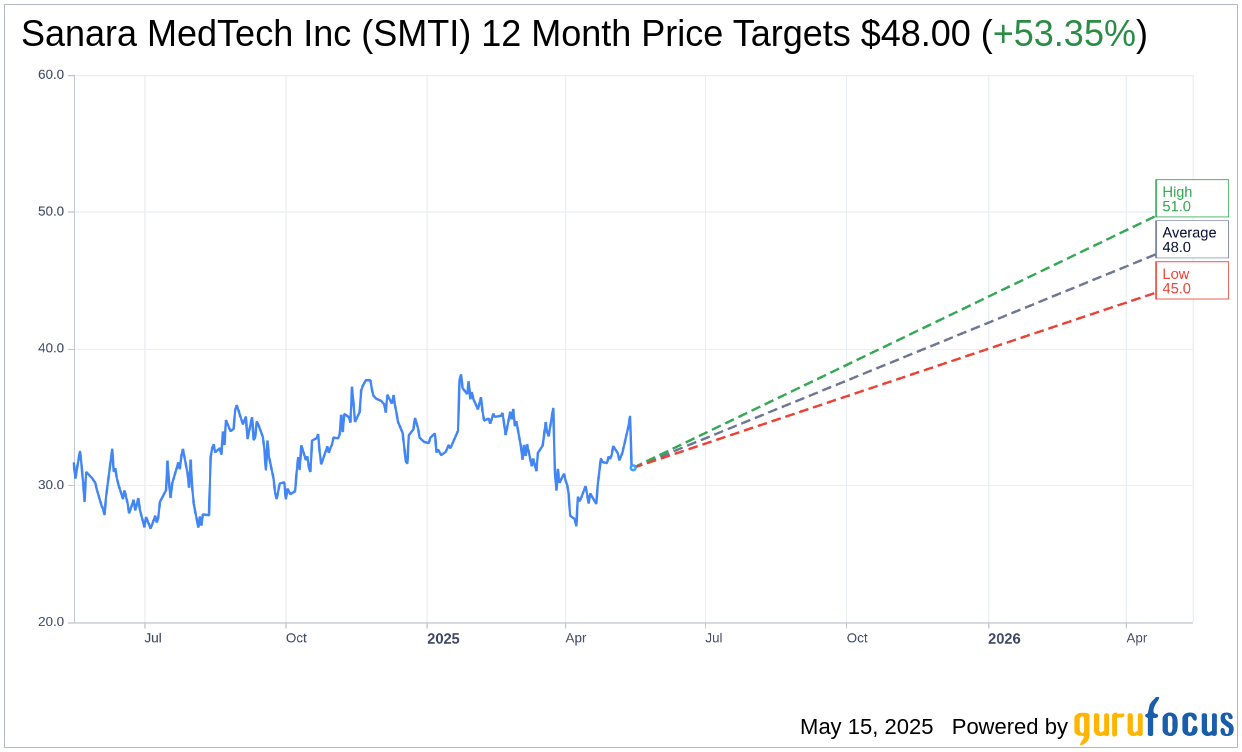

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for Sanara MedTech Inc (SMTI, Financial) is $48.00 with a high estimate of $51.00 and a low estimate of $45.00. The average target implies an upside of 53.35% from the current price of $31.30. More detailed estimate data can be found on the Sanara MedTech Inc (SMTI) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Sanara MedTech Inc's (SMTI, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Sanara MedTech Inc (SMTI, Financial) in one year is $68.00, suggesting a upside of 117.25% from the current price of $31.3. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Sanara MedTech Inc (SMTI) Summary page.