UBS has adjusted its price target for Targa Resources (TRGP, Financial), bringing it down to $228 from a previous estimate of $259. Despite the reduction in target price, the investment firm continues to recommend a Buy rating for the shares. The analysis reflects the company's current performance and market conditions, suggesting confidence in its potential despite the revised financial outlook.

Wall Street Analysts Forecast

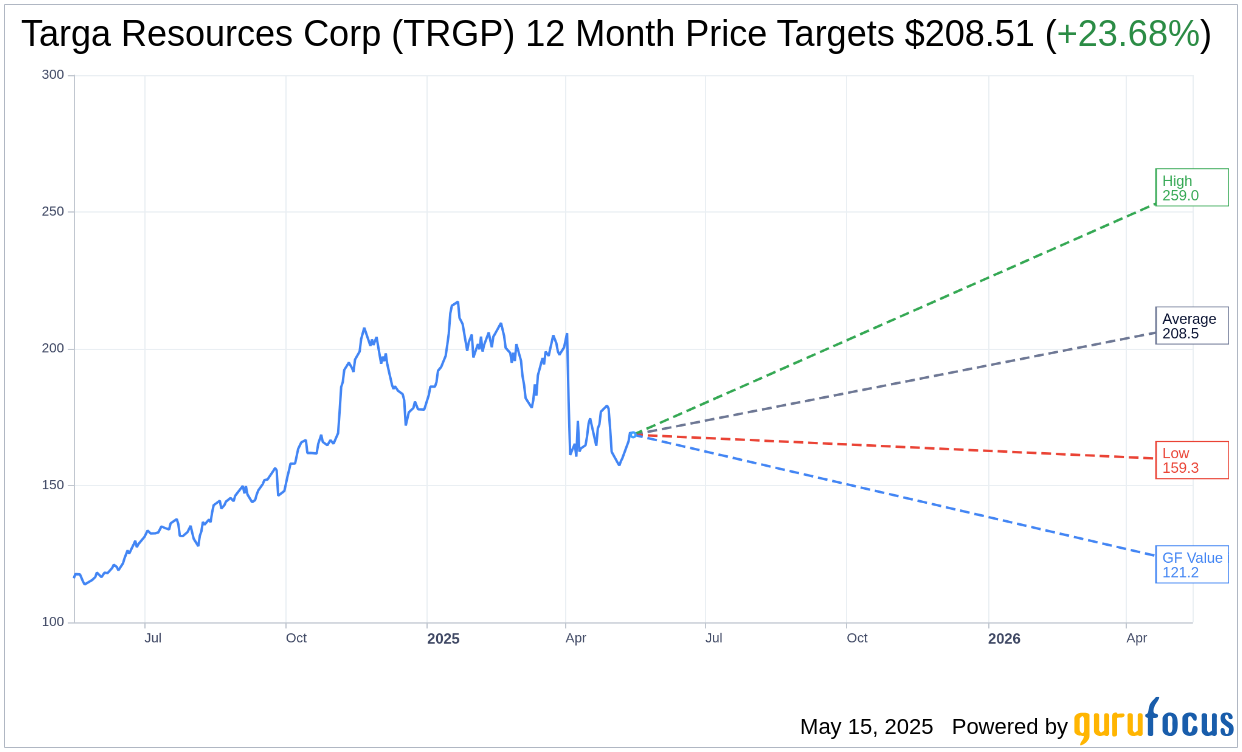

Based on the one-year price targets offered by 19 analysts, the average target price for Targa Resources Corp (TRGP, Financial) is $208.51 with a high estimate of $259.00 and a low estimate of $159.30. The average target implies an upside of 23.68% from the current price of $168.58. More detailed estimate data can be found on the Targa Resources Corp (TRGP) Forecast page.

Based on the consensus recommendation from 22 brokerage firms, Targa Resources Corp's (TRGP, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Targa Resources Corp (TRGP, Financial) in one year is $121.20, suggesting a downside of 28.11% from the current price of $168.58. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Targa Resources Corp (TRGP) Summary page.

TRGP Key Business Developments

Release Date: May 01, 2025

- Adjusted EBITDA: $1.179 billion for Q1 2025, a 22% increase year-over-year.

- Permian Natural Gas Inlet Volumes: Averaged over 6 billion cubic feet per day, an 11% increase from a year ago.

- NGL Pipeline Transportation Volumes: Averaged 844,000 barrels per day in Q1 2025.

- Fractionation Volumes: Averaged 980,000 barrels per day in Q1 2025.

- LPG Export Loadings: Averaged 13.4 million barrels per month during Q1 2025.

- Debt Offering: $2 billion comprised of 5.55% notes due 2035 and 6.125% notes due 2055.

- Available Liquidity: $2.7 billion at the end of Q1 2025.

- Pro Forma Consolidated Leverage Ratio: Approximately 3.6x.

- Net Growth Capital Spending Estimate for 2025: $2.6 billion to $2.8 billion.

- Net Maintenance Capital Spending Estimate for 2025: $250 million.

- Share Repurchase: $125 million in common shares repurchased during Q1 2025.

- Common Dividend Increase: 33% increase for Q1 2025 relative to 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Targa Resources Corp (TRGP, Financial) reported record quarterly adjusted EBITDA despite challenges from winter weather events.

- The company opportunistically repurchased nearly $215 million worth of common shares, demonstrating strong capital management.

- Targa Resources Corp (TRGP) has a robust integrated asset footprint, with a significant presence in the Permian Basin, which is expected to drive future growth.

- The company maintains a strong financial position with an investment-grade rating and a leverage ratio within its long-term target range.

- Targa Resources Corp (TRGP) has successfully managed global tariff impacts by purchasing steel in advance, limiting exposure on capital projects.

Negative Points

- Volumes were impacted by several winter weather events, leading to a slight decline in Permian volumes from the previous quarter.

- The forward crude price curve has shifted lower, which could impact future revenue and profitability.

- There is ongoing market volatility, which poses a risk to future financial performance and capital allocation strategies.

- The company faces potential budget impacts from global tariffs, although these are expected to be within project contingencies.

- Targa Resources Corp (TRGP) is exposed to commodity price fluctuations, although it has hedged 90% of its remaining length through 2026.