On May 15, 2025, Precision BioSciences Inc (DTIL, Financial) released its 8-K filing detailing the financial results for the first quarter of 2025. Precision BioSciences Inc is a genome editing company leveraging its proprietary ARCUS platform to develop therapies for human diseases and agricultural solutions. The company's focus on in vivo gene editing aims to address diseases with high unmet needs.

Financial Performance and Challenges

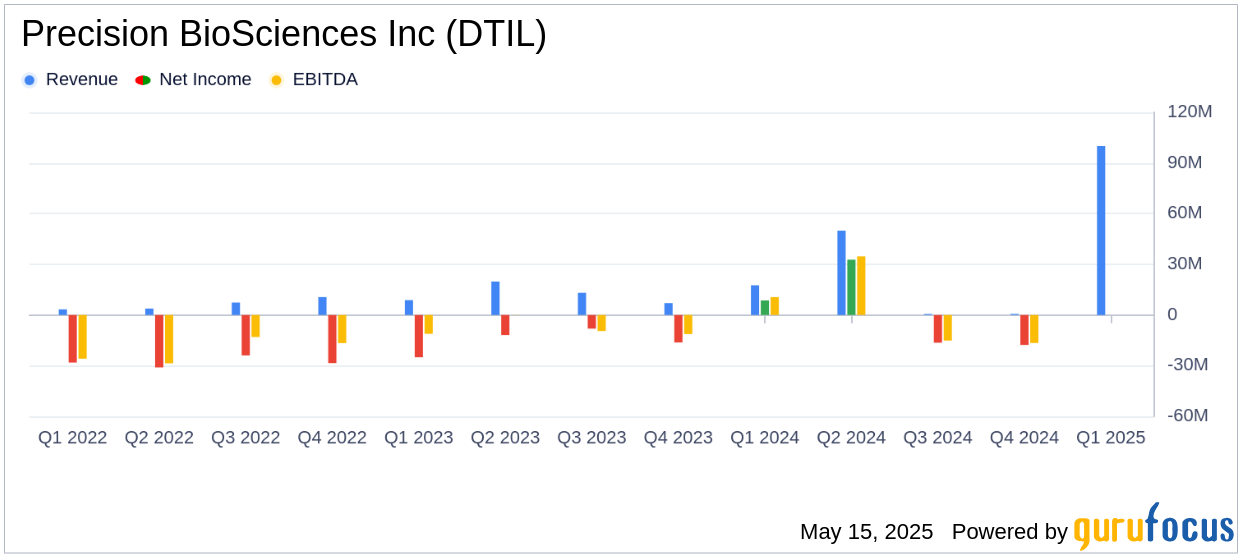

Precision BioSciences Inc reported a net loss of $20.6 million, or $(2.21) per share, for the quarter ended March 31, 2025. This result fell short of the analyst estimate of -$1.72 per share. The company's revenue for the quarter was less than $0.1 million, significantly below the estimated $5.00 million and a sharp decline from $17.6 million in the same quarter of the previous year. This decrease was attributed to the conclusion of several collaboration agreements and nearing completion of pre-clinical work with Novartis.

Strategic Developments and Achievements

Despite financial challenges, Precision BioSciences Inc made significant strides in its clinical programs. The company announced new clinical data validating the safety and efficacy of its ARCUS platform in two programs. Notably, the PBGENE-HBV program for chronic Hepatitis B received Fast Track Designation from the U.S. FDA, highlighting its potential as a curative treatment. Additionally, the PBGENE-DMD program for Duchenne muscular dystrophy is being accelerated, with plans to file an IND/CTA in 2025.

“We started 2025 with strong momentum and a focus on generating impactful clinical data across our in vivo gene editing pipeline,” said Michael Amoroso, Chief Executive Officer of Precision BioSciences.

Financial Metrics and Analysis

As of March 31, 2025, Precision BioSciences Inc had approximately $100 million in cash, cash equivalents, and restricted cash, with a cash runway expected to extend into the second half of 2026. The company's research and development expenses increased slightly to $13.6 million, reflecting ongoing investments in its lead programs. General and administrative expenses also saw a marginal increase to $8.6 million.

| Financial Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Revenue | $29,000 | $17,584,000 |

| Net (Loss) Income | $(20,565,000) | $8,588,000 |

| Net (Loss) Income per Share | $(2.21) | $1.70 |

Conclusion

Precision BioSciences Inc's Q1 2025 financial results highlight the challenges faced in revenue generation, yet the company remains focused on advancing its clinical programs. The strategic developments in its gene editing pipeline, particularly the progress in PBGENE-HBV and PBGENE-DMD, underscore the potential for long-term value creation. As the company navigates its financial landscape, the emphasis on clinical advancements and regulatory achievements will be crucial for future growth.

Explore the complete 8-K earnings release (here) from Precision BioSciences Inc for further details.