An analyst at UBS, Kevin Caliendo, has adjusted the price target for ZimVie (ZIMV, Financial) shares, decreasing it from $16 to $10. Despite this revision, the analyst maintains a Neutral rating on the stock. This decision reflects a reassessment of the company's future prospects, prompting a more conservative outlook on its valuation.

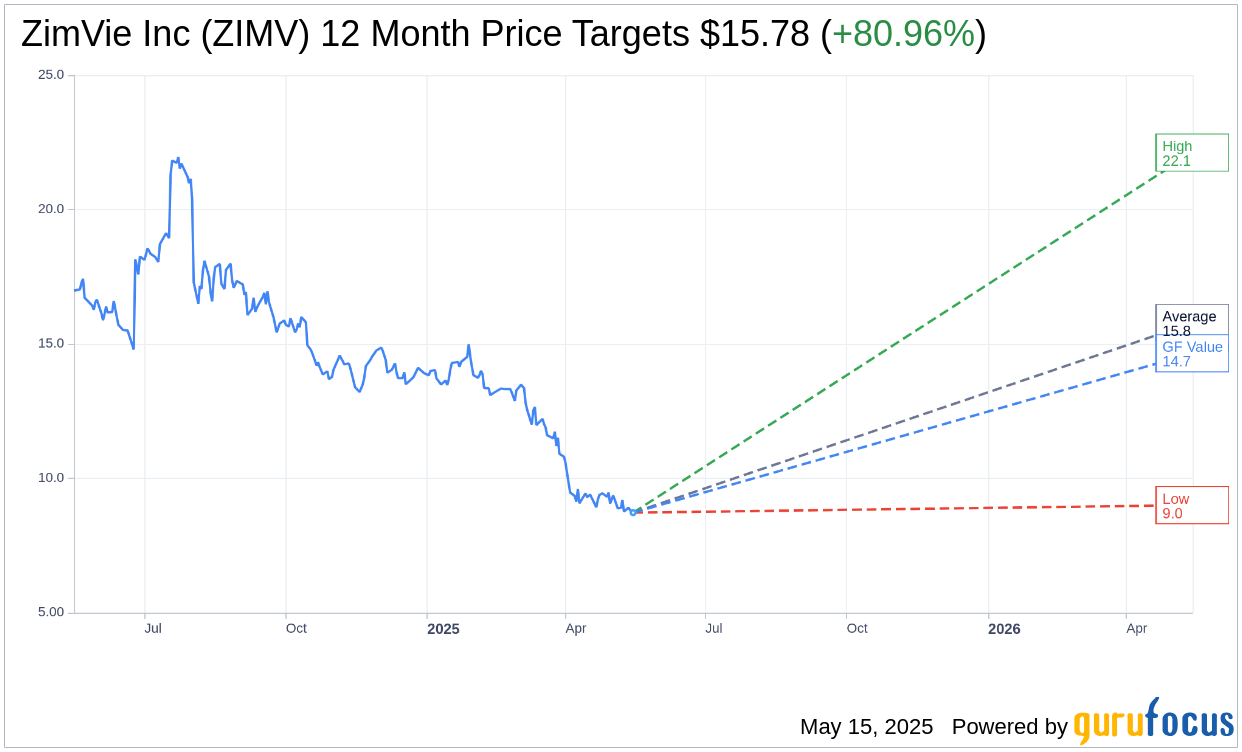

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for ZimVie Inc (ZIMV, Financial) is $15.78 with a high estimate of $22.12 and a low estimate of $9.00. The average target implies an upside of 80.96% from the current price of $8.72. More detailed estimate data can be found on the ZimVie Inc (ZIMV) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, ZimVie Inc's (ZIMV, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for ZimVie Inc (ZIMV, Financial) in one year is $14.65, suggesting a upside of 68% from the current price of $8.72. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the ZimVie Inc (ZIMV) Summary page.

ZIMV Key Business Developments

Release Date: May 08, 2025

- Total Revenue: $112 million for Q1 2025.

- Adjusted EBITDA: Over $17 million, with a margin of 15.7%.

- Adjusted EBITDA Margin Improvement: Over 500 basis points improvement compared to Q1 2024.

- Adjusted Cost of Products Sold: 33.6% of sales, a decrease of 360 basis points from the prior year.

- Net Sales Decline: 5.2% decrease in reported rates; 4.1% decline in constant currency.

- US Net Sales: $65.8 million, a decline of 2.8% compared to the prior year.

- Outside US Net Sales: $46.2 million, a decrease of 8.5% on a reported basis.

- Adjusted R&D Expenses: $5.4 million, or 4.8% of sales.

- Adjusted SG&A Expenses: $58.7 million, a decrease of 2.7% from the prior year.

- Adjusted Earnings Per Share: $0.27, a 238% increase from the prior year period.

- Cash Balance: $67 million at the end of Q1 2025.

- Gross Debt: Approximately $220 million, with net debt of approximately $153 million.

- Biomaterials Growth: Just over 1% growth during the quarter.

- Digital Dentistry Growth: High single digits growth, with implant concierge service growing 11% year-over-year.

- Guidance for Full Year 2025 Revenue: $445 million to $460 million.

- Guidance for Full Year 2025 Adjusted EBITDA: $65 million to $70 million.

- Guidance for Full Year 2025 EPS: $0.80 to $0.95 per share.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- ZimVie Inc (ZIMV, Financial) achieved a significant improvement in adjusted EBITDA margin, reaching 15.7%, which is over 500 basis points higher than the first quarter of 2024.

- The company successfully reduced the adjusted total cost of products sold by over 350 basis points, enhancing profitability.

- ZimVie Inc (ZIMV) launched a new immediate molar implant system, which exceeded internal growth expectations and is expected to drive growth for the remainder of the year.

- The digital dentistry business, excluding scanner sales, grew by high single digits, with the implant concierge service growing 11% year-over-year.

- The acquisition of a distributor partner in Costa Rica is expected to provide immediate benefits to the company's margin profile by leveraging local infrastructure and customer relationships.

Negative Points

- Net sales for the first quarter decreased by 5.2% in reported rates and 4.1% in constant currency, indicating a decline in top-line performance.

- The US market saw a 2.8% decline in net sales, driven by lower implant sales and the impact of one less selling day.

- International sales decreased by 8.5% on a reported basis, with significant headwinds from the expiration of a transition manufacturing agreement and lower China sales.

- The dental implant sales declined in low single digits due to continued macroeconomic pressures.

- The company faces potential tariff-related costs estimated at $3 million per year, primarily due to EU-USA tariff rates, which could impact profitability.