Stifel has adjusted its outlook on DXC Technology (DXC, Financial), reducing the target price from $24 to $15 while maintaining a Hold rating on the stock. Despite the company slightly surpassing expectations for its fourth-quarter results, projections for fiscal year 2026 regarding revenue, earnings per share (EPS), and free cash flow fell short of market forecasts. These disappointing projections may have contributed to the 13% drop in the stock's aftermarket value, which aligns with the midpoint of the EPS revision.

Challenges persist for DXC, as it deals with ongoing growth struggles in its Global Infrastructure Services (GIS) segment and faces cyclical pressures within its Global Business Services (GBS) operations. These factors are creating significant headwinds for the company's financial performance and market position.

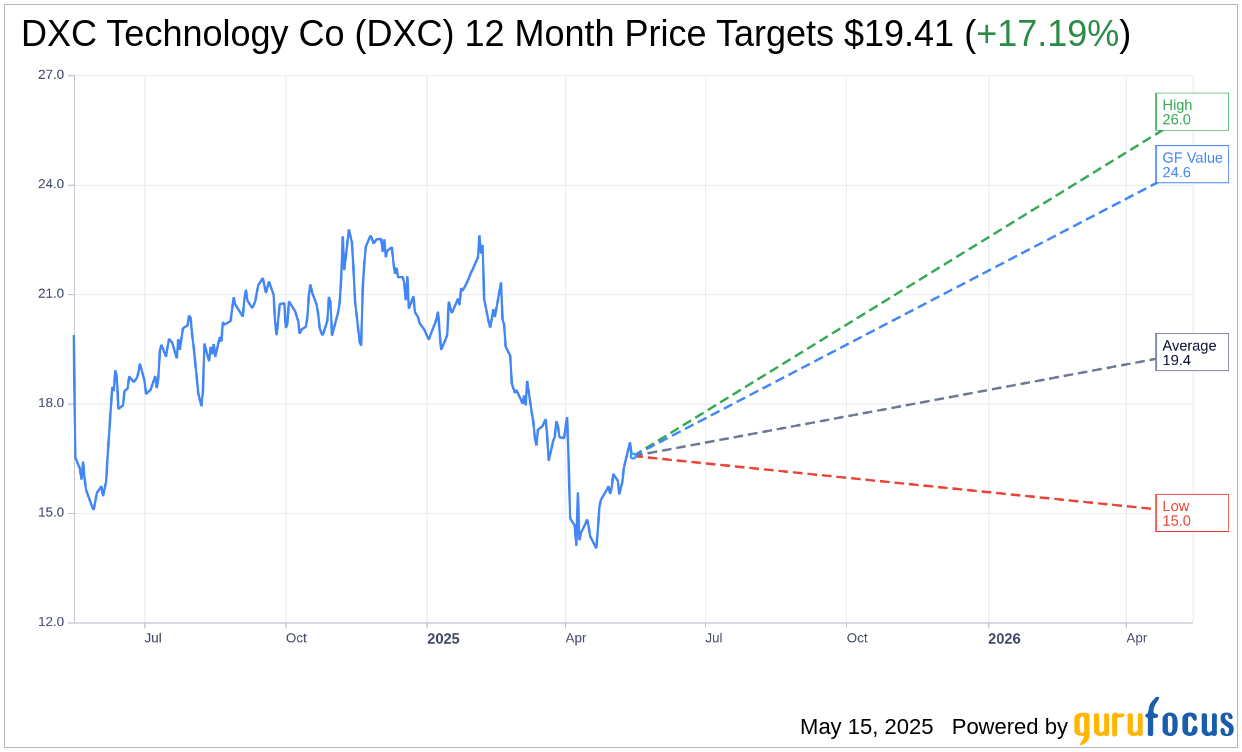

Wall Street Analysts Forecast

Based on the one-year price targets offered by 11 analysts, the average target price for DXC Technology Co (DXC, Financial) is $19.41 with a high estimate of $26.00 and a low estimate of $15.00. The average target implies an upside of 17.19% from the current price of $16.56. More detailed estimate data can be found on the DXC Technology Co (DXC) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, DXC Technology Co's (DXC, Financial) average brokerage recommendation is currently 3.3, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for DXC Technology Co (DXC, Financial) in one year is $24.56, suggesting a upside of 48.31% from the current price of $16.56. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the DXC Technology Co (DXC) Summary page.

DXC Key Business Developments

Release Date: May 14, 2025

- Total Revenue: $3.2 billion, declining 4.2% year-to-year on an organic basis.

- Bookings Growth: Up more than 20% year-to-year, with a book-to-bill ratio of 1.2.

- Adjusted EBIT Margin: 7.3%, down 110 basis points year-to-year.

- Non-GAAP Gross Margin: 24.2%, down 40 basis points year-to-year.

- Non-GAAP SG&A: 11.3% of revenue, expanded 160 basis points year-to-year.

- Non-GAAP EPS: $0.84, down from $0.97 in the prior year quarter.

- GBS Revenue: Down 2.4% year-to-year organically, with a profit margin of 10.9%.

- GIS Revenue: Declined 6% year-to-year organically, with a profit margin of 7.0%.

- Full Year Revenue: $12.9 billion, down 4.6% year-to-year on an organic basis.

- Full Year Adjusted EBIT Margin: 7.9%, expanded 50 basis points year-to-year.

- Full Year Non-GAAP EPS: $3.43, up 11% year-to-year.

- Free Cash Flow: $687 million for fiscal 2025.

- Total Debt: $3.9 billion, down $213 million year-to-year.

- Total Cash: $1.8 billion, increased by approximately $570 million year-to-year.

- Net Debt: Reduced by $785 million to approximately $2.1 billion.

- Fiscal 2026 Guidance - Revenue Decline: Expected to decline 3% to 5% organically.

- Fiscal 2026 Guidance - Adjusted EBIT Margin: Expected between 7% to 8%.

- Fiscal 2026 Guidance - Non-GAAP EPS: Expected between $2.75 and $3.25.

- Fiscal 2026 Guidance - Free Cash Flow: Approximately $600 million.

- Q1 Fiscal 2026 Guidance - Revenue Decline: Expected between 4.0% and 5.5% organically.

- Q1 Fiscal 2026 Guidance - Adjusted EBIT Margin: Expected between 6% to 7%.

- Q1 Fiscal 2026 Guidance - Non-GAAP EPS: Expected between $0.55 to $0.65.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- DXC Technology Co (DXC, Financial) reported a significant increase in bookings, up more than 20%, with a book-to-bill ratio of 1.2, indicating strong market traction.

- The company has successfully recruited 22 new members to its leadership team, enhancing its operational capabilities.

- DXC Technology Co (DXC) has secured a major contract with Carnival Cruise Line, showcasing its ability to win competitive bids.

- The company is well-positioned to capitalize on the growing AI market, with early success in delivering AI-driven solutions to clients.

- DXC Technology Co (DXC) plans to restart its share repurchase program, reflecting confidence in its future performance and commitment to shareholder value.

Negative Points

- DXC Technology Co (DXC) reported a 4.2% year-over-year decline in revenue for the fourth quarter, continuing a trend of revenue decline.

- Adjusted EBIT margin decreased by 110 basis points year-over-year to 7.3%, impacted by investments in employees and sales force improvements.

- The company projects a further 3% to 5% decline in organic revenue for fiscal year 2026, indicating ongoing challenges in reversing revenue decline.

- Non-GAAP EPS decreased from $0.97 to $0.84 year-over-year, driven by lower adjusted EBIT.

- DXC Technology Co (DXC) faces near-term uncertainty due to tariffs and economic conditions, which could impact future performance.