Brookfield Asset Management's (BAM, Financial) affiliate, TerraForm Power, has successfully finalized its acquisition of Sun Tribe Development, a Virginia-based solar and storage project developer. This acquisition significantly boosts TerraForm Power's growth strategy, more than doubling its development pipeline to exceed 6,000 megawatts in solar and battery energy storage. The move enhances TerraForm's capabilities in expanding its presence in the U.S. renewable energy market.

With this strategic collaboration, TerraForm Power aims to increase its footprint and deliver crucial domestically sourced power to support the nation’s digital and industrial advancements. The integration of Sun Tribe Development's assets is expected to complement TerraForm's existing projects, solidifying its status as a preferred partner for major clean energy buyers across the country.

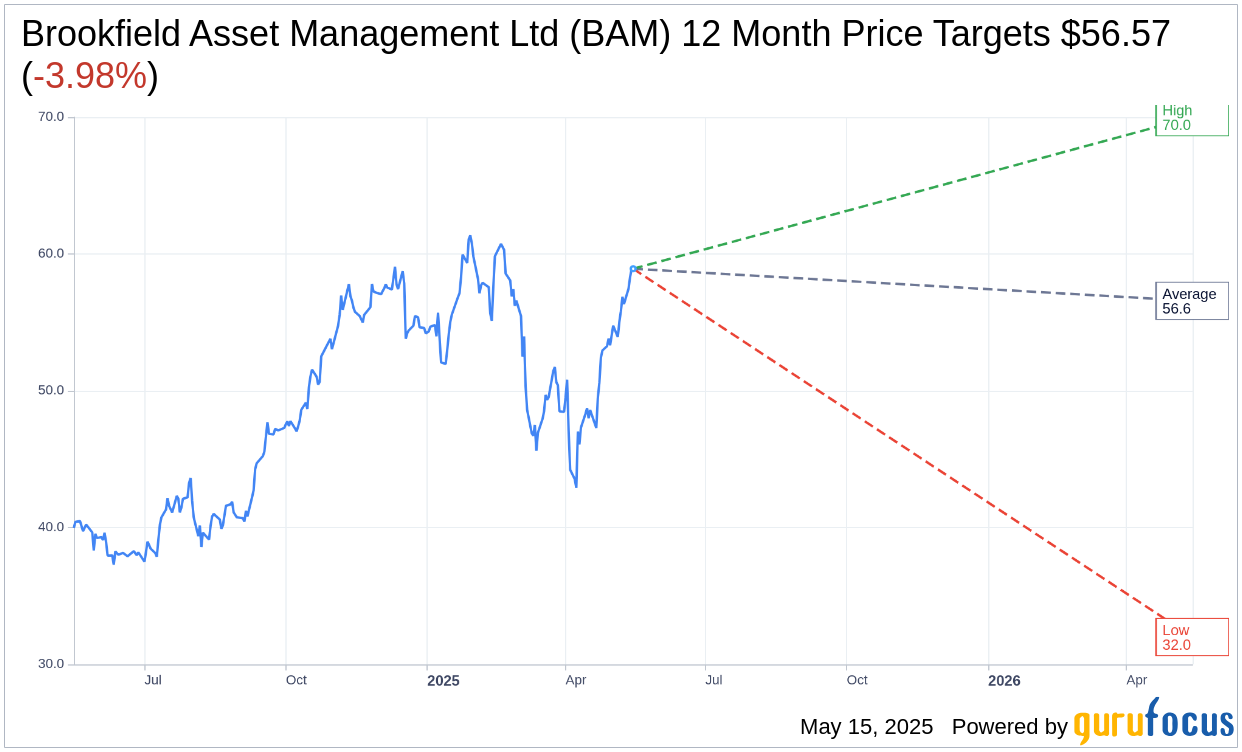

Wall Street Analysts Forecast

Based on the one-year price targets offered by 15 analysts, the average target price for Brookfield Asset Management Ltd (BAM, Financial) is $56.57 with a high estimate of $70.00 and a low estimate of $32.00. The average target implies an downside of 3.98% from the current price of $58.92. More detailed estimate data can be found on the Brookfield Asset Management Ltd (BAM) Forecast page.

Based on the consensus recommendation from 17 brokerage firms, Brookfield Asset Management Ltd's (BAM, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

BAM Key Business Developments

Release Date: May 06, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Brookfield Asset Management Ltd (BAM, Financial) reported its highest quarterly earnings growth since going public, with fee-related earnings reaching a record $698 million, up 26% year over year.

- The company raised $25 billion in capital this quarter, bringing total inflows over the past year to more than $140 billion, demonstrating strong fundraising capabilities.

- BAM's fee-bearing capital increased by 20% compared to last year, now standing at approximately $550 billion, indicating robust growth in its capital base.

- The company successfully closed $6 billion of commitments for its flagship real estate strategy, marking it as the largest real estate strategy ever.

- BAM's private credit business has expanded significantly, with over $320 billion in credit assets under management, positioning it as one of the largest private credit businesses globally.

Negative Points

- The broader market faced heightened volatility, which could pose challenges for future fundraising and investment activities.

- Despite strong performance, the company operates in an environment with increased uncertainty, which may impact investor confidence and capital flows.

- The real estate fundraising environment remains challenging, although BAM has managed to secure commitments, indicating potential difficulties in future capital raising efforts.

- There is a potential risk of overcrowding or saturation within the private credit asset class, which could impact BAM's growth in this area.

- The dividend payout ratio exceeded 100% in the quarter, raising questions about the sustainability of dividend growth in the future.