RBC Capital has adjusted its price target for Adverum Biotechnologies (ADVM, Financial), lowering it from $5 to $4 while maintaining a Sector Perform rating. The revision comes in the wake of the company's first-quarter performance report. Adverum is currently progressing with a major U.S.-based study on wet age-related macular degeneration (AMD), which includes patients with previous treatment experience and those who are new to treatment. However, the reduced price target underscores the ongoing financial uncertainty surrounding Adverum as it continues to wait for further risk mitigation. This stance was detailed in an analyst's note to investors.

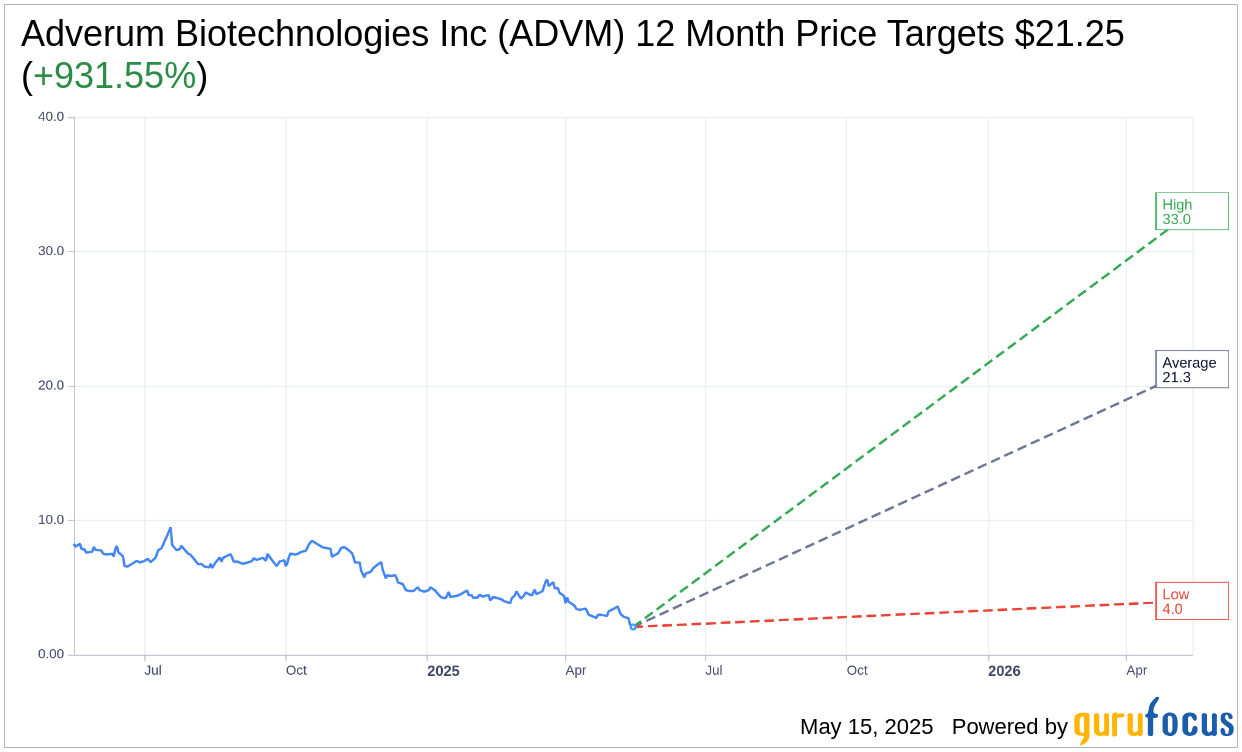

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for Adverum Biotechnologies Inc (ADVM, Financial) is $21.25 with a high estimate of $33.00 and a low estimate of $4.00. The average target implies an upside of 931.55% from the current price of $2.06. More detailed estimate data can be found on the Adverum Biotechnologies Inc (ADVM) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, Adverum Biotechnologies Inc's (ADVM, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.