Abbott Laboratories (ABT, Financial) has recently seen an unusual level of activity in its options classes. This heightened interest could indicate investor anticipation or speculation concerning the company's future performance. Such activity might be driven by various factors, including market trends, the company's financial health, or upcoming announcements that could impact its stock price.

Investors looking to make informed decisions about (ABT, Financial) or any other stock can benefit from tools like KPI data, which offers insights into a company's performance. Staying updated with newsletters that focus on undervalued and resilient stocks can also provide valuable guidance in navigating the current market landscape.

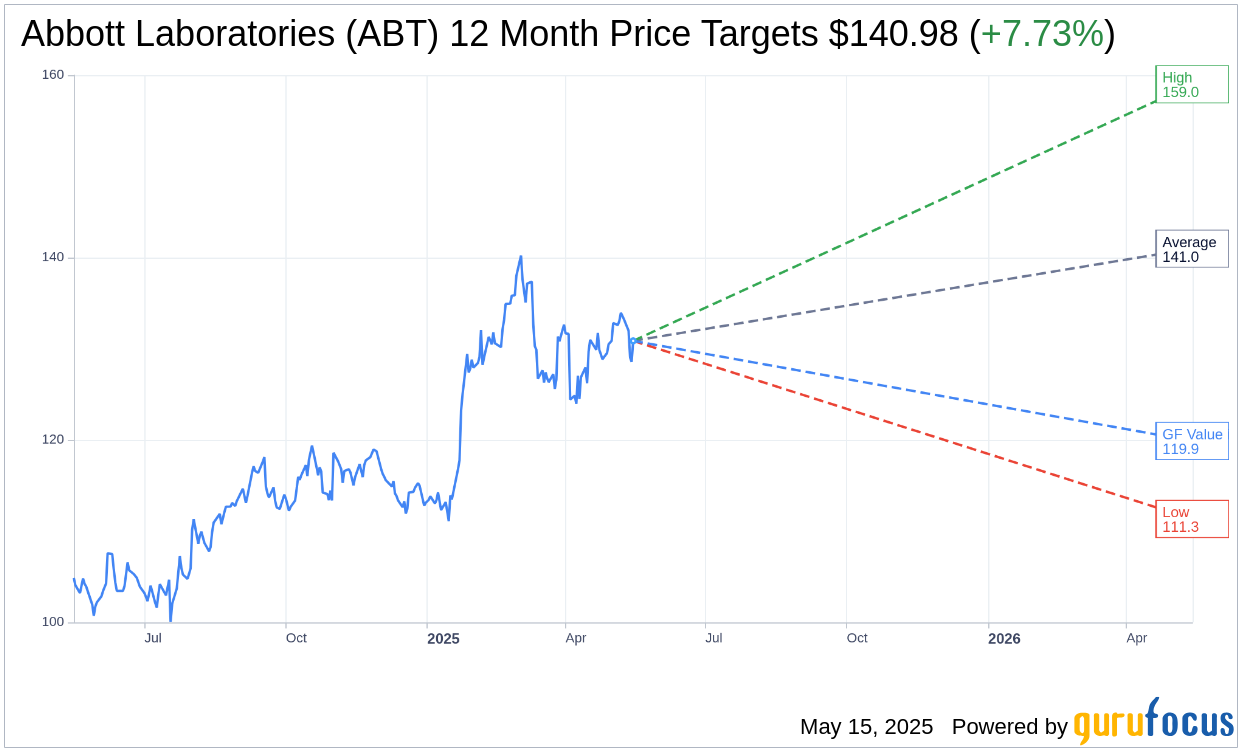

Wall Street Analysts Forecast

Based on the one-year price targets offered by 23 analysts, the average target price for Abbott Laboratories (ABT, Financial) is $140.98 with a high estimate of $159.00 and a low estimate of $111.34. The average target implies an upside of 7.76% from the current price of $130.83. More detailed estimate data can be found on the Abbott Laboratories (ABT) Forecast page.

Based on the consensus recommendation from 28 brokerage firms, Abbott Laboratories's (ABT, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Abbott Laboratories (ABT, Financial) in one year is $119.89, suggesting a downside of 8.36% from the current price of $130.83. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Abbott Laboratories (ABT) Summary page.

ABT Key Business Developments

Release Date: April 16, 2025

- Revenue Growth: Sales increased 6.9% or 8.3% excluding COVID testing-related sales.

- Adjusted Earnings Per Share (EPS): $1.09, an increase of 11% compared to the prior year.

- Nutrition Sales Growth: 7% increase, driven by high-single-digit growth in adult nutrition and double-digit growth in US pediatric nutrition.

- Diagnostics Sales Decline: 5% decrease due to a decline in COVID-19 testing sales.

- EPD Sales Growth: 8% increase, with double-digit growth in more than half of key markets.

- Medical Devices Sales Growth: 12.5% increase, with diabetes care sales of continuous glucose monitors growing over 20%.

- Gross Margin: 57.1% of sales, an increase of 140 basis points compared to the prior year.

- Operating Margin: 21% of sales, reflecting an increase of 130 basis points compared to the prior year.

- Foreign Exchange Impact: Unfavorable year-over-year impact of 2.8% on first-quarter sales.

- Second Quarter EPS Forecast: Adjusted EPS expected to be in the range of $1.23 to $1.27.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Abbott Laboratories (ABT, Financial) achieved high single-digit sales growth and double-digit earnings per share growth in the first quarter of 2025.

- The company's nutrition segment saw a 7% increase in sales, driven by high-single-digit growth in adult nutrition and double-digit growth in US pediatric nutrition.

- Medical devices sales grew 12.5%, with notable growth in diabetes care, electrophysiology, and structural heart segments.

- Abbott Laboratories (ABT) expanded its gross margin by 140 basis points and operating margin by 130 basis points compared to the prior year.

- The company is on track to launch more than 25 key new products over the next three years, indicating a strong pipeline for future growth.

Negative Points

- Sales in the diagnostics segment declined by 5% due to a year-over-year decline in COVID-19 testing sales.

- The company faces financial impacts from new tariff policies, with an estimated tariff impact of a few hundred million dollars in 2025.

- Foreign exchange had an unfavorable year-over-year impact of 2.8% on first-quarter sales.

- Volume-based procurement programs in China negatively impacted core laboratory diagnostics growth.

- The company is navigating challenges in the Chinese market due to price-driven volume-based procurement programs, which have not resulted in volume offsets.