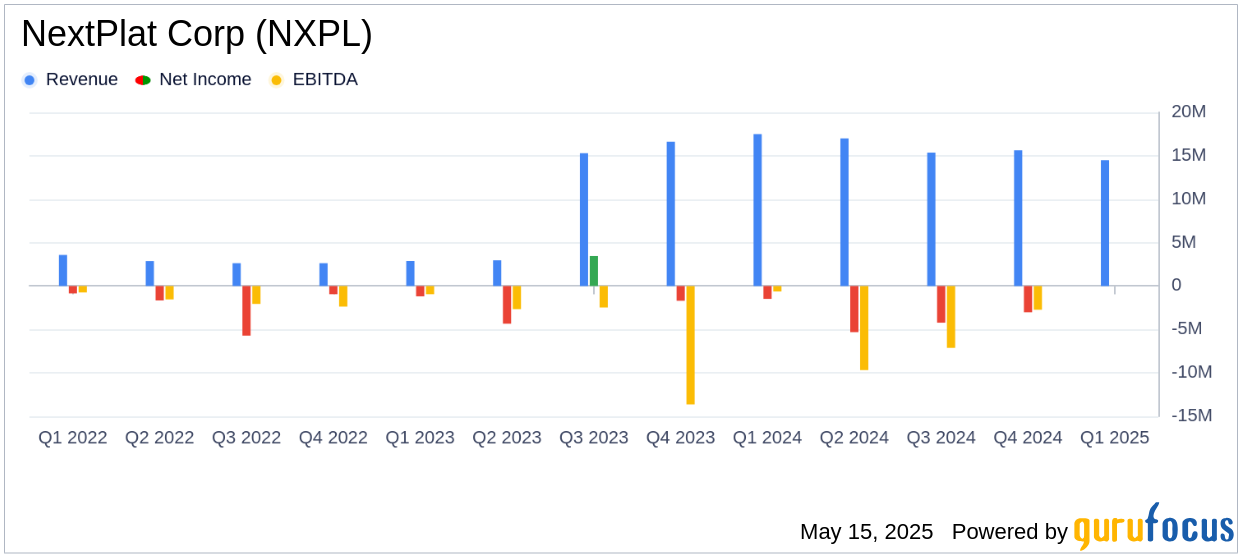

On May 15, 2025, NextPlat Corp (NXPL, Financial) released its 8-K filing detailing the financial results for the first quarter of 2025. The company, a global e-commerce and healthcare provider, reported a revenue of $14.5 million, a decrease from $17.5 million in the same quarter of the previous year. Despite the revenue decline, the company successfully reduced its operating expenses by 26.2% to $4.9 million, reflecting its focus on cost reduction and efficiency improvements.

Company Overview

NextPlat Corp is an e-commerce and healthcare company that operates in two segments: e-Commerce Operations and Healthcare Operations. The e-commerce segment involves acquiring and leasing platforms, while the healthcare segment focuses on improving patient outcomes through various services, including data management and pharmaceutical solutions.

Performance and Challenges

The decline in revenue was primarily attributed to changes in the Healthcare Operations, particularly in the 340B pharmacy service agreements. Some relationships transitioned to other pharmacy partners, and a decline in prescription volume was noted due to shifts in provider relationships and insurance network adjustments. However, the e-Commerce Operations saw growth in recurring airtime revenue, although this was offset by a decline in hardware sales.

Financial Achievements

Despite the challenges, NextPlat Corp achieved a significant reduction in operating expenses, which is crucial for maintaining financial stability amid revenue fluctuations. The company ended the quarter with a strong cash position of $17.7 million, providing a solid foundation for future strategic initiatives.

Key Financial Metrics

NextPlat Corp's gross profit margin declined to 23.8% from 27.8% in the previous year, impacted by decreased 340B contract revenue and increased airtime costs. The net loss attributable to common shareholders decreased by 9% to $1.3 million, or ($0.05) per diluted share, compared to a net loss of $1.5 million, or ($0.08) per diluted share, in the prior year.

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Revenue | $14.5 million | $17.5 million |

| Gross Profit Margin | 23.8% | 27.8% |

| Operating Expenses | $4.9 million | $6.7 million |

| Net Loss | $1.3 million | $1.5 million |

| Cash Position | $17.7 million | N/A |

Analysis and Future Outlook

NextPlat Corp's strategic focus on cost reduction and efficiency improvements is evident in its reduced operating expenses. The company's efforts to expand its service base and explore strategic alternatives in the healthcare segment are expected to contribute to future revenue growth. However, challenges such as rising drug prices and potential tariff impacts remain concerns that the company must navigate carefully.

The first quarter results reflect a series of challenges that we are addressing both domestically and internationally as our teams work to improve the efficiency of the business," said Charles M. Fernandez, Executive Chairman and CEO of NextPlat Corp.

NextPlat Corp's commitment to leveraging its existing businesses and exploring new opportunities positions it well for potential growth, despite the current challenges. The company's strategic initiatives and strong cash position provide a foundation for navigating market volatility and driving value for stakeholders.

Explore the complete 8-K earnings release (here) from NextPlat Corp for further details.