Exploring the Latest 13F Filing and Portfolio Adjustments

Louis Moore Bacon (Trades, Portfolio) recently submitted the 13F filing for the first quarter of 2025, providing insights into his investment moves during this period. Louis Moore Bacon (Trades, Portfolio) (born 1956) is an American hedge fund manager and trader who uses a global macro strategy to invest in the markets. Bacon is considered one of the top 100 traders of the 20th century. He is the manager of a leading New York City-based hedge fund, Moore Capital Management, which he founded in 1989. The firm uses a bold and global macro-based approach to investing. After 30 years of operation, the hedge fund closed itself to outside investors in late 2019 and consolidated its three flagship funds into one proprietary fund. Regarding the new arrangement, Bacon wrote, "now I am once again concentrating on my personal investment account while overseeing a large multi-asset alternatives platform."

Summary of New Buy

Louis Moore Bacon (Trades, Portfolio) added a total of 153 stocks, among them:

- The most significant addition was SPDR S&P 500 ETF Trust (SPY, Financial), with 205,968 shares, accounting for 2.63% of the portfolio and a total value of $115.216 million.

- The second largest addition to the portfolio was iShares 20+ Year Treasury Bond ETF (TLT, Financial), consisting of 716,176 shares, representing approximately 1.49% of the portfolio, with a total value of $65.193 million.

- The third largest addition was UBS Group AG (UBS, Financial), with 1,442,286 shares, accounting for 1% of the portfolio and a total value of $43.799 million.

Key Position Increases

Louis Moore Bacon (Trades, Portfolio) also increased stakes in a total of 64 stocks, among them:

- The most notable increase was iShares Russell 2000 ETF (IWM, Financial), with an additional 720,133 shares, bringing the total to 810,400 shares. This adjustment represents a significant 797.78% increase in share count, a 3.28% impact on the current portfolio, with a total value of $161.667 million.

- The second largest increase was Alibaba Group Holding Ltd (BABA, Financial), with an additional 209,500 shares, bringing the total to 238,000. This adjustment represents a significant 735.09% increase in share count, with a total value of $31.471 million.

Key Position Reduces

Louis Moore Bacon (Trades, Portfolio) also reduced positions in 82 stocks. The most significant changes include:

- Reduced NVIDIA Corp (NVDA, Financial) by 2,224,437 shares, resulting in a -99.85% decrease in shares and a -3.59% impact on the portfolio. The stock traded at an average price of $126.74 during the quarter and has returned -1.94% over the past 3 months and 1.39% year-to-date.

- Reduced Microsoft Corp (MSFT, Financial) by 492,125 shares, resulting in a -98.43% reduction in shares and a -2.49% impact on the portfolio. The stock traded at an average price of $407.71 during the quarter and has returned 11.74% over the past 3 months and 8.28% year-to-date.

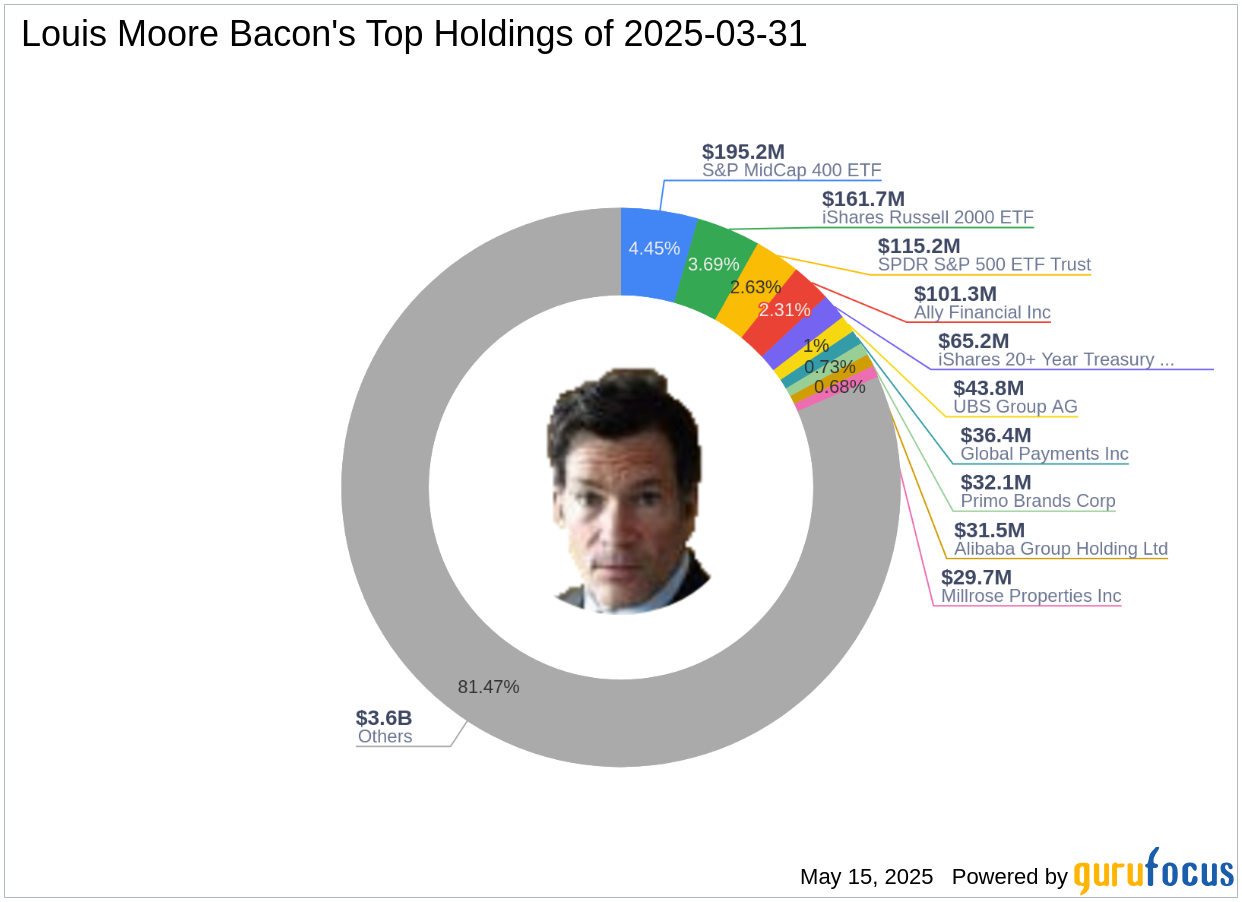

Portfolio Overview

At the first quarter of 2025, Louis Moore Bacon (Trades, Portfolio)'s portfolio included 455 stocks, with top holdings including 4.45% in S&P MidCap 400 ETF (MDY, Financial), 3.69% in iShares Russell 2000 ETF (IWM, Financial), 2.63% in SPDR S&P 500 ETF Trust (SPY, Financial), 2.31% in Ally Financial Inc (ALLY, Financial), and 1.49% in iShares 20+ Year Treasury Bond ETF (TLT, Financial).

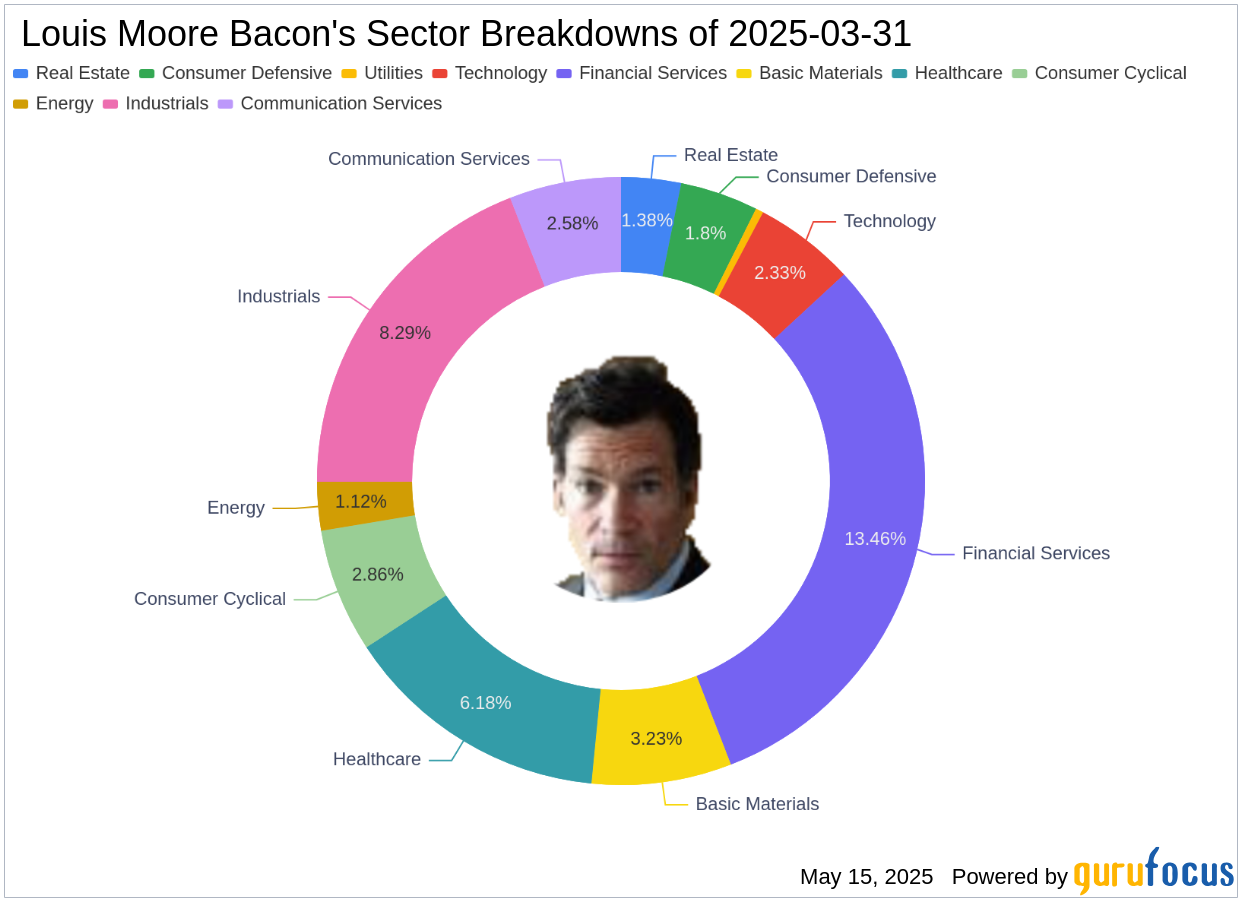

The holdings are mainly concentrated in 11 industries: Financial Services, Industrials, Healthcare, Basic Materials, Consumer Cyclical, Communication Services, Technology, Consumer Defensive, Real Estate, Energy, and Utilities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.