PureCycle Technologies (PCT, Financial) recently experienced a notable spike in options trading, with 17,600 call options exchanged—three times the anticipated volume. Consequently, implied volatility jumped over seven points to reach 82.06%. The most heavily traded call options are the May 2025 $8.50 calls and the June 2025 $10 calls, together accounting for nearly 11,300 contracts. The current Put/Call Ratio stands at 0.20, indicating a bullish sentiment among traders. Investors are keeping an eye out for the company’s upcoming earnings report, due on August 7th.

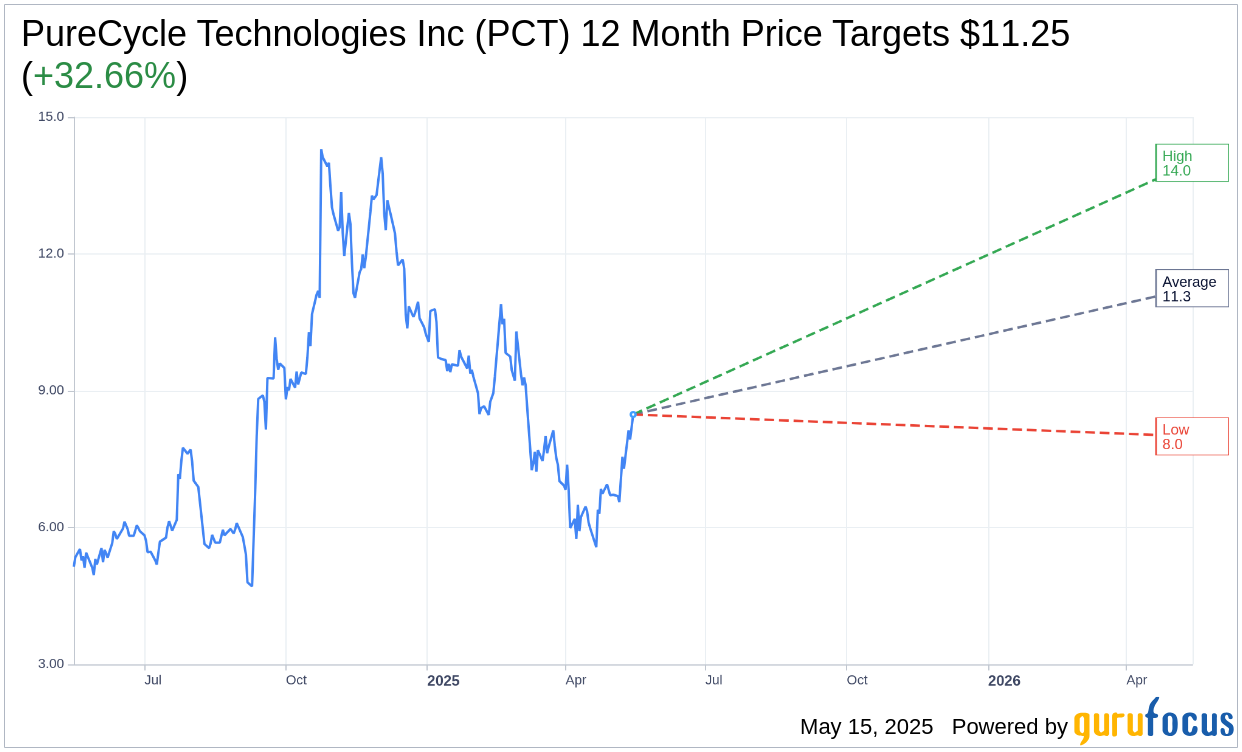

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for PureCycle Technologies Inc (PCT, Financial) is $11.25 with a high estimate of $14.00 and a low estimate of $8.00. The average target implies an upside of 32.66% from the current price of $8.48. More detailed estimate data can be found on the PureCycle Technologies Inc (PCT) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, PureCycle Technologies Inc's (PCT, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

PCT Key Business Developments

Release Date: May 07, 2025

- First Reported Revenues: Achieved first reported revenues in the company's history.

- Onstream Time: Achieved almost 90% onstream time in April, a significant improvement from 25%-30% a year ago.

- Resin Production: Produced 4.3 million pounds of resin in the quarter.

- Inventory: Holding approximately 14 million pounds of inventory.

- Cash on Hand: Ended the quarter with $37.5 million in cash, including $22.5 million of unrestricted cash.

- Capital Raised: Raised just under $55 million through various transactions, including $33 million from common stock sales and $19 million from revenue bonds.

- Operational and Corporate Spend: Approximately $37 million for the quarter, consistent with the previous year and $9 million higher than Q4 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- PureCycle Technologies Inc (PCT, Financial) reported its first-ever revenues, marking a significant milestone for the company.

- The company achieved nearly 90% onstream time in April, a substantial improvement from previous operational challenges.

- PureCycle is engaged in over 30 trials, with 24 progressing to the industrial stage, representing over 300 million pounds of potential product sales.

- The introduction of the PureFive Choice product line allows for flexibility in meeting diverse customer needs across various applications.

- Successful trials with Brückner in the BOPP film market indicate a promising new revenue stream and potential market expansion.

Negative Points

- Despite operational improvements, PureCycle is not yet producing pellets at full capacity, indicating ongoing challenges in reaching nameplate capacity.

- The company has a high cash burn rate, with operations and corporate spend totaling $37 million for the quarter.

- PureCycle's liquidity remains a concern, with $37.5 million in cash on hand and a need to manage cash flow carefully.

- The company is still in the early stages of scaling its technology, which may delay future capacity expansions and economic improvements.

- There is uncertainty around the timeline for converting trials into commercial sales, as each customer has different qualification periods and procedures.