Deutsche Bank (DB, Financial) plans to propose a dividend of 68 cents per share at its upcoming Annual General Meeting on May 22, 2025, reflecting a 50% increase from the previous year. The bank is currently executing a share buyback program valued at EUR750 million, which will raise total capital distributions to shareholders to EUR5.4 billion since 2022 upon completion.

In his speech at the AGM, CEO Christian Sewing reaffirmed management's commitment to further capital distributions in 2025, stating that the bank has applied to the European Central Bank for an additional buyback in the latter half of the year. This move is supported by the bank’s strong capital position and growth in organic capital generation.

Sewing reiterated Deutsche Bank's goal to distribute over EUR8 billion between 2021 and 2025, a target set for payouts between 2022 and 2026. He also stressed their strategy to enhance shareholder returns while investing in growth and client services. Both Sewing and Chairman Alexander Wynaendts emphasized the bank's preparedness to navigate the current geopolitical and economic landscape, underlining its adaptability and the increasing demand for a European bank alternative amid global uncertainties.

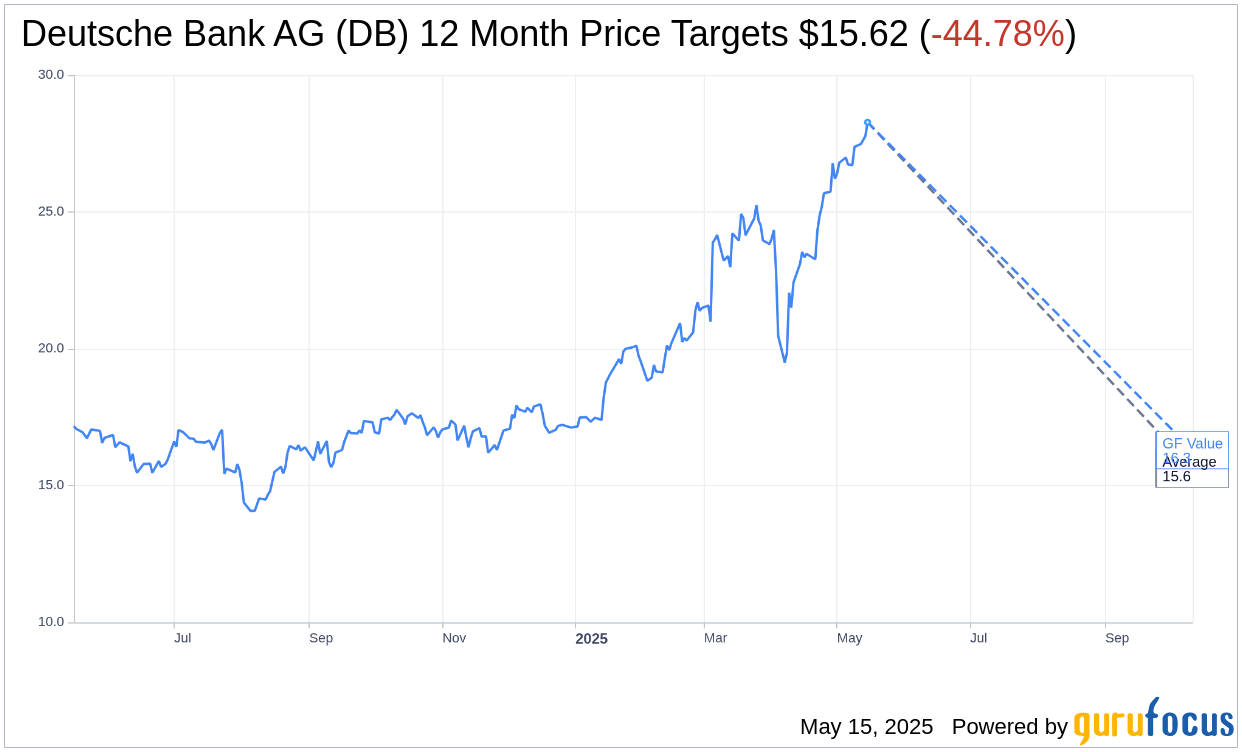

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Deutsche Bank AG (DB, Financial) is $15.62 with a high estimate of $15.62 and a low estimate of $15.62. The average target implies an downside of 44.78% from the current price of $28.28. More detailed estimate data can be found on the Deutsche Bank AG (DB) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Deutsche Bank AG's (DB, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Deutsche Bank AG (DB, Financial) in one year is $16.29, suggesting a downside of 42.4% from the current price of $28.28. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Deutsche Bank AG (DB) Summary page.

DB Key Business Developments

Release Date: April 30, 2025

- Pre-Provision Profit: EUR3.3 billion, up 34% year on year.

- Operating Leverage: 11% with positive operating jaws in each division.

- Post-Tax Return on Tangible Equity: 11.9% for the quarter.

- Net Commission and Fee Income: Increased by 5% year on year.

- Non-Interest Expenses: Declined 2% year on year to EUR5.2 billion.

- Revenue Growth CAGR: 6.1% since 2021, within the target range of 5.5% to 6.5%.

- Loan Growth: EUR4 billion during the first quarter, adjusted for FX effect.

- Deposit Growth: EUR6 billion during the first quarter, adjusted for FX effect.

- Net Interest Income: EUR3.3 billion, broadly stable quarter on quarter.

- Liquidity Coverage Ratio: Increased to 134%.

- Common Equity Tier 1 Ratio: 13.8% at the end of the first quarter.

- Leverage Ratio: 4.6%, up by 1 basis point.

- MREL Surplus: EUR22 billion at the end of the quarter.

- Issuance Plan: EUR15 billion to EUR20 billion for 2025 funding requirements.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Deutsche Bank AG (DB, Financial) delivered a pre-provision profit of EUR3.3 billion, up 34% year on year, showcasing strong operational performance.

- The bank achieved a compound annual growth rate of 6.1% in revenue since 2021, within its target range of 5.5% to 6.5%.

- Revenue quality is robust, with 71% coming from predictable streams in corporate banking, private banking, asset management, and fixed financing.

- Non-interest expenses declined by 2% year on year, reflecting effective cost management and operational efficiencies.

- The liquidity coverage ratio increased to 134%, driven by strong deposit inflows, indicating a solid liquidity position.

Negative Points

- Geopolitical uncertainty and volatility are expected to remain elevated, potentially impacting future performance.

- Loan growth in the corporate and private bank segments remained flat due to macroeconomic headwinds affecting client demand.

- The corporate bank's net interest income was slightly down compared to the prior quarter due to accounting reclassification effects.

- The CET1 MDA buffer reduced by 11 basis points quarter on quarter, reflecting higher capital requirements.

- The bank faces challenges in achieving its net interest income target of EUR13.6 billion due to FX headwinds and lower ECB rates.